This week, I want to pull the curtain back a bit and explain one of the core pillars of The Value Meter – a measure that quietly does more heavy lifting than almost any other number we use.

I’m talking about free cash flow-to-enterprise value, or FCF/EV.

It’s not a flashy metric. You won’t hear it tossed around on financial TV or splashed across brokerage reports. But it’s the number that tells us, more than any other, whether we’re looking at a genuine bargain or a value trap.

It’s also why The Value Meter so often spots cash-rich, underpriced businesses that others miss.

Free cash flow is the cash a company has left over after paying its bills and maintaining its business. It’s the real money that can be used to pay dividends, buy back stock, or reduce debt.

Enterprise value, on the other hand, represents what it would cost to buy the whole company – equity, debt, and all – while subtracting cash.

When we divide one by the other, we find out how much cash a business produces for every dollar it would cost to own it outright.

That’s why FCF/EV is the truest “earnings yield” there is. It ignores accounting games, one-time gains, and headline noise. It’s the simplest measure of what really matters: how efficiently a company converts its resources into spendable dollars.

This isn’t a theory we dreamed up in isolation, by the way. Some of the biggest and most disciplined investors in the world rely on this same approach.

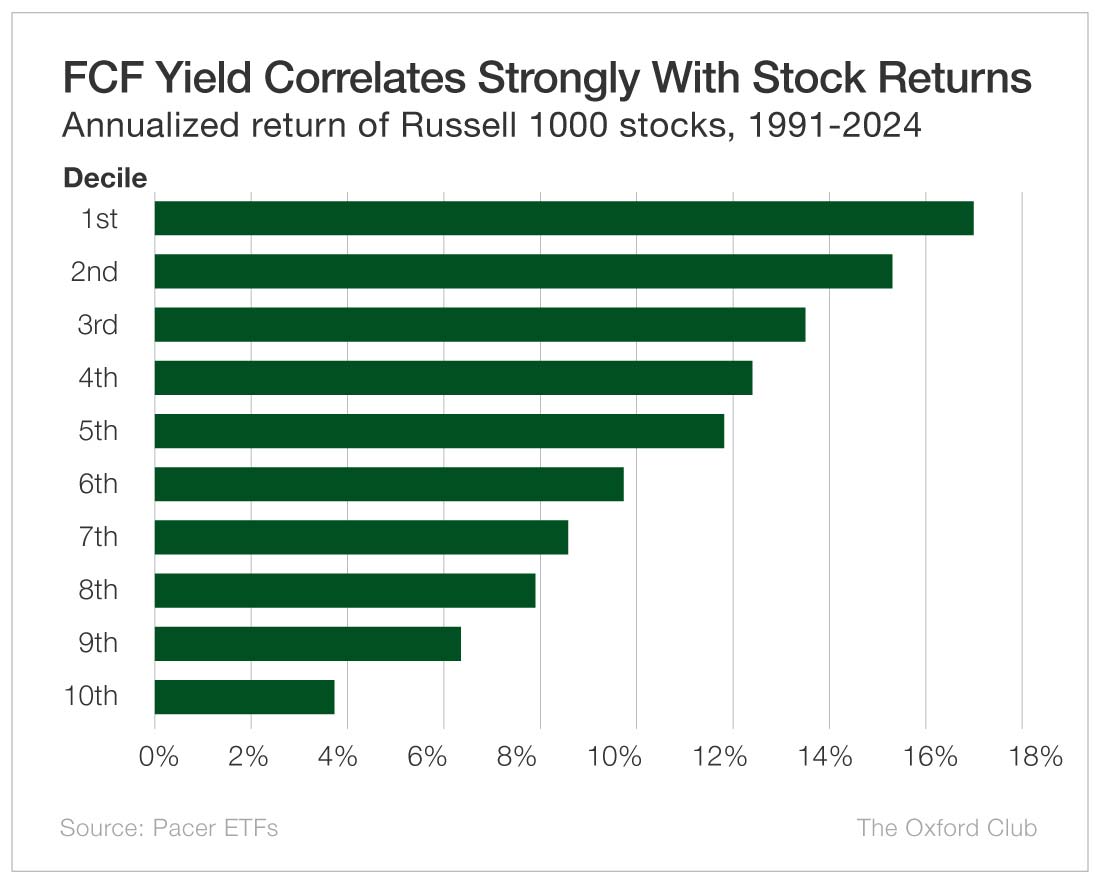

AQR Capital, a quantitative giant managing more than $100 billion, includes free cash flow-to-enterprise value as a core factor in its long-term value strategies. AQR’s research shows that companies with high FCF/EV consistently outperform those with low FCF/EV, even after adjusting for size, leverage, and industry.

