The investing information provided on this page is for educational purposes only. SS, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Kids are often pretty good at being consumers. If you’re a parent with a small business, you have the opportunity to show your kids firsthand what it means to be a producer. Small Business Saturday, which takes place on Nov. 30 this year, may be a great time to do just that.

Small Business Saturday was established by American Express in 2010 and encourages consumers to patronize their local stores as a way to keep dollars circulating within their community.

Here are three reasons you should consider getting your kids involved in Small Business Saturday, according to two mompreneurs.

It teaches them positive work values

Ronne Brown is the owner of HERLISTIC, a plant-derived beauty and feminine care brand in Washington, D.C. She’s been participating in Small Business Saturday since she established her business in 2020.

The entrepreneur gets her kids (ages 24, 18 and 12), plus her bonus daughter, 10, to help out on Small Business Saturday and beyond. Brown’s kids help with customer service, shipping and fulfillment tasks. That could include counting inventory, quality control or packaging boxes.

“I just want them to understand the price and the value of a dollar and what it actually costs to make it,” Brown says.

The mompreneur also hopes her kids learn the benefits of commitment and hard work.

“What I want to show them is that you have to work hard every day. And there are gonna be moments where you’re gonna be tired, you’re gonna be exhausted, and you’re not gonna want to do things, and you’re going to have to push through,” she says.

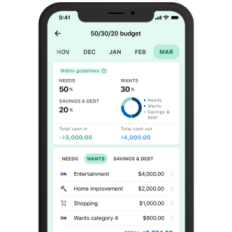

Get started with budget planning

Check your current spending across categories to see where you can save

It creates an opportunity to earn money

Hiring your kids to do legitimate work during Small Business Saturday provides a chance for them to learn pillars needed for a strong financial foundation: earning money, saving money and investing. That said, before hiring kids, it’s critical to understand the child labor laws for your state in addition to the IRS’ rules around hiring kids.

Brown says she pays all of her children, including her 24-year-old son who is on payroll. Additionally, she teaches them about investing in the stock market.

“I want them to understand the importance of making money, but also investing the money that they’re making,” she says. “Because when I pay them, I always ask them, ‘so what are you gonna do to double this money?’”

If you hire your minor kids, they could get a headstart on investing by putting some of their income into a custodial Roth IRA, which requires earned income to open. You could also open them a custodial brokerage account.

Another perk of your kids earning income by working for you is that they may be exempt from paying federal income taxes if they earn less than the standard deduction. In 2024, that threshold is $14,600.

It gives you extra hands to deal with demand

Having your kids add helping hands, whether it be doing administrative tasks or helping customers, can ensure you keep up with a potential increase in sales.

Lisset Tresvant, owner of Glow Esthetics Spa in Hollywood, Florida, has been participating in Small Business Saturday since the genesis of her business in 2019.

“I do tend to sell more because people are usually more inclined to purchase because of the sales, and it gives them a reason to support us,” she says.

To help with the demand, Tresvant’s daughter, 12, and son, 9, fill her skincare products, add labels and help prep items for shipping.

Tresvant says she decided to let her kids get involved in her business so they have a better understanding of what she does.

Looking beyond Small Business Saturday, hiring your child can also help with succession planning, which is about planning for your departure from your business. Tresvant hopes to pass hers down to her kids one day.

“They understand that I’m building this legacy just for not myself, but for them as well,” says Tresvant.

Get started with budget planning

Check your current spending across categories to see where you can save