Not long ago, nuclear energy was looked at as a reckless abuse of nature.

The energy generation it promised was always superior to traditional resources. But the danger and risks associated with nuclear fallout – especially in the constant fog of the Cold War – gave people the heebie-jeebies. (The catastrophe at Chernobyl didn’t do nuclear energy any favors either.)

Today, however, sentiment has shifted dramatically.

Nuclear energy is receiving renewed interest from both hardened advocates and environmentalists alike. Why? Because it’s far safer, far more efficient, and far more environmentally friendly than ever before.

Technology has improved too, and the need has become more urgent. Climate change demands that we find clean energy sources that can actually meet our massive power needs. Solar and wind can’t do it alone.

At the very least, nuclear power is now part of an “all cards on the table” strategy that’s gaining consensus across party lines.

That means uranium is an increasingly hot commodity… and few uranium miners have the market dominance that Cameco (NYSE: CCJ) has.

Based in Saskatchewan, Canada, Cameco is one of the world’s largest uranium producers. It controls some of the highest-grade uranium deposits on the planet and has been mining the stuff for decades.

Lately, the stock has been on a tear. Cameco has climbed from around $16 in early 2022 to current levels near $78 – a nearly fivefold increase as sentiment surrounding nuclear energy has improved.

The question is… Has the run gotten ahead of the fundamentals?

Cameco just reported second quarter results that show the nuclear revival is real.

Revenue jumped to $877 million, a 47% increase compared with the same quarter last year. Net earnings shot up from just $36 million to $321 million.

But the real story is in uranium pricing. The company’s average realized price hit $57.35 per pound in U.S. dollars – up from $56.43 last year. That might not sound like much, but in the uranium business (where you’re selling millions of pounds), every dollar per pound matters.

The company produced 4.6 million pounds of uranium in the quarter but sold 8.7 million pounds, requiring it to draw down inventory to meet strong demand from utilities stocking up for the nuclear revival.

Cameco generated $465 million in operating cash flow during the quarter – up 79% from last year. That’s real money flowing into the business.

However, the company is also dealing with higher costs. Its cash cost per pound jumped to $35.55 from $34.76 last year, and the rising costs are eating into some of the price gains.

Still, the overall trend is positive. Cameco’s adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) hit $673 million in the quarter, nearly double the $343 million from the second quarter of 2024.

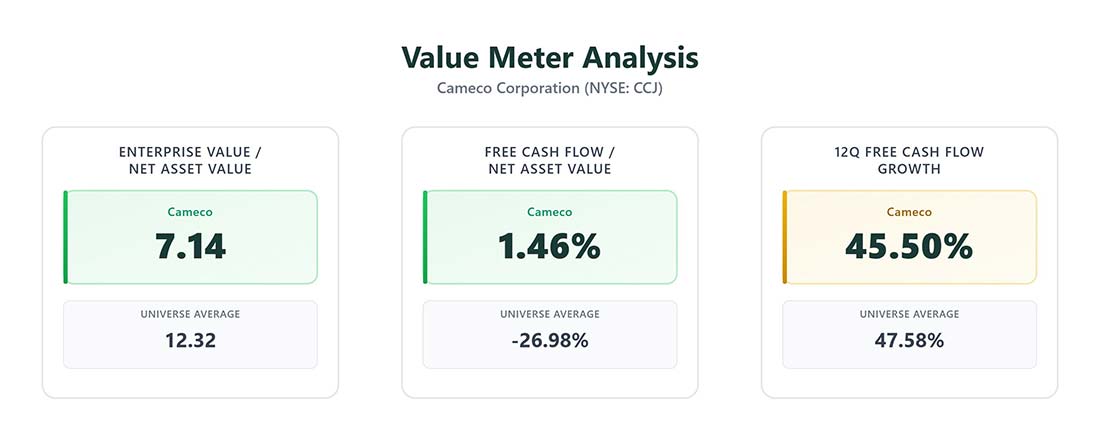

The Value Meter reveals some concerning metrics for Cameco.

The company’s enterprise value-to-net asset value (EV/NAV) ratio sits at 7.14, meaning you’re paying about $7 for every dollar of business assets after covering debts. With our universe average at 12.32, Cameco actually looks relatively cheap by this measure.

But here’s the problem: The company’s free cash flow-to-net asset value (FCF/NAV) percentage of just 1.46% shows that it generates less than $1.50 in free cash flow for every $100 in net assets. Compare that with our universe average of -26.98%, and Cameco looks decent – but that’s a pretty low bar.

The company’s free cash flow growth consistency tells a mixed story – it grew free cash flow quarter over quarter 45.5% of the time over the past 12 quarters, nearly matching our universe average of 47.58%. This shows steady but not spectacular consistency.

Cameco faces a classic commodity dilemma. Uranium prices are rising, but so are costs. The company is benefiting from the nuclear revival, but the stock has already priced in a lot of good news.

At current levels, you’re betting that uranium prices keep climbing and that new nuclear plants actually get built. Both are possible, but neither is guaranteed.

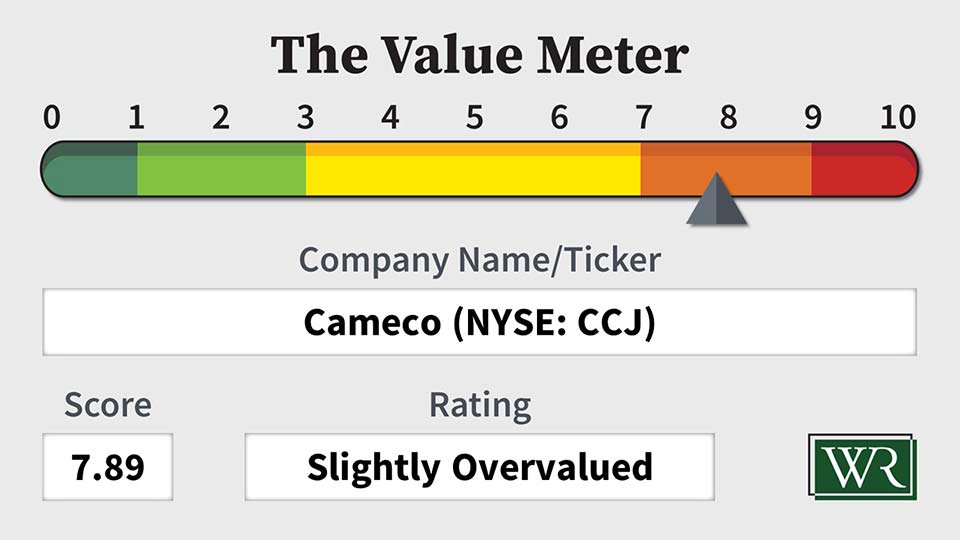

The Value Meter is flashing a warning signal. Right now, investors are paying a premium for a company that, while profitable, isn’t generating the kind of cash flow you’d expect at these prices.

For speculative investors betting on the nuclear revival, Cameco might make sense. But for conservative investors looking for value, the run-up has made this stock expensive relative to its current cash generation.

Sometimes the best investment advice is to know when to wait for a better price.

The Value Meter rates Cameco as “Slightly Overvalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.