69,511.

That’s how many variables my Value Meter spreadsheet is crunching right now. And out of all that data, one number jumped off the screen.

It shows the best cash generator in the entire dataset.

It’s not a tech darling. Not a resource giant. Not a bank.

It’s a flooring company – the kind of “boring” business most hype-obsessed investors completely overlook (if they’ve even heard of it).

Thankfully, you won’t be one of them.

To be fair, Mohawk Industries (NYSE: MHK) isn’t just a flooring company. It’s the largest flooring company in the world, and it sells its products under well-known brands like Daltile, American Olean, Pergo, and Karastan.

It sells to both residential and commercial customers, with a vertically integrated model that includes manufacturing, distribution, and logistics. That integration helps the company control costs, protect margins, and respond faster to shifts in demand.

Plus, Mohawk’s reach is global, spanning North America, Europe, and other regions, which gives it economies of scale. Meanwhile, its focus on design innovation and premium product lines helps it compete in both high-end and budget markets.

The company just wrapped up its second quarter of fiscal 2025 with $2.8 billion in sales, which was flat year over year despite a sluggish housing market. Adjusted earnings per share came in at $2.77, and the company produced roughly $125 million in free cash flow for the quarter.

Margins were a little softer, with adjusted gross margin slipping to 26.4% and operating margin to 8.0%. But Mohawk still found room to return capital to shareholders, buying back $42 million worth of stock and authorizing a new $500 million repurchase program. Net debt stands around $1.7 billion, with leverage at just 1.2 times EBITDA (earnings before interest, taxes, depreciation, and amortization).

At first glance, Mohawk Industries might look like a solid but unremarkable industrial.

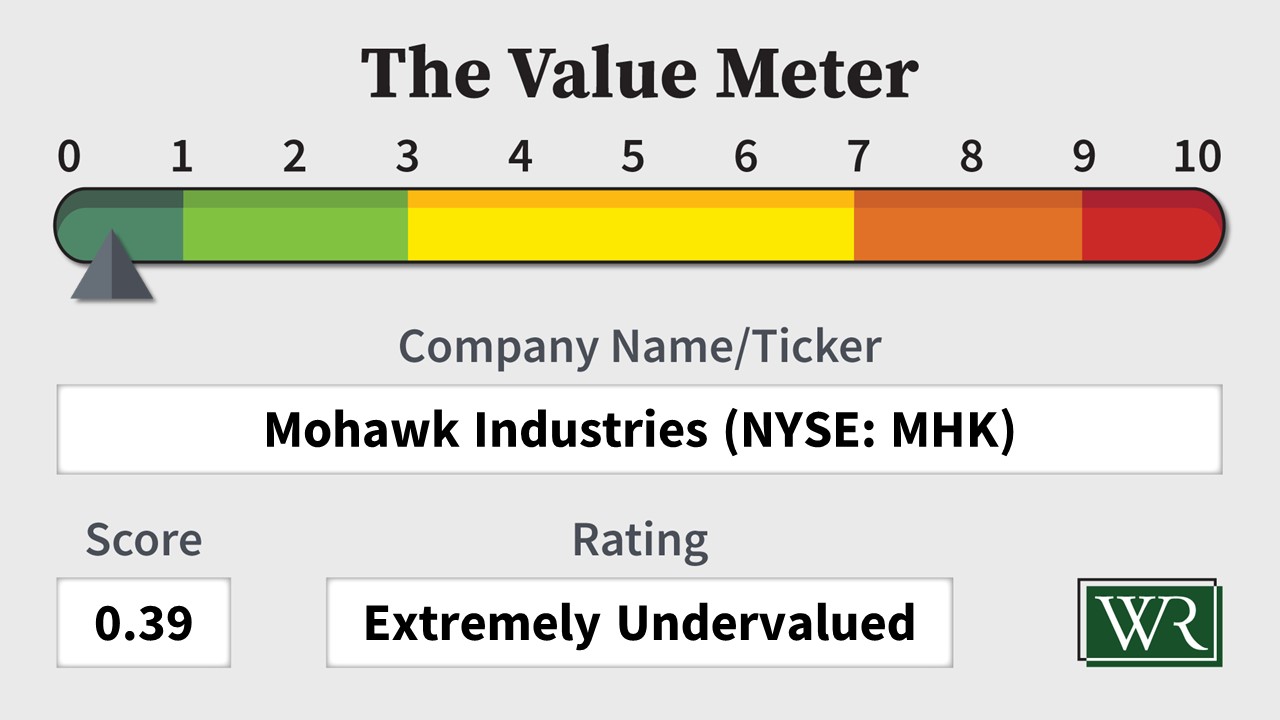

But The Value Meter sees something else entirely.

