Editor’s Note: Speculative trading is on the rise in 2025, and our friends at Monument Traders Alliance have a special way for you to take advantage.

In today’s guest article, Lead Technical Tactician Nate Bear is showing traders how the meme stock craze in 2021 was just the beginning.

– James Ogletree, Senior Managing Editor

Back in January 2021, the trajectory of trading changed forever.

The meme stock craze kicked off one of the wildest moments in recent market history.

Here’s how it started…

Retail traders on Reddit’s r/WallStreetBets noticed that hedge funds were massively shorting GameStop (GME) – betting it would crash.

So if GME’s stock rose, shareholders would be forced to buy shares back at higher prices – creating a short squeeze.

This time, retail traders decided to act – and act big. They used their strong community, pandemic stimulus money and commission-free trading apps to pile into GME.

Then the boom happened…

GameStop skyrocketed from $20 to nearly $483 in just weeks. Many retail traders made life-changing money. Others got wiped out when prices crashed.

What This “Meme-Stock Mania” Did for Trading

As messy as it was… the 2021 meme-stock craze changed the game for retail traders.

They could now move markets en masse all thanks to a strong social media community. For many, it was an addicting feeling of control.

Fast forward to 2025, and those speculative traders are still here.

Except now they’re not just trading meme stocks, they’ve become a key part of mainstream trading.

In fact, they’re part of what JPMorgan is calling a “speculative buying frenzy” in 2025.

Why “Speculative Trading” Is on the Rise in 2025

Retail traders are using speculative trades at a rate we haven’t seen since 2021. Several factors are contributing to a rise.

There’s a volatile political climate from tariff trade wars. Plus an emergence of quantum computing tech to power AI, and the rise of short squeezes from heavily shorted companies.

Factor in a record high on the S&P 500 and retail traders’ appetite for risk is growing.

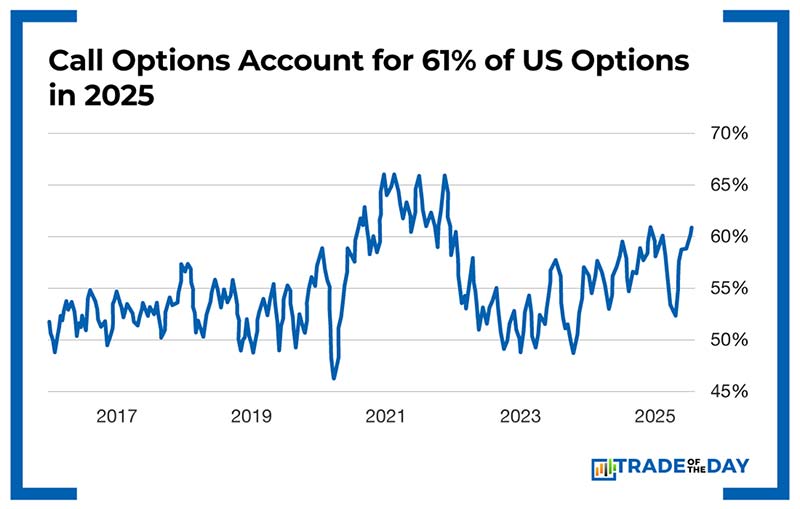

In May 2025 alone, speculative 0DTE options trades (these are options trades that are opened on the option’s expiration date) made up 61% of all SPX options trading – a new high. With retail responsible for 54% of that volume.

Total U.S. options volume also more than doubled from 5 billion contracts in 2019 to 10 billion contracts in 2023. It’s on track to break new records with 11.4 billion contracts.

Overall, trading is now less about investing and more about quick trades with big potential payoffs.

Retail Traders Becoming a Major Force for Driving Volatility

But speculative trading isn’t just about gambling on the next hot AI stock, retail traders are now affecting the overall market sentiment.

Earnings reports are one area that retail traders are looking at more.

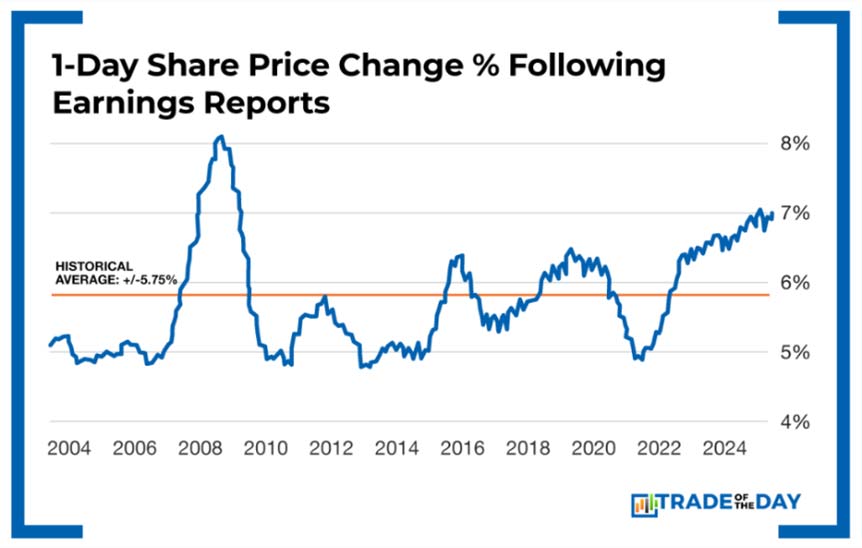

As you’ll see above, recent data from Bespoke Investment Group showed that the typical (over) reaction to earnings reports has been trending the highest since the financial crisis of 2008.

Overall, retail traders are rushing into names that tend to have a big impact on the overall market when earnings come up. Think names like Nvidia (NVDA), Reddit (RDDT) and Tesla (TSLA).

As retailers pour in at higher rates, it creates massive swing trade opportunities as prices overshoot in both directions.

![]()

YOUR ACTION PLAN

I’ve been using “lotto trades” to take advantage of the recent speculative buying frenzy in Daily Profits Live.

To learn more about our mission at Monument Traders Alliance and why I launched Daily Profits Live, click here.