It’s rare to find a small biotech stock that’s likely standing on the edge of a medical breakthrough – but Stoke Therapeutics (Nasdaq: STOK) is one of them.

Stoke’s mission is simple but bold: Use RNA science to “fix” diseases caused by missing or insufficient proteins.

The company’s approach works by boosting protein production only in tissues where the protein normally exists. It doesn’t alter DNA or insert new genes. Instead, it teaches the body to make more of what it’s already built to make.

In August, Stoke dosed the first patient in its Phase 3 EMPEROR trial for zorevunersen, which is a potential disease-modifying treatment for Dravet syndrome – a severe form of childhood epilepsy marked by constant seizures and developmental delay. Patients will receive four doses over a 52-week period.

The main goal of the study is a reduction in seizure frequency at week 28, with secondary goals related to cognition and behavior.

Current drugs can reduce seizures but don’t address the root problem. Zorevunersen might.

Early data have been encouraging. In long-term studies, patients on zorevunersen showed substantial seizure reductions and lasting improvements in cognition and behavior – signs that the treatment may truly modify the disease, not just mask it.

Results through 36 months have shown continued seizure reduction and steady gains in daily living, communication, and motor skills.

Beyond zorevunersen, Stoke is advancing another treatment called STK-002 for autosomal dominant optic atrophy (ADOA). Management confirmed that STK-002 has begun a Phase 1 study in the U.K. The company is also exploring other disorders such as SYNGAP1, expanding its reach across rare neurological conditions.

Now, the Value Meter test.

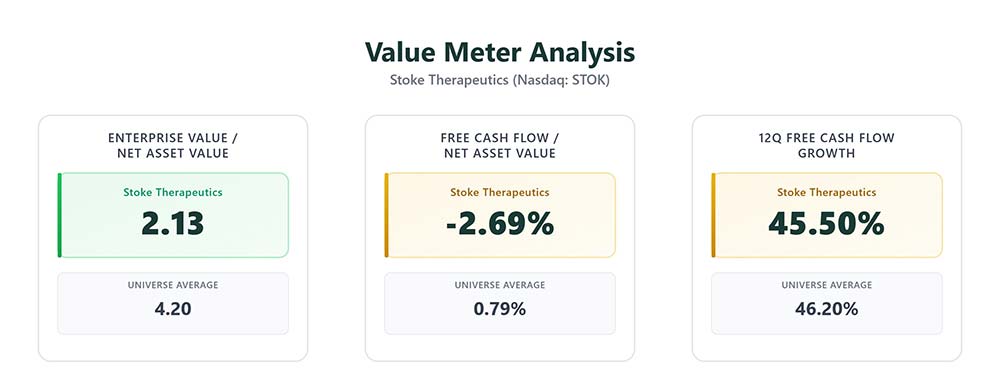

On valuation, EV/NAV stands at 2.13, about half the peer average of 4.20. Investors are paying less for Stoke’s assets than for similar companies, leaving room for upside if zorevunersen succeeds.

On cash efficiency, FCF/NAV averages -2.69%, compared with a peer average of 0.79%. That’s normal for a clinical-stage biotech. It signals steady spending, not waste.

On consistency, Stoke’s 12-quarter FCF growth rate of 45.5% nearly matches the peer average of 46.2%. For a company still in the clinic, that’s a quiet sign of control.

(The company expects its current cash to fund operations through mid-2028, helped by its collaboration with Biogen, which will handle commercialization outside the U.S., Canada, and Mexico.)

Together, these numbers reveal that the market is giving Stoke credit for the science and its strong balance sheet while still pricing in the risk of a binary trial outcome.

The stock reflects that balance. It built a long base over the past year, then broke higher into the fall. Shares recently traded in the high $30s after a strong run.

With Phase 3 now underway and results years away, volatility will remain part of the ride.

For investors, Stoke is a patient-capital story. If the EMPEROR study for zorevunersen delivers, today’s discount could vanish quickly. If not, the market’s caution will look wise. Until then, this one belongs on the watchlist, not in the “set-and-forget” pile.

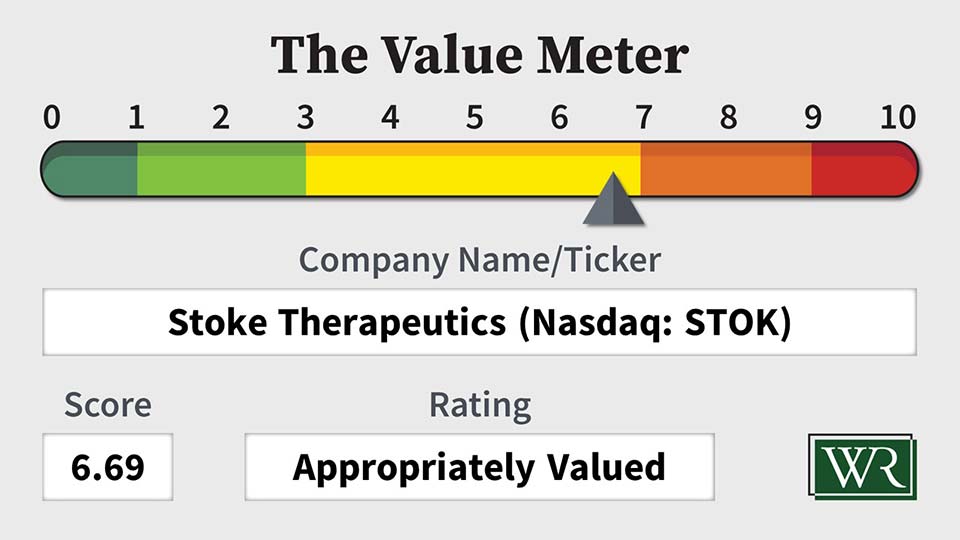

The Value Meter rates Stoke Therapeutics as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.