I’m old enough to remember a time before everyone was plugged into the Matrix… I mean, the internet.

I remember when my parents brought home our first computer and I played my first computer game (though I could never get the floppy disk to run right). There wasn’t much else to do with the machine yet, aside from writing and playing Solitaire.

Years passed, and life changed big-time.

We moved from New York City to the Long Island suburbs. I started taking computer classes in middle school, learning the basics of this new technology. And soon I was putting in CDs of the Encyclopedia Britannica, feeling as if I had access to the world’s knowledge at my fingertips.

Little did I know the world was going through a wave of innovation thanks to the internet.

While I was playing “Math Munchers” on CD-ROM – I can still hear that menu screen music – business owners were quietly building websites and empires that would reshape commerce forever.

But here’s the crazy part…

As companies like Amazon and eBay became the household names of the internet boom, one company was the behind-the-scenes giant making money from every single digital move.

That company was Cisco Systems (Nasdaq: CSCO).

Every time you visited a website or sent an email back then, your data traveled through networks built with Cisco gear. The company wasn’t selling books to consumers. It was selling the routers and switches that made it all possible.

It was the perfect “pick and shovel” play during the internet gold rush.

And now it’s at it again with artificial intelligence.

The Same Playbook, Different Era

Cisco just reported great third quarter numbers. Revenue hit $14.1 billion, up 11% year over year. More importantly, the company pulled in over $600 million in AI gear orders from big tech companies in just one quarter.

That brought its AI revenue to over $1 billion for the first three quarters of fiscal 2025, enabling it to beat its target a full quarter early.

The stock has done well, climbing from lows around $36 in 2022 to current levels near $68.

But here’s what really matters for your money: Cisco made $4.1 billion in operating cash flow last quarter. (That’s real money, not accounting tricks.) It also returned $3.1 billion to shareholders through dividends and buybacks, bringing the total to $9.6 billion returned so far this year.

This isn’t some growth-at-any-cost story. It’s a mature company throwing off serious cash while getting ready for the AI boom. It’s even working with Nvidia to make Cisco gear the standard for AI setup.

Think about the potential here if every major AI rollout were to include Cisco equipment by default. The company could immediately return to a dominant position within the tech sector.

What the Numbers Actually Mean

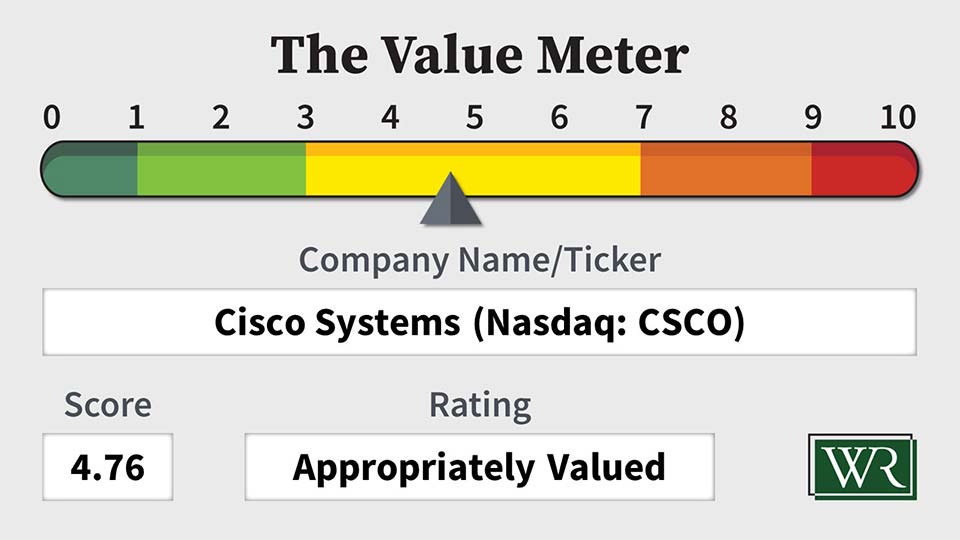

The Value Meter shows some good metrics for Cisco.

The company’s enterprise value-to-net asset value (EV/NAV) ratio sits at 6.15, meaning you’re paying about $6 for every dollar of business assets after covering debts. With our universe average at 12.32, Cisco trades at roughly half the typical premium.

More telling is its free cash flow-to-net asset value (FCF/NAV) percentage of 7.66%. That tells us the company makes over $7 in free cash flow for every $100 in net assets. Compare that with our universe average of -26.98%, and you’re looking at an impressive cash generator.

Cisco’s free cash flow growth consistency tells the real story. It grew free cash flow quarter over quarter 45.5% of the time over the past three years, nearly matching our universe average of 47.58%. This isn’t a company with wild swings – it’s one that’s steadily improving.

Now, Cisco faces real challenges. Competition is tough. Economic downturns hurt infrastructure spending. Tariffs create headwinds.

However, there are also multiple tailwinds pushing the company forward, including a 54% spike in security revenue, increased government orders, and heightened demand as a result of the 5G rollout.

When I look at Cisco, here’s what I see: a company with a dominant market position, $15.6 billion in cash, and partnerships that put it at the center of the AI buildout.

It isn’t the flashy AI stock making headlines. It’s the infrastructure play that quietly profits from everyone else’s AI dreams.

For conservative investors wanting AI exposure without the volatility, Cisco offers something rare: a combination of steady dividends, consistent cash flow, and upside in a massive tech shift.

Sometimes the best investments aren’t the companies everyone’s talking about.

They’re the ones building the backbone that makes everything else work.

The Value Meter rates Cisco Systems as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.