The 2026 conforming loan limits were released during the holiday week and (surprise, surprise) they’re higher!

In case you weren’t aware, these loan limits are driven by the annual change in home prices, and yes, property values went up.

While there have been pockets of weakness lately, namely in places like Florida and Texas, home prices still increased nationally.

As such, the 2026 conforming loan limit will be $26,250 higher versus 2025, rising from $806,500 to $832,750.

And in high-cost regions, the ceiling loan limit for one-unit properties will be a whopping $1,249,125.

2026 Conforming Loan Limits Climb Again

- 1-unit property: $832,750

- 2-unit property: $1,066,250

- 3-unit property: $1,288,800

- 4-unit property: $1,601,750

The FHFA announced last week that the conforming loan limit for mortgages backed by Fannie Mae and Freddie Mac rose to $832,750 for 2026.

This marks an increase of $26,250 from the 2025 loan limits, driven by a 3.26% rise in home prices between the third quarters of 2024 and 2025.

It’s not quite as large as the 5.2% increase seen a year ago, but it’s higher nonetheless.

In high-cost regions of the country like Los Angeles, the new ceiling for one-unit properties will be $1,249,125, which is 150 percent of the baseline limit.

While many expected home prices to be flat this year, or even fall, they still managed to gain a little more despite poor affordability.

The FHFA bases the change on its own nominal, seasonally adjusted, expanded-data FHFA home price index (HPI).

Importantly, the conforming loan limit cannot fall though. So even if home prices did happen to go down between the third quarter of last year and this year, the conforming limit wouldn’t go down.

Instead, it would simply stay put. Something to think about moving forward if the doomsayers are finally right and home prices come down nationally.

In the meantime, home buyers and existing homeowners looking to refinance a mortgage can take advantage of slightly higher loan limits.

What’s the Benefit of Staying At/Below the Conforming Loan Limit?

The main advantage of staying at/below the conforming loan limit is that mortgage rates tend to be lower.

Conforming loans are the most common type of home loan, offered by just about every bank and lender because they’re easy to unload to investors on the secondary market.

Conversely, jumbo loans while widely available, are more niche and don’t have a big backer like Fannie and Freddie.

As a result, interest rates on jumbo loans are often higher, though this isn’t always the case and exceptions do apply.

In addition, it’s often easier to get approved for a conforming loan because the underwriting standards are a little looser.

For example, you can come in with just a 3% down payment and you often don’t need much in the way of asset reserves.

The maximum DTI limits and credit score requirements also tend to be a lot more forgiving.

Meanwhile, a jumbo loan lender might require a 10% minimum down payment and six months of reserves.

So something to consider if you were at/close to the conforming limit and are now under it thanks to the increase.

2026 High-Cost Area Loan Limits Rise to $1,249,125

- 1-unit property: $1,249,125

- 2-unit property: $1,599,375

- 3-unit property: $1,933,200

- 4-unit property: $2,402,625

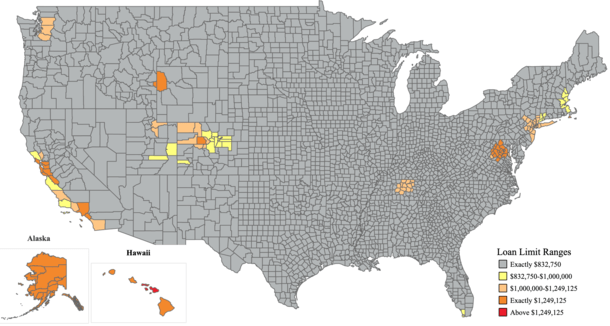

As always, the loan limits are higher in many cities nationwide where property values are greater thanks to the high-cost area limits.

There are more than 3,000 counties or county-equivalent jurisdictions in the United States, and each year about 100 to 200 of them qualify for high-cost limits that exceed the baseline limit, as seen in the map above.

This includes places like Denver, Jackson Hole, Los Angeles, and New York City, and also Alaska, Guam, Hawaii, and the U.S. Virgin Islands.

In those regions, the loan limits go as high as $1,249,125 for a one-unit property, and to nearly $2.5 million for a fourplex.

There are also high-cost regions in the state of Hawaii that go even higher. So there is certainly a lot of opportunity to stay at/below the conforming loan limits.

The new conforming loan limits are effective January 1st, 2026, though some lenders are already accepting the higher limits today.