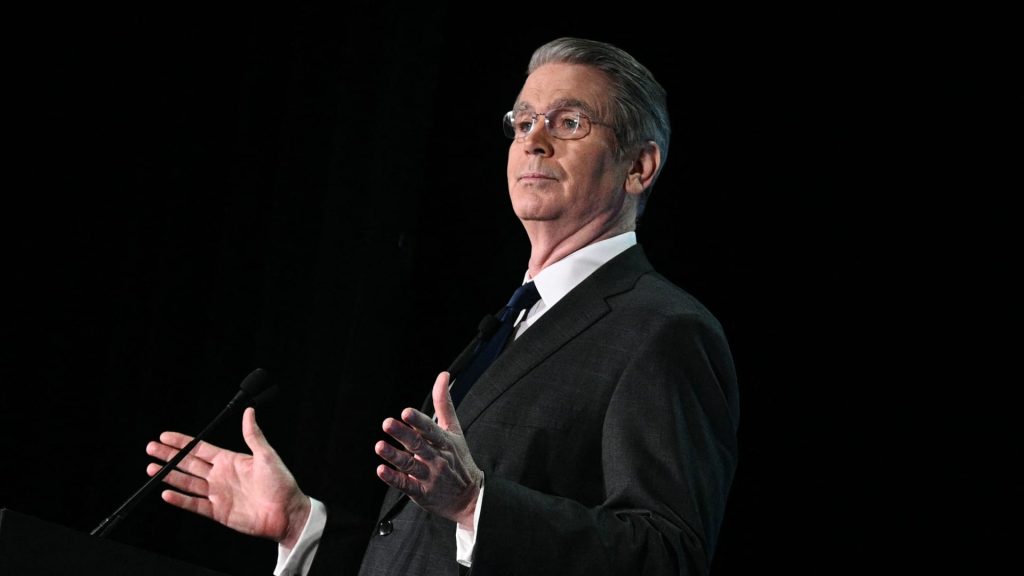

US Treasury Secretary Scott Bessent speaks at the American Bankers Association’s Washington Summit at the Walter E. Washington Convention Center in Washington, DC on April 9, 2025.

Brendan Smialowski | Afp | Getty Images

Treasury Secretary Scott Bessent said Wednesday that President Donald Trump’s aim is for Main Street businesses and consumers to thrive even as the administration’s steep new tariffs threaten to tip the economy into a recession.

“For the last four decades, basically since I began my career in Wall Street, Wall Street has grown wealthier than ever before, and it can continue to grow and do well,” Bessent said at the American Bankers Association’s Washington Summit.

“But for the next four years, the Trump agenda is focused on Main Street. It’s Main Street’s turn. It’s Main Street’s turn to hire workers. It’s Main Street’s turn to drive investment, and it’s Main Street’s turn to restore the American Dream,” he said.

Trump’s imposition of higher tariffs a week ago has fueled the biggest four-day rout for stocks since the onset of the pandemic in 2020. The S&P 500 is nearly 19% off its record high from February, inches away from a 20% bear market.

While the wealthy own the majority of stock, Main Street’s participation has soared with the advent of Individual Retirement Accounts in the 1970s and 401(k)s in the presidency of Ronald Reagan. What’s more, the stock market helps form business confidence, which in turn affects small businesses.

Bessent, a hedge fund veteran, founded investment firm Key Square Capital Management, based on Madison Avenue in New York City, after working with George Soros for years. He has become the main economic spokesman for Trump’s agenda of tax cuts, deregulation and trade rebalancing.

“We want to de-leverage the government sector, re-leverage the private sector …. we can’t do it all at once, or that will cause a recession,” Bessent said. “What will keep us from having a recession is making sure that the tax bill doesn’t expire, adding back 100% depreciation and then adding some of President Trump’s agenda — No tax on tips, no tax on Social Security, no tax on overtime.”

Recession fears have climbed as the Trump tariffs spur uncertainty over how wide the trade war will spread, and its impact on the pace of economic growth, inflation and corporate profits. JPMorgan Chase CEO Jamie Dimon said Wednesday he sees the U.S. economy likely headed for recession because of the trade battle.