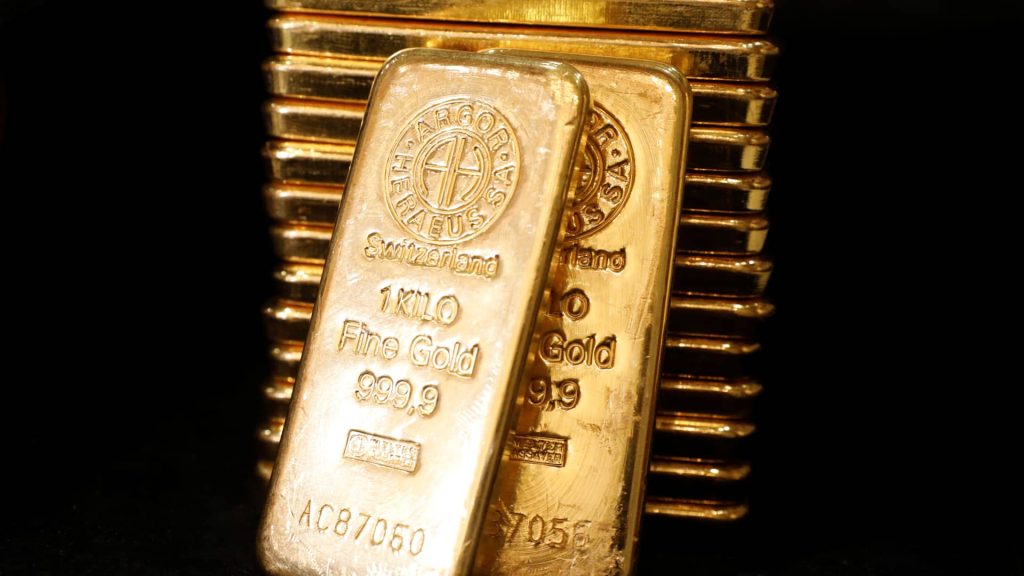

Gold has cooled after a year-long rally that sent the commodity to a gain of 35%, but even with stocks in rebound mode, the market hedge has room to move higher, according to David Schassler, head of multi-asset solutions at fund manager Van Eck.

“I couldn’t imagine a better backdrop for gold,” said Schassler on this week’s CNBC “ETF Edge.”

The U.S. government has “huge debt, huge spending and huge chaos” Schassler said, adding that he doesn’t see that changing anytime soon.

Hedge fund icon David Einhorn of Greenlight Capital echoed that sentiment on CNBC’s “Closing Bell” in an appearance Wednesday from the Sohn Investment Conference. “There’s a bipartisan agreement to do nothing about the deficit until we get to the next crisis,” he said.

Einhorn is long gold and said he thinks it could reach $5,000 in 2026.

Schaasler also called for the price of gold to hit $5,000 next year.

Gold has seen a big jump in the last year, despite a recent downturn.

Schassler is also bullish on the market’s newer hedge, crypto, and sees the two asset classes moving in the same direction. “Bitcoin is the risky cousin of gold” he said.

While it is subject to big swings in sentiment and can trade in tandem with a risk-off move in stocks, bitcoin is up about 60% in the last year, and in contrast to gold’s recent dip, bitcoin is up 10% over the last month.

There are new tools from the ETF industry investors may want to consider to capture upside in bitcoin while limiting risk, according to VettaFi head of research Todd Rosenbluth. “I’m impressed with what’s happening in the options-based world with ETFs,” he said about crypto ETFs with built-in protection on this week’s “ETF Edge.”

The use of options to limit volatility in returns has become popular with equity ETFs, but Rosenbluth also recommends investors consider ETFs like the Calamos Bitcoin 80 Series Structured Alt Protection ETF (CBTJ). There is an upside cap, but if the underlying assets fall more than 20%, an investor’s maximum loss stops there.

Performance of bitcoin over the past one-year period through May 15, 2025.