Bloomberg

WASHINGTON — The House Budget Committee failed to advance House Republicans’

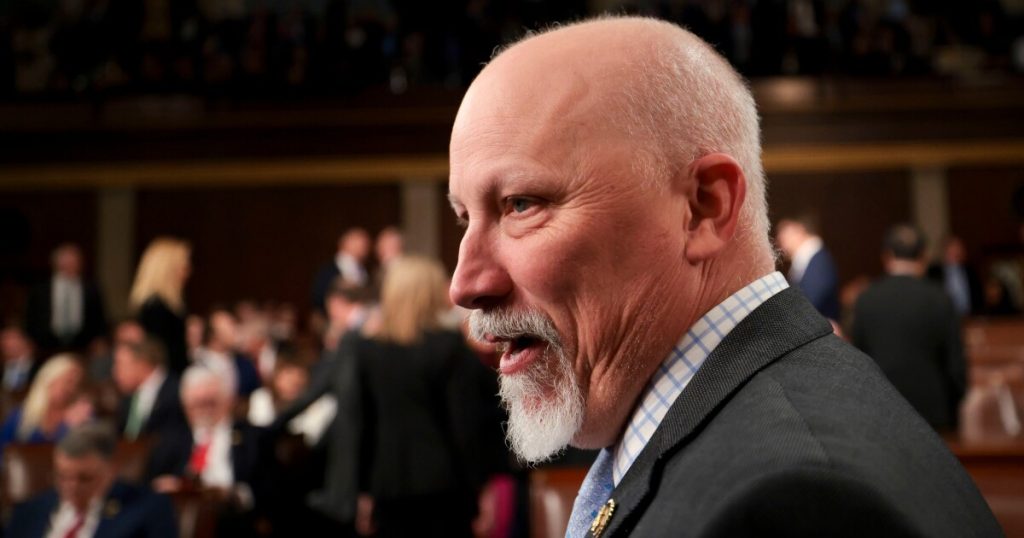

The House committee voted 21-16 to reject the bill, with Republicans Chip Roy of Texas, Ralph Norman of South Carolina, Josh Brecheen of Oklahoma and Andrew Clyde of Georgia joining Democrats in voting against President Donald Trump’s “big, beautiful bill.”

“We don’t need ‘GRANDSTANDERS’ in the Republican Party,” Trump said

The Republican holdouts are demanding more cuts to Medicaid and other programs. The Republican caucus is also balancing the interests of lawmakers from Democratic-led states who demand a larger state and local tax, or SALT, deduction, and more moderate members who don’t want extreme cuts to Medicaid.

“We are writing checks we cannot cash, and our children are going to pay the price,” Roy told the committee. “So, I am a ‘no’ on this bill unless serious reforms are made.”

The panel will hold another vote on Monday, according to Rep. Lloyd Smucker, R-Pa., who changed his vote to “no” in order to bring up the bill again in the committee.

This development throws into jeopardy many of the

The Section 199(a) provisions currently allow owners of pass-through entities to deduct up to 20% of their taxable income from those entities. Bank groups say extending the provision to 23% and making it permanent would keep community banks’ tax rate in line with the corporate tax rate.

Other measures favoring banks, particularly community ones, are also likely safe. The Ways and Means tax bill that passed through committee earlier this week included the ACRE Act, exempting taxation interest on loans secured by farmland and most residential mortgages in small towns, which is politically popular.

Less sure is the future of so-called MAGA accounts.

House Republicans included a measure called Money Accounts for Growth and Advancement, or MAGA accounts, for children born roughly within Trump’s term. The government would seed these accounts with $1,000, and although balances would grow tax free, there would be taxes and penalties for withdrawing the money, especially if the child does so before age 30.

Brokers and banks who hold these accounts might benefit from the added business.

The conservative Republican revolt could also mean that lawmakers need to revisit other measures to please hardliners who want the bill to be budget-neutral, such as higher taxes on some trades, stock buybacks or corporate earnings.

It could also present an opportunity for banks. Notably, the bill out of Ways and Means did not include any change to

It’s more likely that cuts will come on the spending side, but it will be difficult to balance the budget, or get close to it, without making cuts to programs that Republicans in vulnerable districts have warned would be politically toxic.