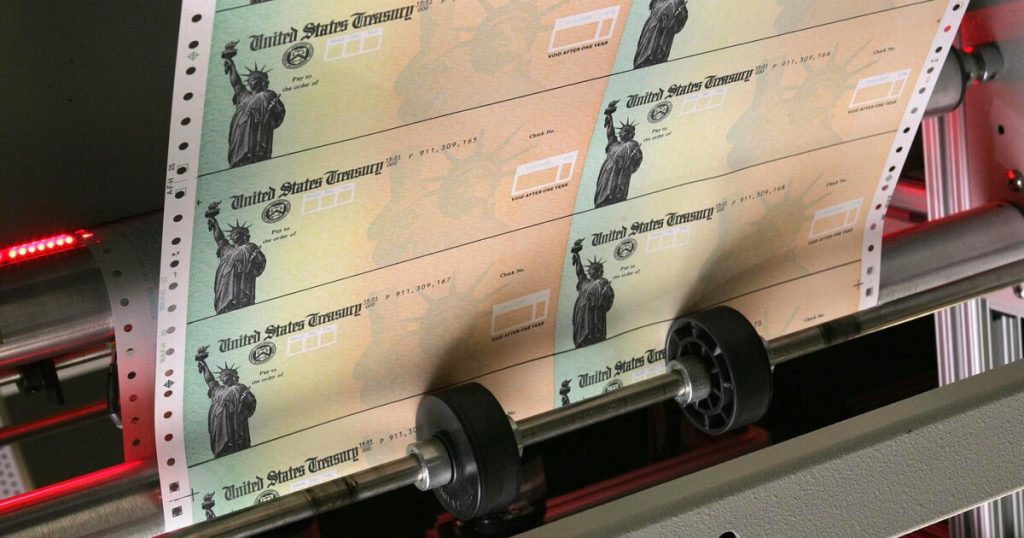

Dennis Brack/Bloomberg News

While hundreds of millions of Americans receive

Payments are the lifeblood of every entity. And when you hear that the U.S. government issues over

The numbers are staggering. The federal government processes more than $5 trillion in disbursements annually through the Bureau of the Fiscal Service, covering everything from Social Security benefits to tax refunds. State governments also process hundreds of billions of dollars in payments each year via unemployment benefits, public payrolls and more. Yet these massive financial flows are hampered by outdated systems that would look familiar to technologists from the 1970s. Paper checks cost 10 times more than digital payments. Vendor payments can take up to 90 days. Most troubling, improper payments waste $236 billion annually, while payment fraud costs up to $521 billion, according to the

Yet, we’ve seen the benefits of modernization on a small scale. For example, during a five-month pilot, the U.S. Department of the Treasury

This isn’t just about fiscal efficiency — it’s about America’s position in the global economy. International competition is fierce and accelerating. Brazil’s PIX system processes instant payments for 60% of its population. India’s UPI platform handles billions of real-time transactions monthly. Even Europe, often criticized for bureaucratic sluggishness, has implemented SEPA Instant, a continent-wide instant payment network.

The good news? We have the technology to fix this. If given the chance, the same digital infrastructure powering modern private sector payments can transform government payments. We can dramatically improve how government money moves by embracing real-time payment networks like FedNow, implementing API-driven solutions and leveraging artificial intelligence for decisioning, monitoring and fraud detection. Automation can ease the operational burden of payment operations and delight the end customers waiting to be paid.

This vision isn’t a distant future — it’s reality in the private sector today. Companies across the most important sectors of the economy already use modern payment operations software to process transactions in seconds rather than days, with complete transparency, accurate tracking and minimal error rates. The government can and should do the same.

The benefits would be immediate and far-reaching. Emergency relief payments that currently take weeks could be delivered in seconds. The $236 billion lost to improper payments could be dramatically reduced through automated verification and real-time monitoring. The billions spent processing paper checks could be redirected to critical government services. And all of this would be done with greater real-time transparency and reconciliation.

Critics might argue that modernizing government payment systems is too complex or risky. But the real risk lies in maintaining the status quo. Every day, we delay modernization, waste taxpayer money, frustrate citizens waiting for payments and fall further behind our global competitors.

When citizens wait weeks for tax refunds or disaster relief payments, it erodes their confidence in public institutions. When billions are lost to fraud and improper payments, it undermines faith in fiscal stewardship. Modern payment systems are the key to restoring transparency, efficiency and reliability.

The path forward is known. The technology exists. The private sector has shown it works. The choice is simple, and the cost of inaction is too high. We can continue with systems designed for the last century or build a payment infrastructure worthy of America’s innovation economy. The time for modernization is now.