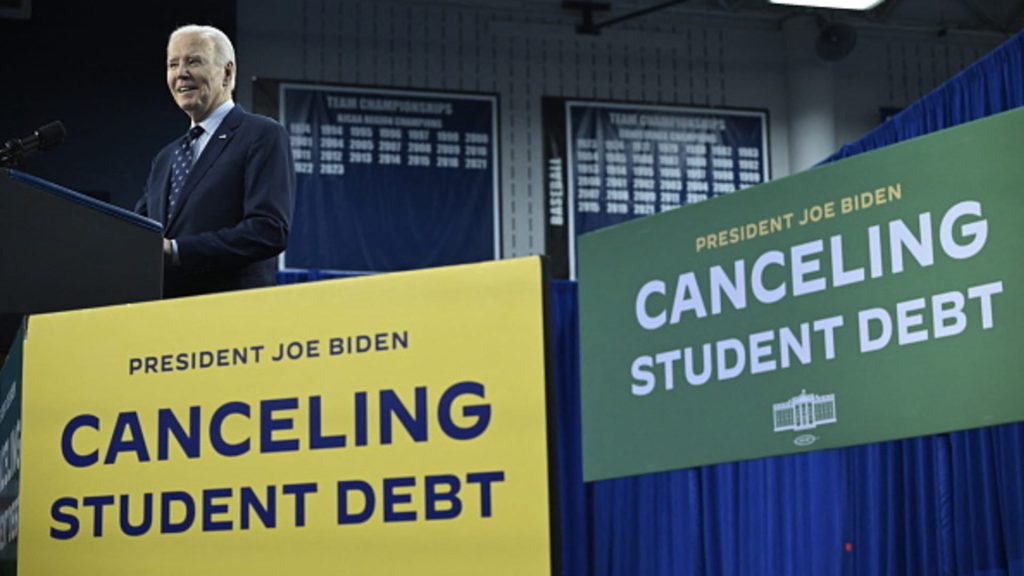

Former U.S. President Joe Biden speaks about student loan debt relief at Madison Area Technical College in Madison, Wisconsin, on April 8, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

A U.S. appeals court on Tuesday blocked the Biden administration’s student loan relief plan known as SAVE, a move that will likely lead to higher monthly payments for millions of borrowers.

The 8th U.S. Circuit Court of Appeals sided with the seven Republican-led states that filed a lawsuit against the U.S. Department of Education’s plan. The states had argued that former President Joe Biden lacked the authority to establish the student loan relief plan.

The GOP states argued that Biden, with SAVE, was essentially trying to find a roundabout way to forgive student debt after the Supreme Court blocked his sweeping debt cancellation plan in June 2023.

SAVE, or the Saving on a Valuable Education plan, came with two key provisions that the lawsuits targeted. It had lower monthly payments than any other federal student loan repayment plan, and it led to quicker debt erasure for those with small balances.

Implementing SAVE could cost as much as $475 billion over a decade, an analysis by the University of Pennsylvania’s Penn Wharton Budget Model found. That made it a target for Republicans, who argued that taxpayers should not be asked to subsidize the loan payments of those who have benefited from a higher education.

However, consumer advocates say most families need to borrow to send their children to college today and that they require more affordable ways to repay their debt. Research shows student loans make it harder for people to start businesses, buy a house and even have children.

The court’s ruling comes at the same time that House Republicans are floating proposals that could raise federal student loan bills for millions of borrowers.

The average student loan borrower could pay nearly $200 a month more if the GOP’s plans to reshape student loan repayments succeed, according to an early estimate by The Institute for College Access & Success. Republican lawmakers want to use the extra revenue to fund President Donald Trump’s tax cuts.

How will the end of the SAVE plan affect you financially? If you’re willing to share your experience for an upcoming story, contact me at [email protected].