B&G Foods (NYSE: BGS) is a company you may not know, but you are likely familiar with some of its more than 50 brands, including Crisco, Ortega, and Green Giant.

Income investors may have seen B&G come across their radar thanks to the stock’s sky-high 17% dividend yield.

But is that dividend as reliable as a bowl of the company’s Cream of Wheat hot cereal?

We’ll dig into the numbers in just a minute, but first, a word of caution: Anytime you see a dividend yield that high, your guard should be up. It doesn’t automatically mean that the dividend is unsafe or that the stock is a dog, but the risk of both is certainly elevated.

One reason B&G Foods’ yield is so high is that the stock has been a disaster. It’s been just about cut in half in the past year and is down more than 80% over the past five years.

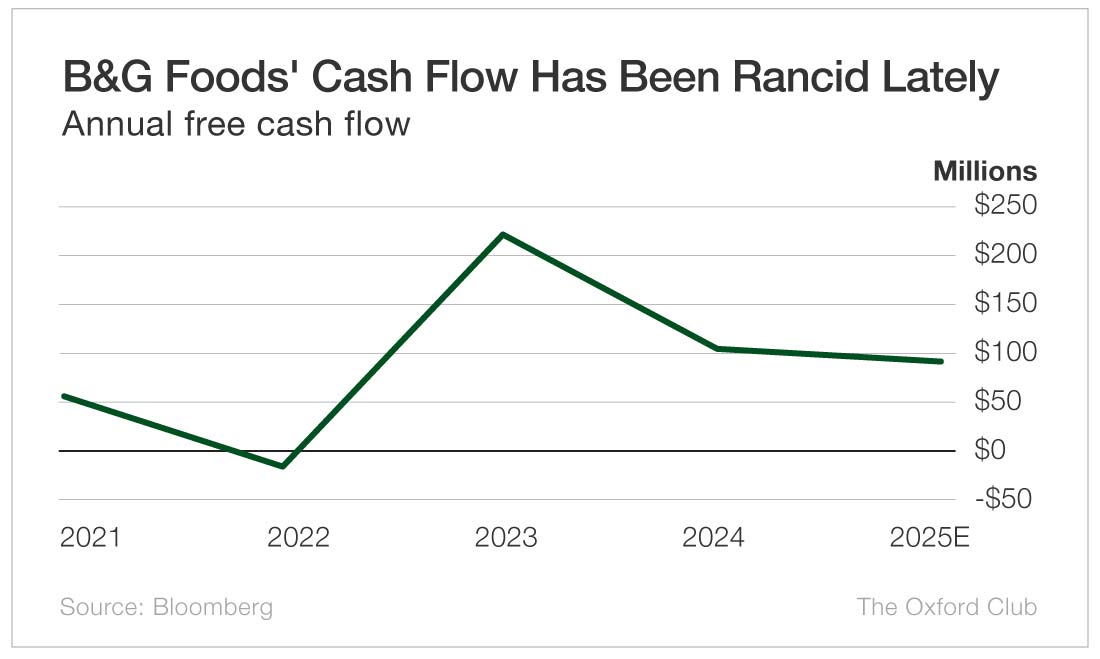

Part of the problem is that cash flow has been very inconsistent.

Last year, it slid 54% from $222 million to $103 million. This year, it is forecast to drop another 10% to $93 million.

The Safety Net model penalizes stocks for declining free cash flow. The reasoning is very simple: You want to see cash flow growth in order to boost your confidence that the company will be able to afford its dividend in the future.

The good news is that B&G’s payout ratio is low enough to not set off any alarms.

Last year, the company paid out 58% of its cash flow in dividends. This year, that number is forecast to remain the same.

In late 2022, B&G Foods slashed its quarterly dividend from $0.475 to the current $0.19. Once a management team has shown a willingness to cut the dividend, the payout is no longer sacrosanct, and investors should be on guard that it could happen again.

The saving grace for the company’s dividend safety rating is that the payout ratio is reasonable. But if cash flow continues to deteriorate, it could become a problem.

B&G Foods’ dividend has a high risk of being cut.

Dividend Safety Rating: D

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.