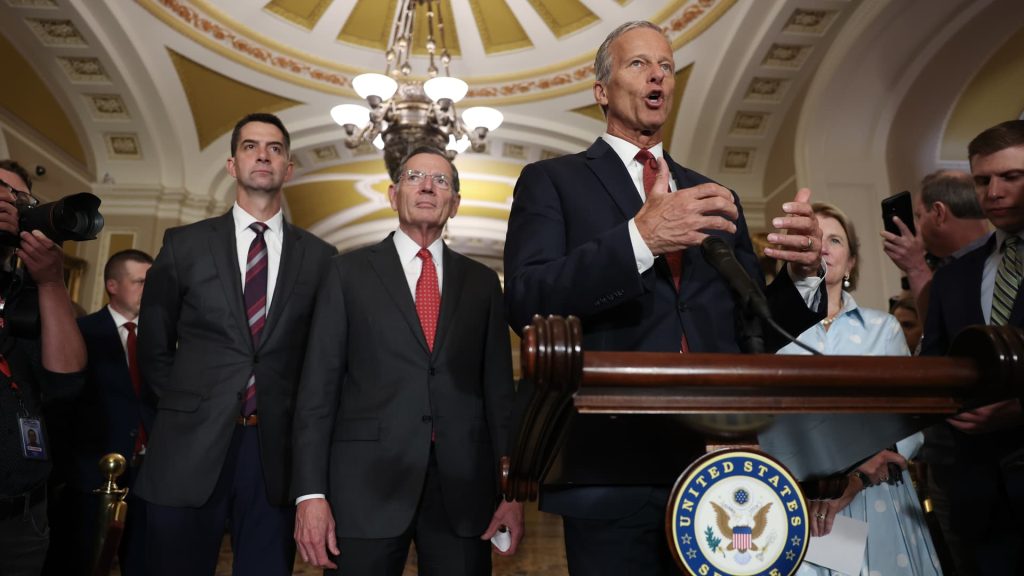

Senate Majority Leader John Thune (R-SD) speaks to reporters at Capitol Hill on June 24, 2025 in Washington.

Tasos Katopodis | Getty Images News | Getty Images

A Republican megabill that lawmakers are trying to pass by the Fourth of July would clamp down on the finances of immigrant households, including those in the U.S. legally, economists and policy experts said.

The legislation, championed by President Donald Trump, would restrict access to tax benefits like the child tax credit. Republican lawmakers in the House and Senate have also included a tax on the money immigrants send abroad, called remittances, and a $1,000 fee for those who seek asylum.

The provisions “make life harder for immigrants in the U.S., both legal and undocumented immigrants,” said Tara Watson, director of the Center for Economic Security and Opportunity at the Brookings Institution.

“I think this will make a significant difference” in their financial lives, Watson said.

More from Personal Finance:

GOP megabill proposes new Medicaid work requirements

House, Senate tax bills both end many clean energy credits

GOP bill may add to medical debt for households

The Republican-majority House Judiciary Committee, chaired by Rep. Jim Jordan, R-Ohio, said in a statement last month that some of the financial measures aim to make immigration services “self-sustaining.”

“This is about providing resources to enforce our immigration laws … and implement responsible fiscal policy,” the committee said.

Republicans are cutting safety net spending more broadly to help finance their so-called one big beautiful bill, the centerpiece of which is a multitrillion-dollar package of tax cuts. The benefits of those largely accrue to wealthy households, data shows.

The cuts also come as the Trump administration pursues an aggressive deportation agenda.

The legislation is still in flux and differs somewhat between House and Senate versions. The Senate may vote on its measure as soon as this week.

In some cases, GOP lawmakers may not be able to restrict benefits to the extent they’d like.

For example, the Senate parliamentarian, a nonpartisan procedural advisor, ruled in recent days that the GOP must strip a provision from the legislation that would curb some immigrants’ eligibility for Supplemental Nutrition Assistance Program benefits, formerly known as food stamps.

The parliamentarian also dealt a blow to Republicans’ proposals to deny certain legal immigrants from federal health benefits, according to a Senate Budget Committee release on Thursday. The bill text included provisions to cut access to Medicaid, Medicare and Affordable Care Act insurance subsidies from refugees and individuals seeking asylum, among others.

It’s unclear how Republicans may alter the legislation to reconcile these rulings.

Barring immigrants from tax benefits

A view of the Internal Revenue Service (IRS) building in Washington, D.C., U.S., February 16, 2025.

