A change in mindset, away from the transactional and more towards creating relationships has led to higher customer satisfaction scores, improved trust and increased levels of brand loyalty, the latest J.D. Power survey found.

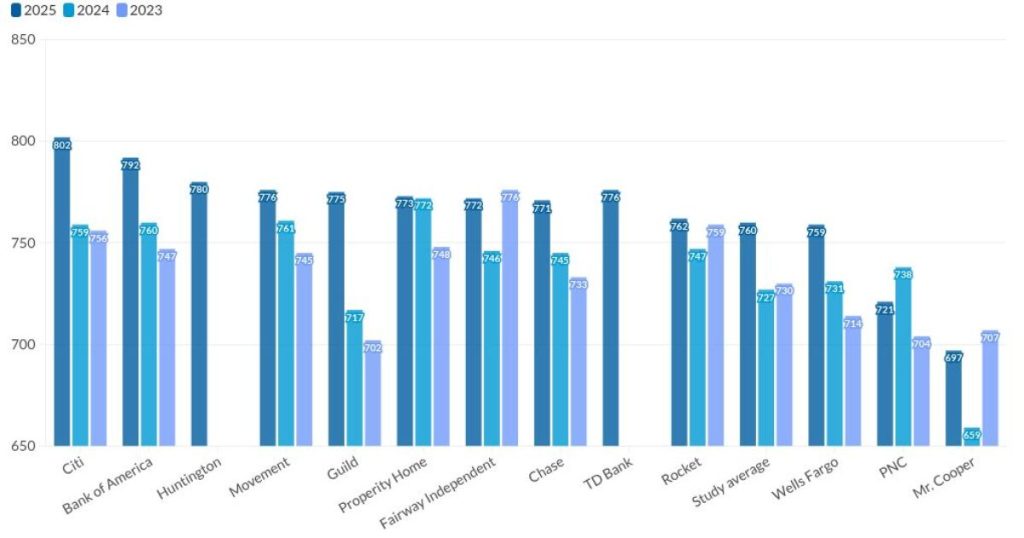

But in what can be termed as a surprise in the results, Citi had the highest score in the 2025 U.S. Mortgage Origination Satisfaction Study. Perennial leader Rocket was just above the industry average in its results.

The companies ahead of Rocket had larger increases in their scores, noted Bruce Gehrke, senior director of wealth and lending intelligence at J.D. Power.

Rocket was the

Unlike the Power results, the ASCI study found customer satisfaction scores for the industry was 1% lower than the prior year.

How did mortgage lenders do on this year’s survey

The industry average score this year was 760, an unheard of

It is also significantly different from

Meanwhile the difference between banks and independent mortgage banks average scores in the origination survey narrowed to 12 points from 18 points one year ago after widening from 1 point in the 2023 survey.

Besides Citi, the next three on the list, Bank of America, Citizens and Huntington are depositories. Slots five through eight were non-bank lenders Movement, Guild, Prosperity and Fairway.

What the leaders in the origination survey have in common

All eight have something in common. The top companies on the list, both bank and non-bank, “are bringing to the process less friction; smoother, faster transactions; and then that engagement difference, being more advisory in the process earlier, it is magnifying that effect,” Gehrke said.

Furthermore, all eight of these lenders are focused on

“They have local loan officers in the community working in conjunction with realtors, real estate agents, etc.,” he added. “They’re out there with very personal interaction and relationships with borrowers, and so those top eight firms all are driving a little bit of that more advisory interaction.”

What factor helps customer satisfaction

The earlier the initial contact, the better. Overall satisfaction is 32 points higher when lenders connect with customers at the beginning of their home-buying journey, before they start actively shopping, the survey found. But this drops by 64 points when lenders first engage the borrower at the mortgage application stage.

With Rocket, the recent Redfin acquisition puts them in

Even though Mr. Cooper was at the bottom of the list at a 697 score, it was a vast improvement from 2024, when it scored 659.

In fact, all but two of the scored companies showed year-over-year improvement, Gehrke said.

What role does home equity lending play

Among the industry trends that Power is watching which impacts both origination and servicing is the

The growth of home equity/second lien lending is an opportunity for servicers to play in the customer advisory arena, Gehrke said.

“I think it makes it challenging for independent mortgage bankers who don’t have a lot of servicing to fall back on when it comes if we see some significant drops in interest rates, which, of course, is an open question,” Gehrke said. “Originating refinances outside of those big servicers, I think it’s going to get more and more challenging.”

How artificial intelligence use effects satisfaction

This year’s survey asked customers about

Slightly more than half (54%) of customers claimed they were “completely comfortable” with their lenders using AI in the mortgage origination process, while another 31% say they are “partially comfortable.” Customers also want to know how the technology is being used, Gehrke said.

But a growing use of AI is to make marketing calls; while the survey didn’t mention any specific instances, United Wholesale Mortgage in its third quarter results

It is possible that such calls could be seen as just