A new loyalty program has been launched by Better Mortgage that waives loan origination fees for life.

Known as the “Better Forever Program,” it rewards customers by removing these fees when they refinance in the future or purchase a new property.

While these fees can vary by bank or lender, it’s not uncommon to see a 1% fee charged as part of your closing costs.

For example, a $500,000 loan with a 1% origination fee amounts to $5,000, so it’s not a trivial amount.

The big question, as I always ask, is this a good deal!

Better Forever Programs Allows You to Refi or Purchase a Home without Some of the Fees

First let’s talk program specifics so we know what we’re actually getting here.

As stated, Better Forever works as a sort of loyalty program where you aren’t charged loan origination fees if you use them again in the future.

But the key here is that you need to use them a first time in order to be eligible. And that ostensibly means you’ll be charged a loan origination fee the first go around.

Not all lenders charge these fees, so that’s something to consider. I’ll speak more to that in a moment, but let’s examine the fine print.

In order to get the fee waived, you must refinance an existing loan originally secured with Better.

Or in the case of a new property purchase, previously get any type of loan with Better. The distinction here is you could have merely taken out a home equity loan or a HELOC with Better in the past to qualify.

Speaking of, a future second mortgage from Better like a HELOAN or HELOC is not eligible for the fee waiver. So it doesn’t work both ways.

For clarity, the fee is only waived on a first mortgage via refinance or a new purchase loan.

Regarding the amount of the fee, Better apparently only charges a $995 origination fee, meaning it’s not based on a percentage of the loan amount.

To that end, it’s not necessarily as advantageous given it’s a relatively small number, especially if you have a large loan amount.

Anyone who closed on a home purchase or the refinance of a primary residence, second home, or investment property, or a HELOAN/HELOC with Better Mortgage since January 1st, 2019 is eligible.

Notably, there are a few exclusions. You can’t refinance a loan before six months have passed since the original loan closed.

And you must apply directly with Better, as opposed to using a third-party such as LendingTree or Nerdwallet, among others.

And as I mentioned, future second mortgages like HELOANs and HELOCs aren’t eligible for the fee waiver.

In the Past, Better Didn’t Charge Fees or Hire Commissioned Loan Officers

Better Mortgage, which launched back in 2017, originally didn’t charge any lender fees or use commissioned loan officers.

Instead, they relied heavily on technology to fund loans. But this model only proved effective when mortgage rates were at record lows and there was practically a waiting list to refinance.

Today, with mortgage rates a lot higher, and purchase lending the more dominant line of business, seasoned loan officers who demand commissions are needed.

Of course, they still strive to make the loan process painless and operate as a direct-to-consumer mortgage lender with a digital loan process powered by their Tinman platform.

Aside from the convenience, their mission is speed, with their One Day Mortgage program allowing customers to get a loan commitment letter in 24 hours.

Customers are also able to view tailored mortgage rate options in seconds, get pre-approved for a mortgage in just minutes, lock a rate on their own, and close their loan as quickly as three weeks.

While that all sounds great, the big question is if they offer the best deal in town or you can get a cheaper rate elsewhere.

How Great of a Deal Is This Really?

I always say that mortgages are mostly a commodity, in that everyone basically offers the same thing. A boring old 30-year fixed mortgage.

The only real difference is the service and the ability to close the thing. That second part is very important.

The first part matters too, but less so since your loan will likely be transferred to a third-party loan servicer shortly after closing.

In other words, loan pricing is really what matters in the long run, for the 30 years after your mortgage funds.

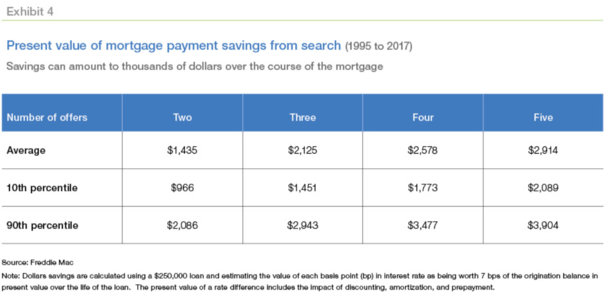

That’s why it’s important to speak to a few different lenders, banks, credit union, and local mortgage brokers. And to get more than just one quote, as seen in the table above from Freddie Mac.

With regard to the Better Forever Program, it appears you’re only saving $995, which is their fixed dollar amount loan origination fee.

So to determine if this is a good deal, you’d need to compare the costs of other options, including the interest rate offered and the lender fees.

Any bank or broker can structure your mortgage to be a no cost loan, where only the mortgage rate matters.

This can make it easier to compare lenders by mortgage rate, knowing third-party costs like appraisal and title insurance are largely the same.

Then you can determine if Better Mortgage truly is better, or if even with their fee waiver in place, a competing lender can do better.

Read on: Refinance for Free Later Deals Might Have Some Issues