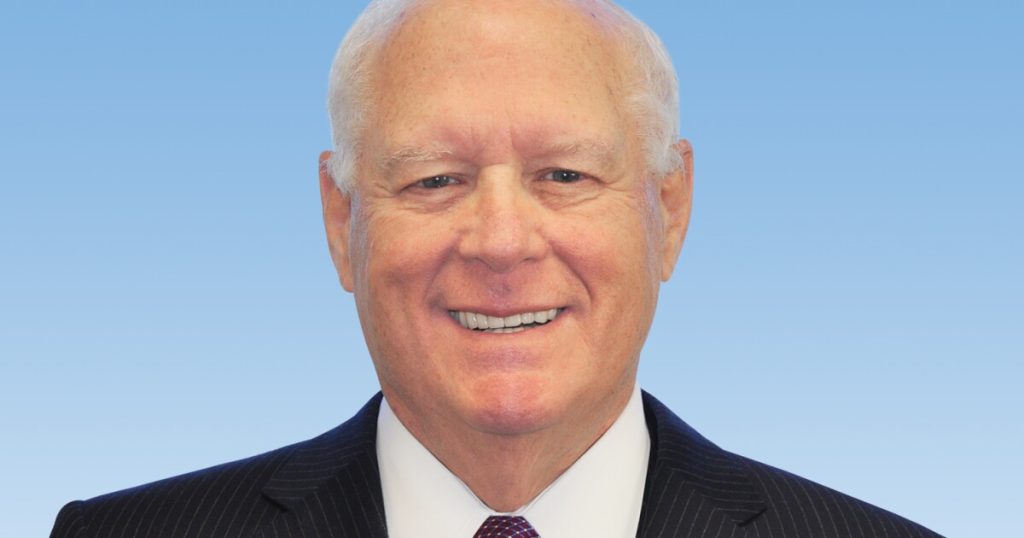

Gerald Lipkin, who spent nearly three decades as CEO of Valley National Bancorp in New Jersey, presiding over its expansion into a regional institution with more than $23 billion of assets, passed away Wednesday. He was 84.

In a statement Thursday, Valley Chairman and CEO Ira Robbins said Lipkin’s “leadership and vision” shaped the company “for more than four decades.”

“Gerry was more than a CEO. He was a mentor, a friend and the heart of our organization for many years,” Robbins said. Lipkin joined what was then known as the Bank of Passaic and Clifton in 1975. The following year, the company merged with the Bank of Wayne and rebranded as Valley National Bank.

When Lipkin was appointed CEO in 1989, he succeeded another legendary banker, Samuel Riskin, who served for 35 years as CEO. At the time, Wayne, New Jersey-based Valley had eight branches and less than $1.9 billion of assets. By the time Lipkin

Born in Passaic, New Jersey, Lipkin attended Rutgers University. He joined the Office of the Comptroller of the Currency after graduating in 1963.

Lipkin earned an MBA from New York University in 1966. He graduated from the American Bankers Association’s Stonier School of Banking in 1972. The OCC promoted him to deputy regional administrator prior to his move to the Bank of Passaic and Clifton.

Valley was an active acquirer under Lipkin’s leadership, completing 16 whole-bank deals between 1990 and Jan. 1, 2018.

Lipkin’s final two deals — the acquisitions of 1st United Bancorp in Clearwater, Florida, and

Valley was known under Lipkin for its solid asset quality. Throughout his tenure, the bank finished most years with net charge-offs at or below 10 basis points of total loans.

At the same time, Lipkin acted as Valley’s number-one pitchman, appearing in commercials to promote the bank’s loan products.

“His passion for this company and the people in it was unmatched and his approach to banking remains at the heart of Valley’s culture today,” Robbins said of Lipkin. “He led with integrity, expected the best from those around him and never wavered in his commitment to doing the right thing. Gerry’s legacy lives on in the culture he helped create and the countless lives he touched.”

“He worked [at Valley] more than 40 years and loved everything he did,’ Lipkin’s son Jeffrey said Friday at a memorial service, adding that “love it or leave it” was one of his father’s rules for success.

Michael Affuso, chairman and CEO of the New Jersey Bankers Association, described Lipkin’s career, from humble beginnings in Passaic to leading a regional bank, as “inspiring.”

“We lost a titan,” Affuso told American Banker on Friday. Beyond his professional accomplishments, Lipkin was “such a decent man,” Affuso said. “I loved him. I was so sad when I heard the news.”

During his career, Lipkin served as chairman of the New Jersey Bankers Association and sat on the board of the Federal Home Loan Bank of New York. He remained close to Rutgers and received the school’s distinguished alumni award in 2006.

Lipkin married his wife Linda in 1964. The couple had two children and five grandchildren.