The

In particular, the outlook for regional bank combinations has improved in recent months, according to analysts tracking the sector.

On Wednesday, the market got

Columbia Banking System and Pacific Premier Bancorp said

At the same time, analysts bullish about bank mergers and acquisitions shrugged off

Mergers of equals generally tend to have shakier rollouts than more straightforward acquisitions. And in the case of the Pinnacle-Synovus transaction, premiums were built into both banks’ valuations prior to the deal’s announcement, according to Jefferies analyst David Chiaverini.

“It was a unique situation in that both Pinnacle and Synovus were viewed as takeout targets,” Chiaverini told American Banker.

Chiaverini pointed to a range of factors that have recently made bank M&A more attractive, on top of the favorable regulatory environment. Among them: higher stock prices and incrementally lower interest rates, which have reduced unrealized losses on banks’ balance sheets.

Chiaverini also repeated a longstanding argument for consolidation: that regional banks are keenly aware of the advantages of scale in the banking businesses.

“I think that is a motivating factor,” he said.

In a report published this week, Chiaverini and his Jefferies colleagues offered more specific thoughts, laying out scenarios in which certain regional banks might decide to sell themselves.

There are various reasons why certain banks could seek an exit, ranging from lagging financial performance to a demonstrated willingness to sell in the past to a strategic fit with a particular merger partner.

“There’s an old adage that banks are sold, not bought,” said Henry Lacey, who leads the banking deal advisory practice at KPMG.

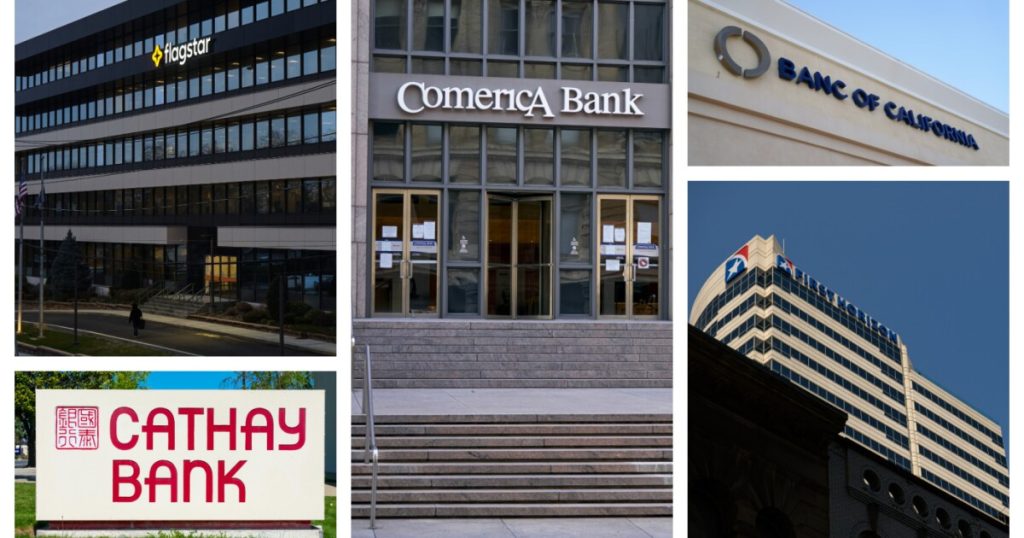

Below is a look at five of the regional banks that the Jefferies analysts identified as potential sellers. None of the banks named in this article, either as prospective buyers or sellers, provided comment for this story.

Comerica

Comerica has been a visible acquisition target since late last month, when the activist investor HoldCo Asset Management

In response, Comerica said in a statement that it is “focused on driving value” for shareholders and continuing to execute its strategic plan.

But following the HoldCo report’s release, Chiaverini said “the heat has been turned up a notch in the boardroom.”

HoldCo identified three potential buyers for Comerica, and the Jefferies analysts proposed the same list: PNC Financial Services Group, Fifth Third Bancorp and Huntington Bancshares.

The potential cost savings would range from 25% in either a Fifth Third-Comerica deal or a Huntington-Comerica transaction to 35% in a PNC acquisition, according to the Jefferies analysts.

First Horizon

First Horizon agreed to sell itself to TD Bank Group in 2022, but after that $13 billion deal

The Jefferies analysts noted that First Horizon’s share price has rebounded since the TD deal was terminated, but it remains below the original offer price in 2022.

Still, First Horizon is by no means in a distressed scenario, Chiaverini said. The bank operates in attractive Southeast markets, which could help entice a buyer. The Jefferies analysts wrote that potential bidders could include Fifth Third, Huntington, Truist Financial or a Canadian bank other than TD, which is now facing U.S. growth restrictions.

First Horizon had $82.1 billion of assets as of June 30. “The company’s approach toward the $100 billion asset threshold over the next few years could accelerate its openness to a strategic transaction,” the Jefferies analysts wrote.

Flagstar Financial

Flagstar Financial has been eyed as a potential takeover target ever since a private equity-led group

While the bank says it’s on course to return to profitability before the end of this year, the Jefferies analysts described it as under-performing its peers on both profit and valuation metrics.

Even Flagstar CEO Joseph Otting has spoken publicly about the possibility that the bank will be sold,

The Jefferies analysts considered two potential exits for Flagstar and its shareholders.

One of the two scenarios — a possible deal with Raleigh, North Carolina-based First Citizens Bancshares — would be a traditional sale. The other — a potential tie-up with another New York area lender, Valley National Bancorp — would be more akin to a merger of equals that would allow the combined bank to bulk up in its existing footprint.

Banc of California

Banc of California, which had $9.4 billion of assets as of June 30, 2023, got quite a lot larger with its subsequent

With the PacWest integration now complete, Banc of California faces certain headwinds and could attract interest from institutions seeking to expand on the West Coast, according to the Jefferies analysts.

Chiaverini said that Banc of California’s asset size puts it in a sweet spot in terms of M&A — neither so big that certain smaller potential buyers would be dissuaded, nor so small that larger regional banks would decide a deal is not worth their time.

“I think that their size is conducive to a transaction,” Chiaverini said.

He and his colleagues floated scenarios where Banc of California gets bought by First Citizens, Cleveland-based KeyCorp or Tacoma, Washington-based Columbia.

Cathay Bank

Cathay General Bancorp was included on the Jefferies list because of what the report described as the lender’s strong presence in Southern California and its focus on the Asian American community.

The Jefferies analysts identified Pasadena, California-based

Such a deal would cause 35% cost savings, the Jefferies analysts calculated.

“The main thing with Cathay is that I think they would make a very good cultural fit with East West,” Chiaverini said. “I think that this would make a good strategic move.”