Bloomberg News

Alaska Governor Mike Dunleavy Wednesday vetoed a bill that would have capped annual interest rates on consumer loans at 36%, arguing that the measure would “reduce short-term credit options” for underserved consumers in the state.

Senate Bill 39, sponsored by Anchorage state Sen. Forrest Dunbar, a Democrat, was intended to protect low-income borrowers from being caught in predatory lending practices. But Dunleavy said in a brief letter to the state legislature explaining his veto that the cap would make the lack of access to financial services —

“SB 39 replaces the state’s existing small-loan framework with substantially reduced rate limits and new compliance requirements,” Dunleavy said in the letter. “These changes would reduce short-term credit options — particularly for those without access to traditional banking services — while creating enforcement challenges for the state.”

SB 39 would have capped the total cost of consumer loans — including fees and interest — at 36% APR for loans up to $25,000. That 36% threshold one that

The Alaska state legislature could override Dunleavy’s veto, but that prospect is unclear. The bill passed with bipartisan majorities in both houses of the state legislature, but state law requires 40 of the 60 members of the House and Senate to override a veto. When the bill was passed, it only had

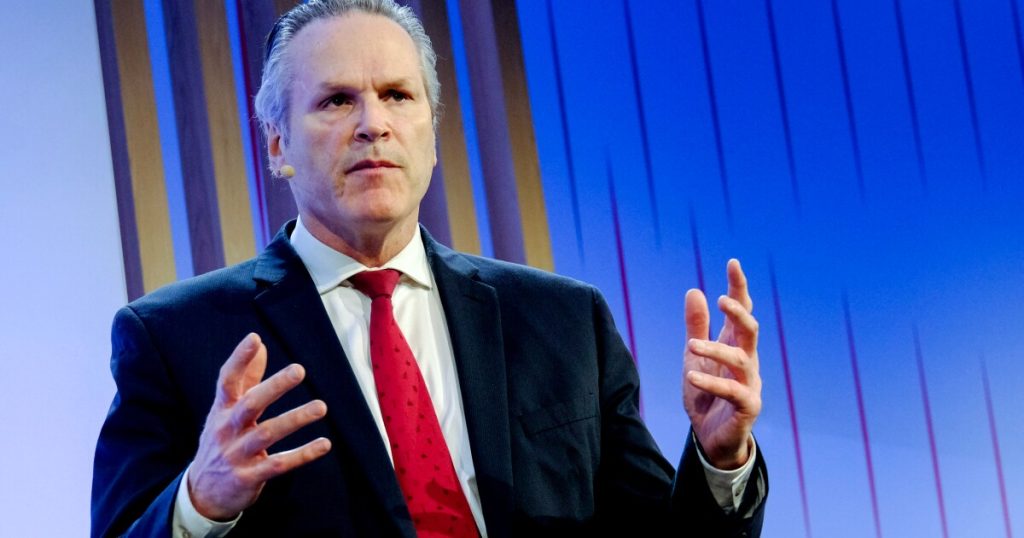

Lender advocates like Online Lenders Alliance Chief Executive Officer Andrew Duke celebrated the decision, calling it a win for credit access.

“Governor Dunleavy made the right choice for Alaska consumers by vetoing this flawed legislation,” Duke said. “The ability to access credit is the cornerstone of financial independence and stability. Unfortunately, SB 39 would have taken away credit options and financial choices for Alaskan consumers and small businesses.”

Patrice Onwuka, director of Independent Women’s Center for Economic Opportunity said the law would have eliminated access to credit. Onwuka argued the more credit available to borrowers, the better, regardless of the rate.

“For those whose credit is subprime or are unbanked and underbanked, fintech lending and other forms of short-term lending offer a lifeline to help them meet unexpected needs,” said Onwuka. “From female small business owners to working parents, many people turn to these credit options. This bill would have dried up those options. Thankfully, Alaska will avoid the folly that other states that implemented similar ill-advised laws imposed on their citizens, especially the most vulnerable communities.”

During the 2024 campaign, President Trump floated the idea of capping credit card interest rates at 10%. Sens. Bernie Sanders, I-Vt., and Josh Hawley, R-Mo., introduced a proposal to cap credit cards at 10% — in line with President Donald Trump’s campaign promise. Hawley