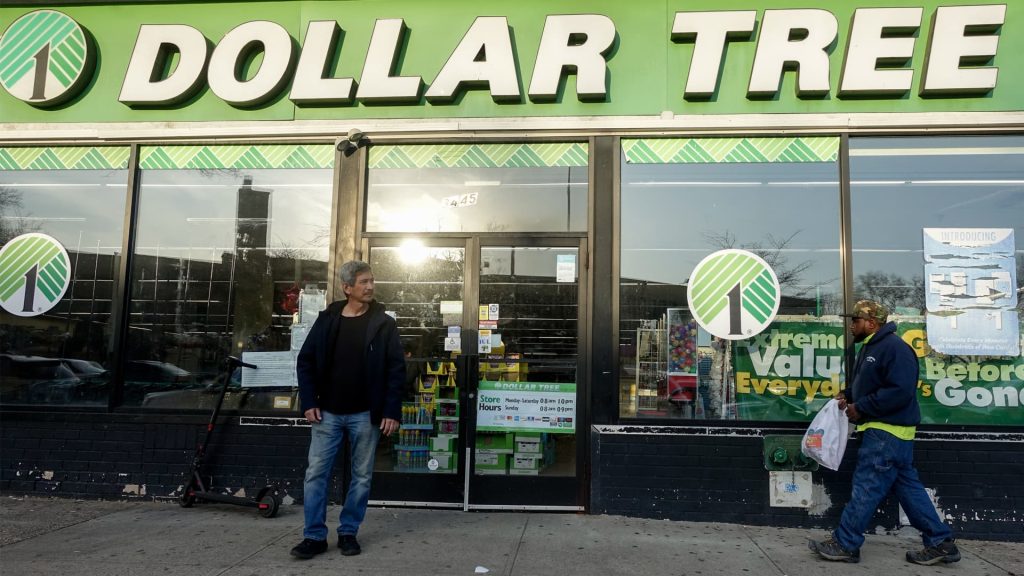

Check out the companies making headlines in midday trading: GameStop — The meme stock soared 11.7%. On Tuesday, GameStop’s board announced it had unanimously approved a plan to buy bitcoin with a portion of its corporate cash, following a similar move by MicroStrategy. Dollar Tree — The discount retail chain popped 3.1% after announcing on Wednesday that it would offload its Family Dollar business to a group of private-equity investors for $1 billion. Playtika — The mobile gaming stock gained 20.5% after receiving a double upgrade to buy from underperform at Bank of America. The bank said the company has high profitability in a “mature” industry that is “still growing.” TotalEnergies SE — U.S. shares of the French energy and petroleum company advanced 2.1% after Citi upgraded it to buy . The firm said the market could be underestimating the company’s potential volume and margin growth. Paychex — Shares rose 4.2% after the company’s fiscal third-quarter earnings results topped Wall Street estimates. Paychex posted adjusted earnings of $1.49 per share, above the $1.48 per share that analysts polled by FactSet were expecting. Revenue, however, came in line with expectations at $1.51 billion. Nvidia — The artificial intelligence darling’s shares slid about 6% amid a sharp sell-off in tech names. The information technology sector dropped more than 1%. Shares of Alphabet and Amazon declined more than 1%, while Meta Platforms lost nearly 2%. Tesla — Shares of the electric vehicle maker pulled back 5.6%, putting it on pace to snap a five-day winning streak. The stock has still gained more than 16% over the past week. Cintas — The stock jumped 5.8% after the company posted better-than-expected earnings and revenue for its fiscal third quarter. Cintas earned $1.13 per share on revenue of $2.61 billion, while analysts had penciled in $1.05 per share in earnings and $2.60 billion in revenue, according to FactSet. Perimeter Solutions — The fire retardant maker surged about 10% on the back of a UBS upgrade to buy from neutral . UBS said the stock can benefit as wildfires hit more populated areas. — CNBC’s Alex Harring, Lisa Kailai Han and Michelle Fox contributed reporting.

Previous ArticleWatchdog: Agencies followed ‘best practices’ for Basel III

Related Posts

Add A Comment