- What’s at Stake: Banks risk losing primary deposit share amid fragmented account relationships and promotion-driven churn.

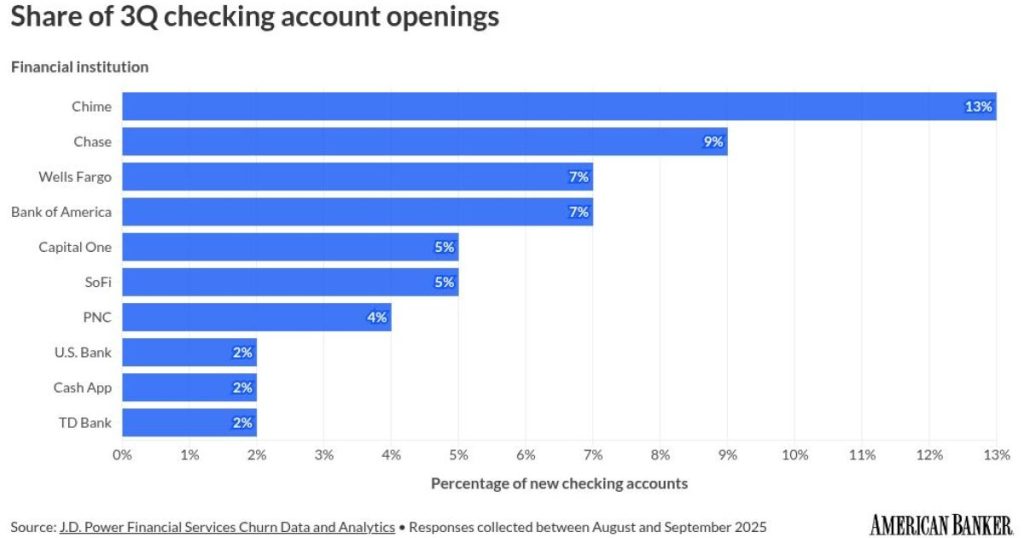

- Supporting Data: Chime captured 13% of new Q3 checking account openings, outpacing major banks.

- Forward Look: Open-banking shifts are reshaping how banks attract direct deposits.

Source: Bullets generated by AI with editorial review

Neobank Chime has become the most popular destination for consumers opening new checking accounts, according to the most recent

The J.D. Power report, which tracks customer attrition among financial services providers in the U.S., also identified a trend in which many customers are expanding their relationships with additional banks or fintechs rather than completely switching from one to another.

More than half (52%) of new checking accounts opened over the course of Q3 2025 were additional accounts, while 25% were replacement accounts and 23% were accounts opened by consumers who didn’t have a like account at the time they opened.

Of the additional and replacement accounts opened, 72% were opened with a different bank than the previous account. Fifty-four percent of the additional and replacement checking accounts opened with a different firm became what consumers identified as their primary account, according to the report.

The J.D. Power report called the trend “soft switching,” or customers moving their primary accounts to other institutions without closing prior accounts or formally severing ties.

Emmett Higdon, director of digital banking at Javelin Strategy & Research, attributes the trend of opening multiple financial accounts instead of replacing them to the growing number of younger financial customers who are accustomed to a fragmented financial marketplace.

“It’s long been very easy to open a second account,” Higdon told American Banker. “This is not a new threat to the big banks. We’ve been writing in our reports about ‘silent churn’ for a decade.”

Javelin’s 2025 Digital Banking consumer survey also found that consumers are increasingly shifting individual financial products away from their primary bank, which the firm defines as the first place consumers think of when it comes to finances.

“It’s not so much share of wallet but share of mind,” Javelin senior analyst Dylan Lerner told American Banker.

Chime has not yet released its third-quarter earnings, but in its

According to the earnings report, 67% of those consumers use Chime as their primary financial account, a phrase the company defines as a consumer “who made 15 or more purchases using their Chime cards in the past calendar month or who had at least one qualifying direct deposit of $200 or more.”

“Our ambition is to become the largest provider of primary account relationships in the U.S.,” Chime co-founder Ryan King told American Banker. “Approximately 85% of new members that direct deposit with Chime come from a prior direct deposit relationship, most often from traditional banks. We believe these members are coming to us because they are ‘unhappily banked’ and want a better experience.”

Higdon pushed back against Chime’s definition of a primary account, stating that “if it’s an active account that has a direct deposit, that doesn’t necessarily mean it’s a primary account anymore. Given Chime’s promotions and the fact that they’re tied to getting that direct deposit, it is certainly a big step toward someone becoming a primary relationship, but it’s not the only thing.”

Consumers opening checking accounts with Chime reported to J.D. Power that the top reasons they chose the neobank included convenience, promotional offers, no fees and the neobank’s reputation. Of these, respondents that switched to Chime from another institution were primarily driven by poor service experiences with their incumbent banks with 37% in agreement.

Chime customers were also more likely than others surveyed to say they value the ability to send/receive money (58%), use online/mobile bill pay (50%) and have access to a digital wallet (49%) when shopping for a new checking account.

Chime tends to have high customer acquisition costs due to its payouts and promotional offers. King views this as an investment into what he hopes will be long-term customer relationships.

“Our members consistently generate transaction profit over time, with an estimated lifetime customer value to customer acquisition cost ratio of about 8x,” King said, citing a figure released by the company in its August earnings statement.

Higdon noted that the ease which attracts customers to Chime is also a challenge for the neobank: If there is generally little friction to open and close financial accounts, even primary ones, consumers can leave Chime as easily as they arrived.

“It’s super simple to give a slice of that [market share] to Chime, but it also makes it really simple to take it away from Chime and give it to someone else like SoFi or Revolut,” Higdon said. “That’s called open banking.”