General Mills (NYSE: GIS) started as a flour mill in 1866. Since then, it has created some of the most iconic American food brands, including Cheerios, Betty Crocker, and Pillsbury. It has also expanded into the lucrative pet food market.

However, the stock has not performed well over the past two years. The decline in the share price – plus annual raises in the dividend – means the stock now yields nearly 5%, which is catching the attention of income investors.

Is the dividend as reliable as that box of Cheerios in the pantry, or will it spoil like a pint of raspberries the minute you bring them home from the store?

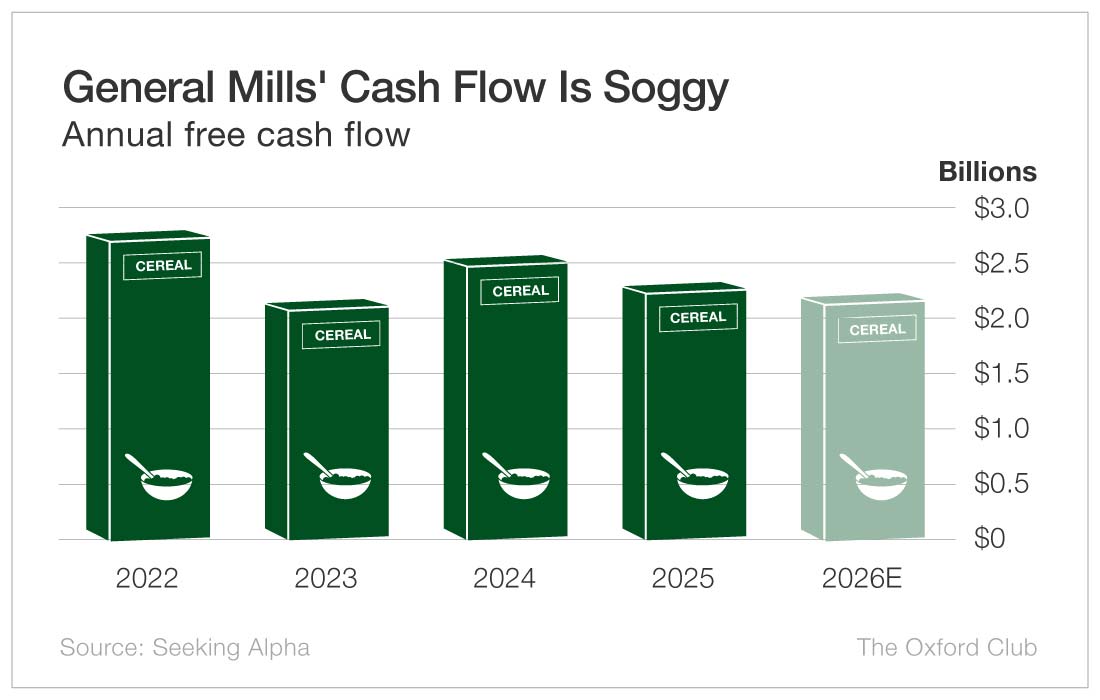

The company already completed its fiscal 2025 in May. The results weren’t great. Revenue and profits were down, and free cash flow fell 9%. Over the past three years, free cash flow has plummeted from $2.75 billion to $2.29 billion. In fiscal 2026, free cash flow is forecast to slip again to $2.16 billion.

Anytime cash flow is falling, the Safety Net model will penalize the company and lower its dividend safety grade. It’s not a good sign.

General Mills currently pays a $0.61 per share quarterly dividend, which comes out to a 4.9% yield. Last year, the company paid out $1.3 billion in dividends, which was 58% of its free cash flow. That payout ratio is perfectly acceptable. I like payout ratios to be 75% or less of free cash flow. That gives me comfort that the company can continue to pay its dividend even if cash flow falls.

In fiscal 2026, General Mills’ payout ratio is expected to inch up to 62%, which is still fine.

The company has paid dividends every year for 127 years. It has raised its payout to shareholders every year since 2021. It has not cut its dividend in at least 36 years.

However, if free cash flow doesn’t rebound, management could be faced with some difficult decisions.

I don’t suspect a dividend cut is imminent, but with no rebound in sight for free cash flow (it’s projected to decline through at least 2028), there is definite risk to this dividend.

Dividend Safety Rating: D

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

The post General Mills: How Safe Is This Beloved Company’s Dividend? appeared first on Wealthy Retirement.