BCE (NYSE: BCE) is Canada’s largest telecom company, providing phone and internet services as well as creating content via several networks.

The company pays an attractive 5.4% yield on its American depositary receipts, or ADRs. (An ADR is very similar to a stock and is a way for investors to get exposure to foreign stocks.) Can shareholders expect to see that strong dividend in the future, or will management say, “Sorry, eh”?

Things aren’t looking so hot for the company from the Great White North.

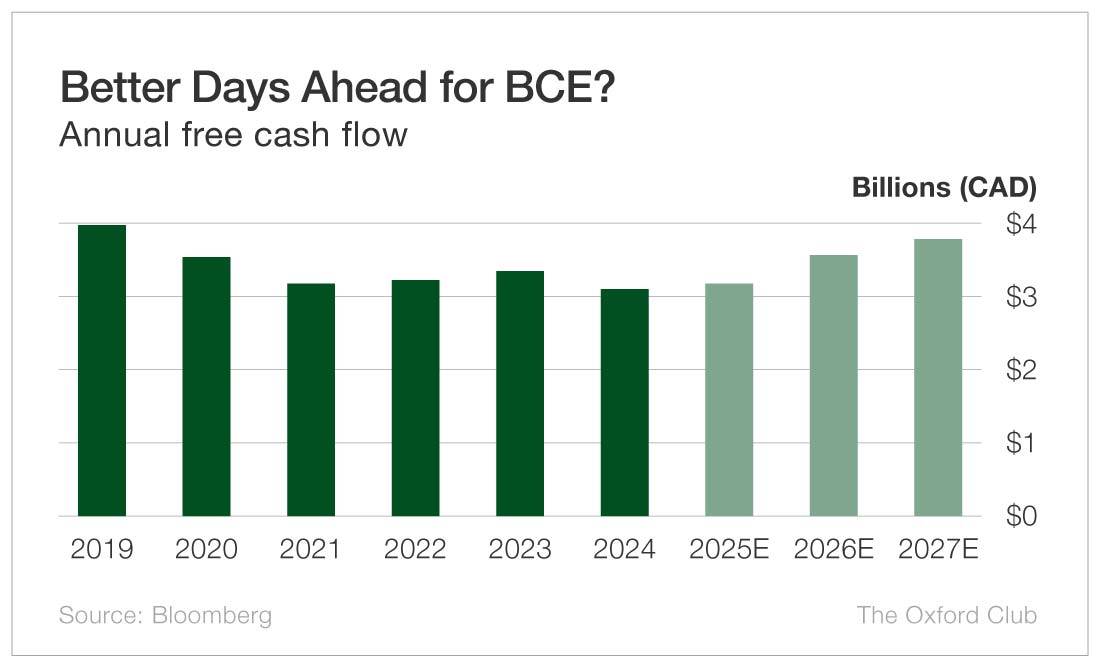

In 2024, free cash flow sunk to its lowest level in years.

BCE’s free cash flow is projected to grow starting in 2025, but Safety Net doesn’t factor in estimates beyond the nearest forecast.

Once the calendar rolls over and 2026’s estimate is included in the model, the stock could get an upgrade if projections suggest growth over 2025’s figure.

Not helping matters is that BCE paid out CA$3.8 billion in dividends last year while generating only CA$3.1 billion in free cash flow. That’s a payout ratio of 123%. In other words, BCE paid shareholders $1.23 for every $1 in free cash flow. That’s not sustainable.

Also damaging the Safety Net rating is a sizable recent dividend cut. Management slashed the quarterly dividend by 56% from CA$0.9975 to CA$0.4375 earlier this year. That’s a big deal. Up until it reduced the payout, the company had boosted its dividend every year since 2007.

To blow up a nearly 20-year track record of annual dividend increases means the situation was critical. Quite frankly, the cut was warranted, given that cash flow was not covering the dividend.

So BCE is projected to boost its cash flow in the future, which is positive. But given that cash flow is still well below where it was in previous years, the company pays more in dividends than it generates in cash flow, and management has shown the willingness to cut the dividend, another reduction is very possible.

BCE’s dividend is not safe.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.