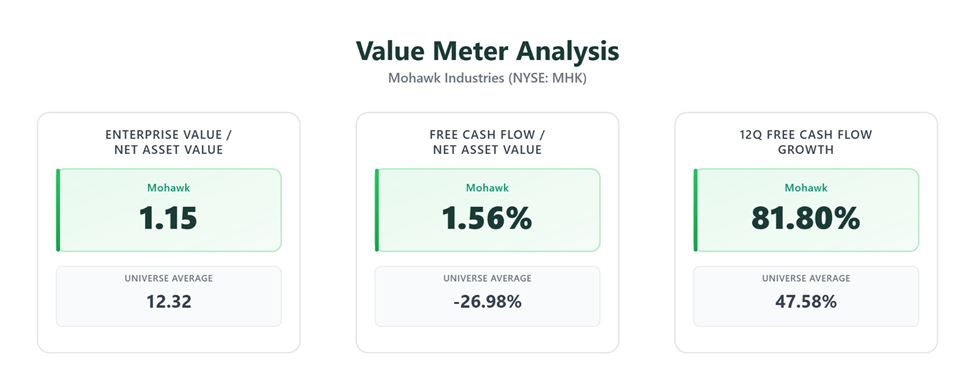

On an enterprise value-to-net asset value (EV/NAV) basis, Mohawk trades at 1.15. That’s a price of just over $1 for every dollar of net assets – a fraction of the 12.32 average for its peers.

Next is the free cash flow-to-net asset value (FCF/NAV) ratio, which stands at 1.56%. That’s a far cry from the peer group’s -26.98%, meaning Mohawk is generating positive cash flow while many competitors are bleeding cash.

The growth story is equally compelling: Over the last three years, Mohawk’s free cash flow has risen quarter over quarter about 82% of the time, compared with an average of less than 48% for its peers.

Yes, the housing market is still soft. Residential remodeling and new construction are sluggish, and Europe remains a challenge. But tariffs on imported flooring could flip into a growth driver – about 85% of the products Mohawk sells in the U.S. are made domestically, allowing it to benefit from price hikes while importers feel the squeeze.

For patient investors, the setup is compelling: a debt-light balance sheet, a cash machine of a business, active share buybacks, and the potential for margin expansion if tariffs lift pricing and input costs ease after the third quarter.

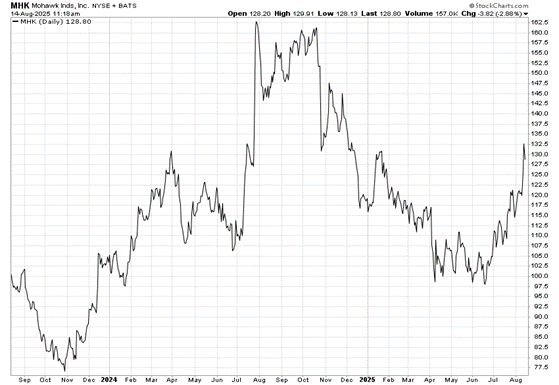

After peaking near $160 last summer, the stock slid sharply into early 2025. That sell-off coincided with a weak housing market and soft margins.

Since then, the stock has staged a solid recovery, climbing more than 30% off its spring lows, so some consolidation wouldn’t be surprising. But the rising trend since April, coupled with the improving fundamentals, suggests momentum is shifting in the bulls’ favor.

Ultimately, Mohawk isn’t flashy. At all. But in a market that often chases stories over substance, boring can be beautiful – especially when boring throws off this much cash.

The Value Meter gives Mohawk Industries a rare “Extremely Undervalued” rating.

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.