Melinda Huspen/American Banker

The products on display at the Fintech Innovation Lab’s

All of the featured startups advertised software or programs of some sort, so the demo room consisted of a semicircle of TV monitors with different dashboards and interfaces.

The open setup of the 16th floor at BNY’s New York office overlooked the financial district, a rapidly rising hub for fintech investment.

I tried out two products at the event. Here’s what I found.

Wellthi

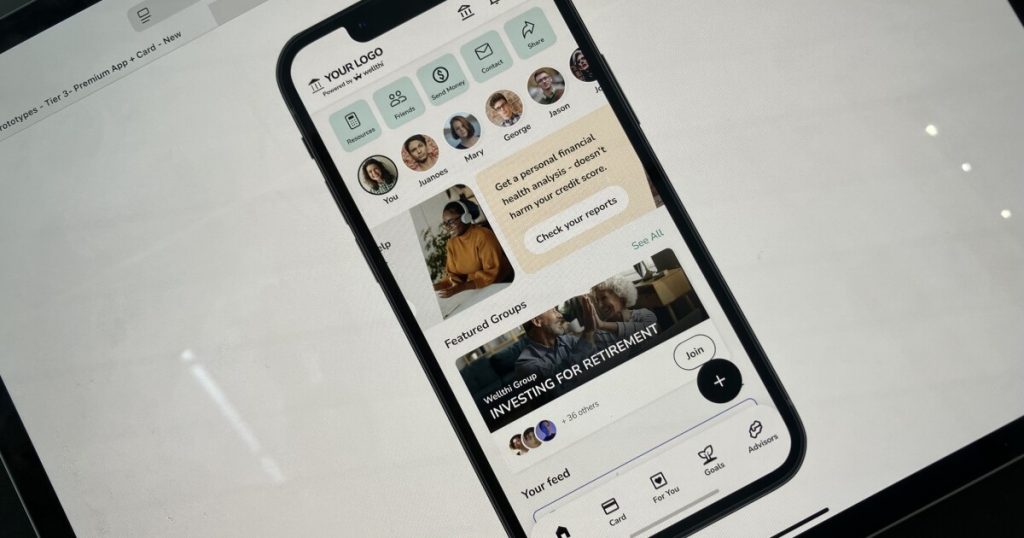

The first demo table I approached was for Wellthi, a Black-owned fintech startup targeting banks and credit unions. CEO Fonta Gilliam offered me her tablet to interact with the platform’s prototype.

Gilliam built Wellthi as a “fintech social enterprise” to help consumers reach their financial goals with family and friends. Wellthi also helps financial institutions use generative AI and social networking to attract and retain customers. Banks can license, co-brand and embed Wellthi’s platform inside their mobile apps.

The prototype I explored on Gilliam’s tablet looked like a sample phone screen with a white-label app dashboard. The top left corner held a spot for a bank’s name and logo, with a small “Powered by Wellthi” underneath. Otherwise, the app interface looked like it could belong to any bank mobile app.

As I tapped through the different buttons and modules in the “app,” the prototype reminded me of the social elements of LinkedIn but inside a banking app. There is a feed for users to post on, in-bank financial advisor profiles to connect with, and public groups to join based on common interests or financial goals.

The idea of seeing the financial activity of friends and family also reminded me of Venmo’s app feed. Venmo might seem like a stretch when discussing social app comparisons, but public Venmo transaction histories have exposed multiple

I found the prototype easy to use and, coming from a large family myself, I could see the benefits of connecting with friends and relatives to work toward savings goals together such as group vacations or wedding budgets.

AnChain.AI

Next, I headed over to AnChain.AI. The company

The demo was less interactive than Wellthi’s. I watched Anchain.AI’s monitor play through an automatic animation of the agentic interface. The night-mode dashboard labeled “AML Alert Agent” and the list of alerts with red and green labels looked like a high-tech security database to my untrained eye.

Melinda Huspen/American Banker

The animation highlighted one of the red-labeled alert lines, then opened a separate screen filled with codes and transaction history tickers. One of the code lines, labeled “LLM Reasoning,” indicated that it was an AI agent that pulled out this suspicious-looking transaction and flagged it for further review by a human.

The interface looked not entirely unlike the hacker programs I’ve seen in spy thrillers or action flicks, but this AI agent is built to block those kinds of heists. It is currently used for financial crime investigations by regulatory agencies such as the Financial Crimes Enforcement Network and the Securities and Exchange Commission.

I imagine this sort of setup would be useful for banks that engage in cryptocurrency transactions and are trying to prevent fraud and money laundering. It’s possible there will be more demand for the product as Congress and the Trump administration