Annabelle Gordon | Reuters

Among the most impactful tax changes is one that would restrict the child tax credit, Watson said.

A 2017 tax law enacted during Trump’s first term barred parents from claiming the credit for children who don’t have a Social Security number. The House and Senate would make this provision permanent, impacting an estimated 1 million children.

GOP lawmakers would further cut access for kids whose parents don’t have a Social Security number. The change would “exclusively” impact kids who are U.S. citizens or legal residents, according to the Institute on Taxation and Economic Policy.

The House bill’s language on this issue is stricter than the Senate, Watson said.

In the House bill, kids would be ineligible for the credit if either of their parents doesn’t have a Social Security number, she said. The Senate would allow a child to receive the benefit if at least one parent has a work-eligible SSN.

The House bill’s policy would cut access to about 4.5 million children with Social Security numbers, according to the Center for Migration Studies.

The five states in which the largest estimated number of kids would be impacted are California (910,000), Texas (875,000), Florida (247,000), New York (226,000) and Illinois (196,000), the center said.

Parents and caregivers with the Economic Security Project gather outside the White House to advocate for the Child Tax Credit in advance of the White House Conference on Hunger, Nutrition, and Health on Sept. 20, 2022.

Larry French | Getty Images Entertainment | Getty Images

“If a U.S. citizen is married to an undocumented immigrant, or if a citizen child has an undocumented parent, then the House bill considers the citizen to have forfeited their right to a range of tax breaks,” ITEP researchers Carl Davis and Sarah Austin wrote in an analysis in May.

Beyond the child tax credit, those also include existing tax breaks like the American Opportunity Tax Credit and Lifetime Learning Credit and new benefits proposed in the legislation, from so-called Trump accounts to tax breaks for tips and overtime, experts said.

Many immigrants are members of such mixed-status families, Davis and Austin wrote.

The policy debate comes as the Trump administration is trying to end birthright citizenship, the precedent that anyone born on U.S. soil automatically gets citizenship at birth. The Supreme Court is expected to soon rule on the policy.

The House bill also requires all parents to file a joint tax return if they are married and claiming the child tax credit, according to the National Immigration Law Center.

This provision would also impact nonimmigrant households in which married couples typically file separate tax returns, as happens if one spouse has substantial student loan debt or has been a victim of identity theft, for example, Davis and Austin wrote.

Tax on remittances

A man works on the street exchanging dollars for lempiras (official Honduran currency) in Tegucigalpa on April 8, 2024. Guatemala, El Salvador, Honduras, and Nicaragua together received almost US$42 billion in family remittances in 2023, according to AFP calculations based on official data from central banks and the intergovernmental Central American Monetary Council, a record figure that represents a quarter of the combined GDP of these countries.

Orlando Sierra | Afp | Getty Images

Republicans would put a tax on “remittances.” These are transfers of money such as earnings to family members and others abroad.

Remittances have been “growing rapidly” and have become the largest source of foreign income for many developing countries, Dilip Ratha, lead economist for migration and remittances at the World Bank, wrote in 2023.

India, Mexico, China, the Philippines and Pakistan are the top five recipients for global remittances, according to World Bank data from last year. The U.S. was the largest source of global remittances in 2023, it said.

The House and Senate bills would put a 3.5% tax on remittances, to be paid by the sender.

Such taxes would come on top of remittance fees that providers like banks or money transfer services like Western Union already charge to send money abroad electronically. Such fees can be high, perhaps 10% or more, Ratha wrote.

There are some differences. For example, the House would require this tax for all noncitizens, while the Senate would do so for those without Social Security numbers, according to the National Immigration Law Center. Others would be able to claim a tax credit for any taxes they pay on remittances.

New fees for asylum, other applicants

The Senate and House bills would add fees for immigrants who apply for asylum or interact with many other levers of the U.S. immigration system.

According to the National Immigration Law Center, the fees include, among others:

- A $1,000 application fee for asylum, a protection that lets individuals remain in the U.S. instead of being deported to a nation where they fear persecution or harm. (There’s no current fee.)

- Asylees would need to pay at least another $550 every six months to get work authorization. (There’s no current fee.)

- A $500 application fee for Temporary Protected Status. (The current fee is $50 and another $30 for biometrics.)

- A $5,000 fee for anyone apprehended between ports of entry and determined inadmissible. (There’s no current fee.)

These are minimum fees without waivers, and the legislation provides for regular annual increases, according to the National Immigration Law Center.