If you’ve been around the markets long enough, you’ll notice a funny thing: Some companies are so loved that people stop asking whether the stock is actually worth the price. They just assume it is.

Netflix (Nasdaq: NFLX) is one of those companies.

It’s the streaming giant that changed how the world watches TV, and it keeps reinventing itself with new content, new tech, and now even live sports. The question is… with shares running hot again, is Netflix still a good buy? Or are investors just paying up for nostalgia?

The company’s second quarter results give us plenty to chew on.

Revenue came in at $11.1 billion, up 16% from last year. Operating margin was a sizable 34%, up from 27% a year ago. Earnings per share climbed to $7.19 – nearly 50% higher than the second quarter of last year – and free cash flow was $2.3 billion, almost double last year’s inflows.

Management nudged full-year guidance higher, now expecting $44.8 billion to $45.2 billion in revenue and $8 billion to $8.5 billion in free cash flow. Growth is being fueled by steady subscriber gains, price hikes, and an ad business that’s on track to double sales this year.

That’s no small feat for a company of Netflix’s size.

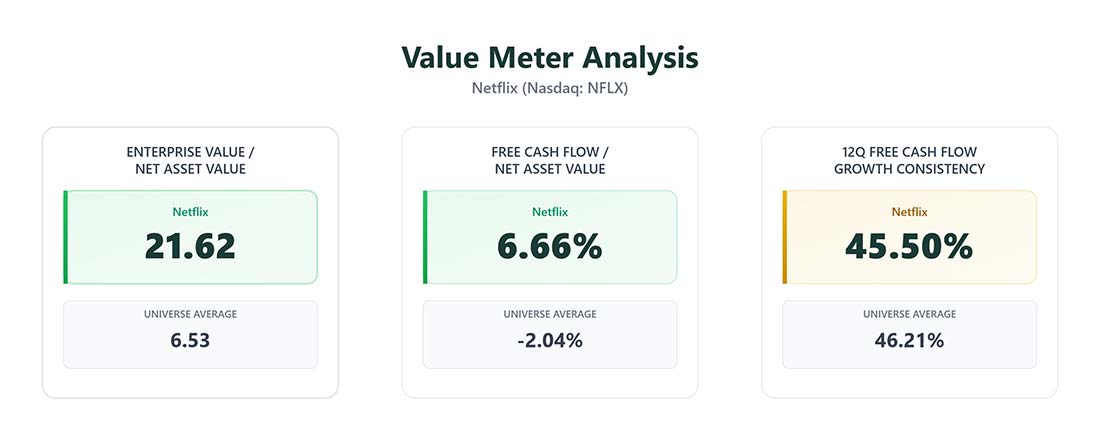

But as always, The Value Meter cuts through the hype by looking at three simple questions: How much do you pay for the business relative to its assets? How efficiently does it turn those assets into free cash? And how consistently does it generate that cash?

Here’s what the numbers say.

Netflix’s enterprise value-to-net asset value (EV/NAV) sits at 21.6, more than three times the peer average of 6.5. That’s a steep premium. But investors are clearly willing to pay up for Netflix’s content engine and brand power.

It makes sense when you consider the company’s efficiency. Its free cash flow-to-net asset value (FCF/NAV) ratio is 6.7%, compared with the average company, which runs negative at -2.0%.

But it’s not just about whether Netflix makes money each quarter – plenty of firms can do that. It’s also about how often free cash flow actually grows from one quarter to the next.

Netflix has posted positive quarter-over-quarter FCF growth in five of the past 11 quarters. That’s roughly 45.5% consistency, almost exactly in line with the peer universe at 46.2%.

In other words, the company isn’t a standout, but it’s not lagging either. Its cash generation has been steady enough to justify Wall Street’s willingness to pay a premium.

Over the past year, Netflix shares have rewarded believers. The stock has climbed strongly, fueled by better-than-expected margins.

You can see at the bottom of the chart that Netflix’s 45-day relative strength index (a metric I recently analyzed for Oxford Club Members in The Oxford Insight) is below 50 right now. Readings under 50 tend to signal good buying opportunities from a strictly technical perspective.

[Editor’s Note: If you’re a Member of The Oxford Club, which is the publisher of Wealthy Retirement, you already have access to The Oxford Insight, our Members-only e-letter. Click here to read Anthony’s article from last week on the relative strength index.]

However, Netflix’s recent gains also mean expectations are sky-high.

So what do we have?

On one hand, you’re paying top dollar. On the other, you’re buying a company that reliably turns assets into cash and has a long runway with global content, advertising, and live programming.

The bottom line: If you’re looking for a screaming bargain, Netflix isn’t it. The valuation premium is real. But it’s not crazy either. The cash flow seems to support it.

This is a stock that has matured from “high growth” to “steady compounder” at this stage of its existence. For long-term investors, patience makes sense here.

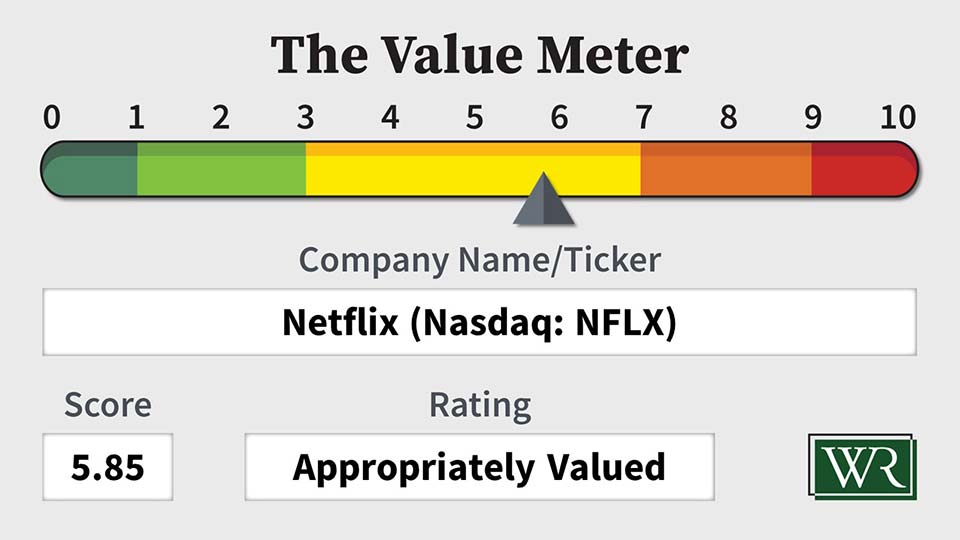

The Value Meter rates Netflix as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.