- Key insights: Lloyds Banking finalized its controversial acquisition of Curve, a London-based digital wallet provider.

- What’s at stake: Apple has opened its mobile payments technology, creating room for competitors.

- Forward look: Lloyds will add Curve’s technology to the bank’s payments pipeline.

Lloyds Bank on Wednesday said it completed its acquisition of Curve, a London-based payment fintech, potentially improving its ability to compete with digital wallets.

Curve offers a card, digital wallet and payment infrastructure and is often seen as a competitor to Apple Pay. One of Curve’s key features is the ability to

The details of the acquisition weren’t provided, but SkyNews previously

“This strategic acquisition of Curve marks another significant step forward in Lloyds Banking Group’s digital transformation journey,” Jas Singh, the bank holding company’s CEO of consumer relationships, said in a release. “Building on the innovative changes we’ve made to our app recently, integrating Curve’s cutting-edge technology and digital wallet capabilities will deliver a next-generation digital banking experience for our customers as we help them to take control of their finances in a simple and convenient way.”

In a release, Shachar Bialick, Curve’s founder and CEO, said “joining forces with Lloyds Banking Group means we can now scale our vision faster.”

The deal followed earlier complications from one of Curve’s largest investors, IDC Ventures, which holds a 12% stake in fintech. IDC objected to the handling of the acquisition by the board and distribution of proceeds from the sale,

“Despite the noise around governance and investor frustration, Lloyds is effectively acquiring a proven, fully-regulated wallet platform that can orchestrate multiple payment types behind a single card or token,” Chris Jones, managing director at PSE Consulting, told American Banker in an email. “This capability is still rare. Banks have focused for years on individual products — current accounts, credit cards, overdrafts, BNPL, e-money — but have rarely offered a unified way for consumers to control how they pay at the point of purchase.” —Joey Pizzolato

Global Payments adds Uber Eats to Genius’ roster

Global Payments’ strategy to expand its signature point of sale system

These restaurants will also make Uber Eats their preferred delivery partner. Restaurants will onboard Uber Eats through a self-serve process.

Uber, and its related apps, have an easy payment process that has influenced other payment firms’ strategies as they try to

Genius is a mix of new payment technology and a restructuring of existing systems. Global Payments has been gradually deploying Genius in different markets and industries, including restaurants, large enterprises and schools.

The company has also altered its compensation system to improve Genius’ sales. Global Payments has added base pay plus commission for sales people, replacing 100% commission. This will encourage sales of new technology, rather than sales people taking a “wait and see” approach to new technology, Global Payments CEO Cameron Bready said during a recent earnings call. The company plans to hire 500 sales people in North America.

“There are encouraging early returns from sales force realignment and the company’s incremental field sales investments in North America,” analysts at William Jeffries said in a research note, noting the “realignment has driven a 50% reduction in new hire attrition among the first group of reps to transition to the new model. —John Adams

Mastercard bolsters AI-powered remittances

Cross-border remittance platform Félix has expanded its collaboration with Mastercard to improve processing for transfers between the U.S. and Latin America.

The Miami-based Félix will use Mastercard Move to enable AI payments via Félix’s chatbot. Users initiate a remittance via text voice note.

“By combining the reach of the Félix platform on WhatsApp with the power of Mastercard Move, we’re making it easier for families to send money home quickly, safely, and with full transparency,” Stefany Bello, senior vice president of digital partnerships, fintech and enablers, North America, at Mastercard, in a release. —John Adams

ADRIAN DENNIS/Photographer: Aadrian Dennis/AFP

Revolut gets more aggressive in crypto payments

The integration has the potential to reach 65 million Revolut users in the U.K. and EU. Polygon’s other partners include Stripe, WorldPay, Flutterwave and other distributed finance protocols. POL, Polygon’s native token, is available to trade on Revolut’s and the Revolut X crypto exchange alongside more than 250 other tokens.

Revolut’s collaboration with Polygon follows other moves to beef up its financial services menu, such as expanding credit options in the U.S.

