Economic uncertainty hasn’t put a dent in investor appetite for fintech, which has held up so far in 2025.

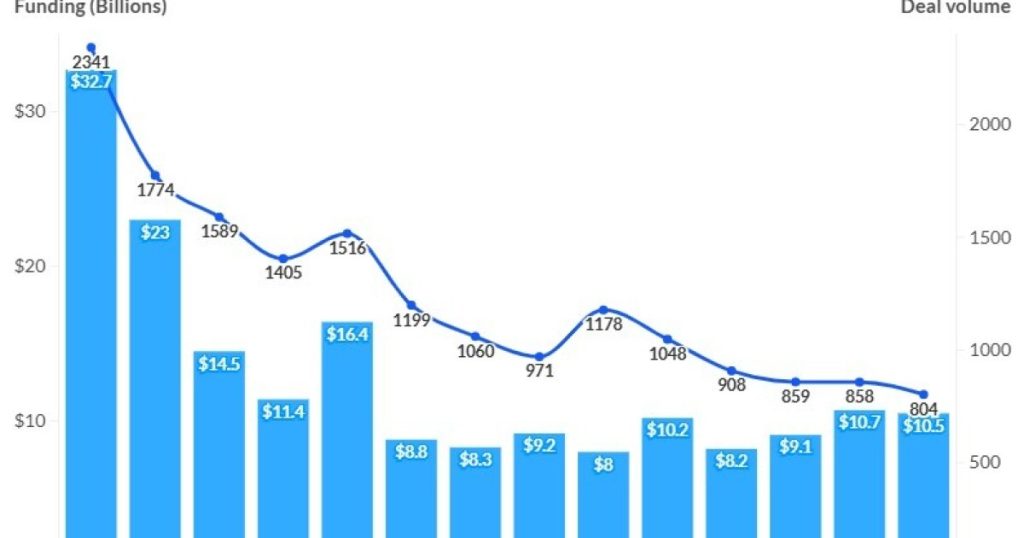

Equity deals in the global fintech sector surpassed $10 billion in Q1 and Q2 of this year, which hasn’t happened since early 2023 according to CB Insights’

“CB Insights is right to flag two strong quarters with over $10 billion in fintech funding as an encouraging signal,” Hadar Siterman Norris, a partner at global venture group Team8, told American Banker. “While not yet a full recovery, there’s certainly growing optimism, driven by rising investor confidence.”

The report also noted an increase in merger and acquisition deals from the previous quarter and a rise in fintech initial public offerings, especially through digital asset companies, such as

“Larger deal sizes, steady M&A growth, and more backing for strong companies signal a sector gradually maturing and consolidating,” Siterman Norris said.

While investing showed an uptick this quarter, it’s still comparatively low from two years ago.

“We need the other side of these transactions to happen so that the investing machine works, whether it’s venture or private equity,” Chris Sugden, fintech investor at Edison Partners, told American Banker. “I would say we’re actually lighter on exits, even though we’re starting to see a little bit of promise.”

The fintech sector wasn’t as notably affected by market uncertainty surrounding the Trump administration’s

“Tariffs have had little impact so far,” she said. “Most fintech activity is in software, which is largely insulated.”

However, funding in the sector still remains below early 2022 levels, when fintech equity investment reached its peak before the 2022-2023 drop and the

“The fintech sector got beaten up well before even the tariff news hit, so it was already in a recovery of sorts,” Sugden said.

He went on to say that the second half of the year would reveal whether the two-quarter rally is just a “seasonal blip” or if it is the beginnings of a longer-term trend toward full recovery for the sector.

Sugden also noted that the Trump administration has created a “tailwind” for the fintech sector with recent regulatory shifts.

“The administration has been a tailwind for fintechs,” he said. “The

Innovation in

“AI guidance is pushing teams to formalize model risk management, which actually helps buyers green light budgets,” Puri told American Banker. “That is a tailwind for AI native risk, underwriting, collections, and data quality platforms that come with governance built in. … If rules stay ambiguous, funding will still flow, but it will skew toward compliance infrastructure that helps firms be ‘compliant by default.’ In short, more clarity means faster committee approvals and larger checks in those subsectors through year-end.”

CB Insights covers over 23,000 fintech companies worldwide. The data analytics firm defines a “fintech” as a company or startup that “provide[s] technology to streamline, improve and transform financial services, products and operations for individuals and businesses,” according to a company representative.