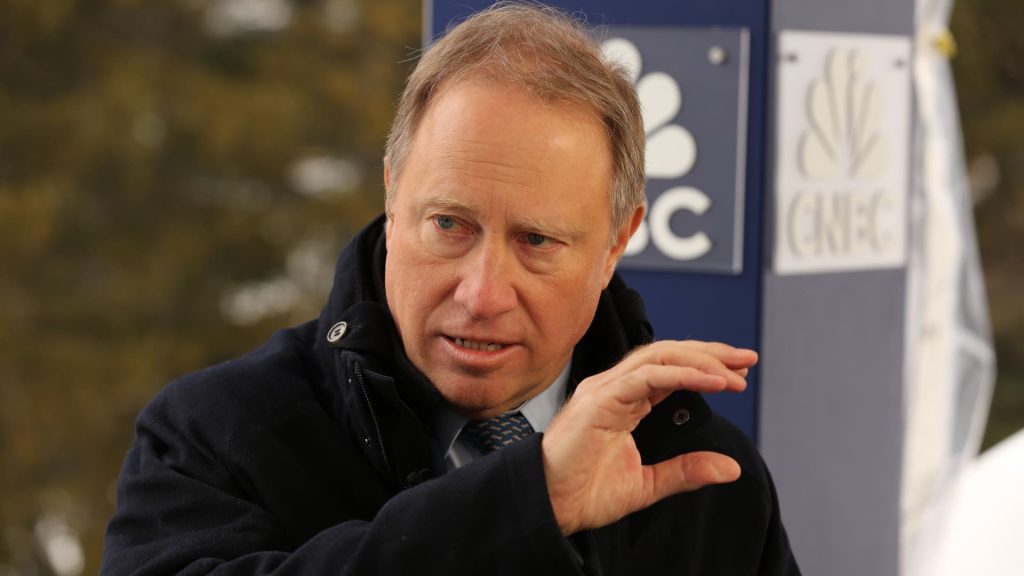

Ted Pick, CEO of Morgan Stanley speaks on CNBC’s Squawk Box outside the World Economic Forum in Davos, Switzerland on Jan. 23, 2025.

Gerry Miller | CNBC

Morgan Stanley on Wednesday posted third-quarter earnings that topped expectations by the largest margin in nearly five years.

Here’s what the company reported:

- Earnings per share: $2.80 vs. $2.10 LSEG estimate

- Revenue: $18.22 billion vs. expected $16.70 billion

The bank said profit surged 45% from a year earlier to $4.61 billion, or $2.80 per share. Revenue rose 18% to a record $18.22 billion.

Wall Street trading desks have seen booming activity in the quarter, while investment banking continues to see a resurgence in activity for mergers and IPOs. Stocks at or near record highs bolstered Morgan Stanley’s giant wealth management division as well.

Put together, Wall Street-centric banks like Morgan Stanley and peer Goldman Sachs are in an ideal environment.

Morgan Stanley said investment banking revenue in the quarter jumped 44% from a year earlier to $2.11 billion, about $430 million more than the StreetAccount estimate. The bank cited more completed mergers, more IPO activity and more fixed income fundraising as reasons for the booming results.

Shares of Morgan Stanley have climbed almost 24% this year.

On Tuesday, JPMorgan Chase, Goldman, Citigroup and Wells Fargo each posted earnings that topped analysts’ expectations for earnings and revenue.

This story is developing. Please check back for updates.