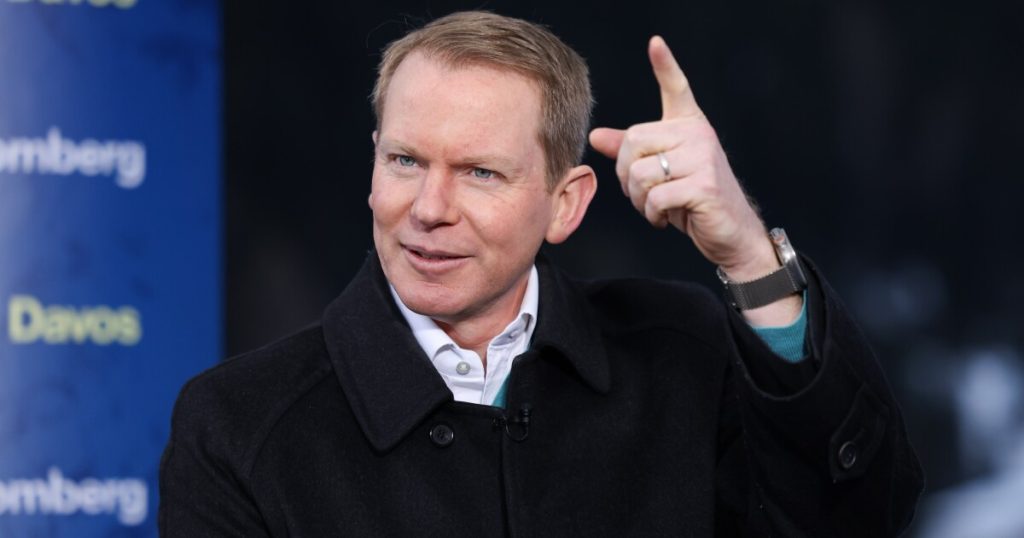

World Economic Forum / Ciaran Mc

Circle adds to its emerging markets reach

USDC and EURC issuer Circle has added payments fintech dLocal to the

Based in Montevideo, Uruguay,

Circle Payment Network’s partners include Banco Santander, Deutsche Bank, Societe Generale and Standard Chartered Bank.

Circle and dLocal hope to address a shortcoming in cross-border payments. It costs an average of 6.4% to send a $200 payment to an emerging market, according to The World Bank, which says that’s more than double the United Nations’ 3% target for a payment of that size.

“A key driver in the development of Circle Payments Network was creating a new layer for payments to reach emerging markets in a fast and cost-effective way,” said Kash Razzaghi, chief business officer at Circle, in a release. “dLocal’s payout offerings throughout emerging markets are crucial to delivering on this promise and creating a more open, digital financial system.” —John Adams

Visa completes first recurring A2A transaction in UK

Visa successfully demonstrated its first recurring account-to-account transaction, a necessary proof of concept for pay by bank use cases to go mainstream.

The payments giant completed a variable recurring payment to Utilia Energy, a U.K.-based electric and gas company. Tink, an open banking fintech that Visa acquired in 2021, initiated the transaction on behalf of the payer. Kroo Bank acted as the payer bank, and Visa’s

“Today marks a major milestone in UK payments innovation with the first commercial Variable Recurring Payment transaction powered by Visa A2A,” Mark Wilcocks, head of product and solutions at Visa UK & Ireland, said in a statement Wednesday. “This breakthrough demonstrates how industry collaboration is transforming the way consumers and businesses manage recurring payments. For consumers, it means greater control, transparency, and security when paying bills – no more surprises or delays. For merchants, it unlocks faster settlement, improved cash flow, and a trusted payment experience for their customers.”

A2A payments rely on open banking technology to move funds directly from one bank account to another, bypassing traditional card networks. They have gained the most traction in the U.K. and Europe, where open banking frameworks are more clearly defined. Visa pulled back from its

Tiffany Hagler-Geard/Bloomberg

Kraken submits confidential IPO filing

Cryptocurrency exchange Kraken submitted a confidential filing for an initial public offering on Tuesday less than 24 hours after the company said it raised $800 million in fresh funding.

Citadel Securities invested $200 million and Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management and Tribe Capital also participated in the $800 million round. All in, the investment round puts Kraken at a $20 billion valuation.

“This investment represents long-term conviction in Kraken’s mission to build trusted, regulated infrastructure for the open financial system,” said Arjun Sethi, co-CEO of Kraken, in a statement. “Our focus has always been straightforward: to create a platform where anyone can trade any asset, anytime, anywhere. The caliber of our new investors reflects both the scale of the opportunity ahead and the depth of alignment around how this infrastructure should be built.”

Kraken was founded in 2011 and offers clients the ability to buy, sell, stake, earn rewards, send and receive assets, and custody holdings. It has more than 450 digital assets trading on its platform, along with futures, U.S.-listed stocks, ETFs and other fiat currencies.

The IPO announcement comes seven months after the Securities and Exchange Commission

Worldline and Gr4vy team up for international merchant payments

French payment service provider

The collaboration helps merchants reduce payment failures, increase conversion rates and deal with the nuances of local payment systems without adding engineering work.

“Payments today are fragmented. Every market has its own providers, rules, and preferences, and merchants are the ones stuck stitching it all together,” said John Lunn, founder and CEO of Gr4vy, in a statement. “Partnering with Worldline means our merchants get access to local expertise and infrastructure without giving up control or flexibility.” —Joey Pizzolato