S&P Dow Jones has also leaned into this principle. In 2024, it launched the S&P Quality Free Cash Flow Aristocrats Index, which screens for companies that generate strong and stable cash flows relative to their assets.

The results speak for themselves. These stocks have shown greater resilience during market drawdowns and stronger returns over full cycles.

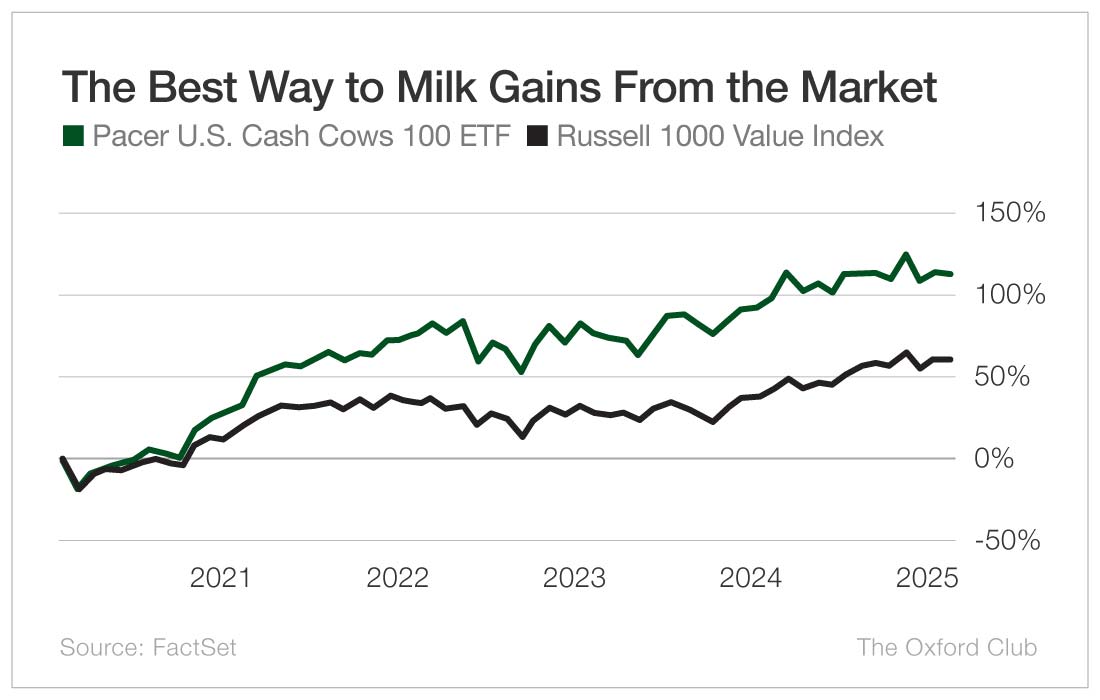

Meanwhile, investors can see the power of this metric in real-world performance. The Pacer U.S. Cash Cows 100 ETF (BATS: COWZ), which ranks companies purely by FCF/EV (also called FCF yield), has beaten the Russell 1000 Value Index by roughly seven percentage points per year over the past five years.

That’s not luck. That’s free cash flow doing its job by identifying businesses that generate real money relative to what they cost.

Traditional measures like price-to-earnings or price-to-book simply can’t compete. Earnings can be massaged with creative accounting, and book value has lost its meaning in a world where the most valuable assets – software, patents, and brands – don’t appear on a balance sheet.

Cash is unambiguous. It doesn’t need interpretation.

When a company consistently produces more free cash than its peers for every dollar of enterprise value, it’s usually because it runs a better business, not because of financial smoke and mirrors.

This is why FCF/EV sits at the heart of The Value Meter.

The other metrics we use – free cash flow-to-net asset value and enterprise value-to-net asset value – tell us how efficiently a business converts its assets into cash and how expensive those assets have become. But FCF/EV ties it all together. It’s the ratio that tells us what we’re paying for the company’s ability to produce real, recurring cash. It’s our “truth serum.”

The takeaway is simple: In a market full of noise, cash flow remains the one number that can’t be faked. It’s the most direct signal of whether a business truly earns more than it spends.

That’s why free cash flow-to-enterprise value isn’t just another ratio – it’s the cornerstone of how we find genuine value. And it’s why it will stay at the center of The Value Meter long after price-to-earnings ratios are no longer relevant.