- Key insight: HoldCo Asset Management said in a lawsuit that Comerica rushed to make a deal with Fifth Third, and omitted material information in disclosures.

- What’s at stake: The $10.9 billion deal is the largest bank transaction announced in 2025, and would create one of the country’s larger regional banks.

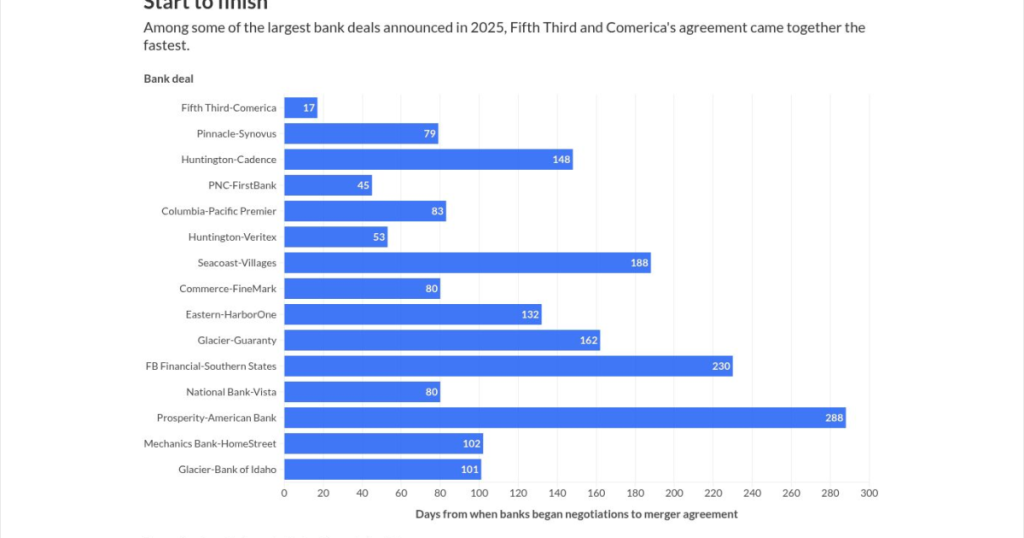

- Supporting data: Only 17 days passed from when the two companies said they started deal talks to when they signed an agreement, the fastest bank M&A sales process this year.

One of banking’s most prominent activist investors is suing Comerica , alleging that the beleaguered Dallas company breached its fiduciary duties to shareholders when it quickly hatched its sale to Fifth Third Bancorp this fall.

HoldCo Asset Management claims in a lawsuit filed Friday that Comerica rushed to complete its deal with Fifth Third, omitted material information in disclosures and agreed to “draconian deal protections.” HoldCo also alleges that Fifth Third aided and abetted breaches of fiduciary duty.

The class-action suit, filed in the Delaware Court of the Chancery, follows a report HoldCo published last week that called the deal’s process “flawed.”

Comerica’s $10.9 billion agreement to sell itself to Fifth Third is the largest bank deal announced this year, and the quickest to come together, at least among bigger transactions, according to regulatory filings.

The companies have said they inked the transaction just 17 days after initial conversations between their CEOs began. Among larger bank mergers, the next-fastest deal to come together this year was PNC Financial Services Group’s planned $4.1 billion purchase of FirstBank Holding Company, which took 45 days.

Now HoldCo claims that the process was “flawed,” and that Comerica didn’t properly shop its deal for buyers before landing the agreement with Fifth Third. The investor said in its complaint that the deal was driven by Comerica CEO Curt Farmer’s “fear” of a proxy battle led by HoldCo, as well as “his fear that no other bidder would keep him on.”

Comerica and Fifth Third declined to comment.

In July, HoldCo called for Comerica to sell itself in a scathing report, citing what it called years of mismanagement. In early October, the bank announced its deal with Cincinnati-based Fifth Third.

Fifth Third has said the acquisition of Comerica will give it a stronghold in high-growth markets like Texas, and that the buyer can provide the low-cost deposit network Comerica had been struggling to develop.

In November, Comerica disclosed it had received a bid from a different financial institution, before it approached Fifth Third. Sources later told American Banker that the other potential buyer was Regions Financial.

Financial terms of the other offer weren’t disclosed, which HoldCo said makes the two banks’ regulatory filing “materially misleading and incomplete.”

The plaintiff also claims that the deal process was rushed, in part, so that it could close before Comerica’s next annual meeting, which is legally required to be held no later than May 2026.

If an annual meeting were held, a stockholder could launch a proxy contest. The deal with Fifth Third is expected to close in the first quarter of 2026.

HoldCo said in its complaint that Comerica’s “board — through its conflicted negotiating agent Farmer — quickly agreed to an unreasonably low merger price at the very bottom of Farmer’s preferred acquiror’s range.”

The activist investor said in its report last week that Comerica’s board chose to “rubber-stamp a deal [its] conflicted chairman negotiated with the only counterparty poised to give him a windfall he’d never see under the status quo.”

Farmer will become Fifth Third’s vice chair after the companies merge, and will earn $8.75 million in annual compensation, per public filings. He will eventually serve as a senior advisor to the bank and receive the same pay in that role.

If Farmer’s employment agreement falls through, or if he loses his position in the next roughly two years, Fifth Third will pay him $42 million. At his current level of compensation, he will earn that amount in about five years, though he’s eligible to sit on Fifth Third’s board until a decade from now.

At the time the deal was announced, the price tag implied that Fifth Third was paying a 20% premium for Comerica, based on the bank’s 10-day volume weighted average stock price. But the deal came with no dilution to tangible book value for Fifth Third, which is rare among bank deals, and which HoldCo claims implies an “unusually low price.”

Investors who are vocal critics of bank M&A deals generally, and the Fifth Third–Comerica deal in particular, are rare. Analysts from TD Securities wrote in a note last week that they disagree with HoldCo’s assessment that Comerica could have found a better deal.

“Not only do we view the offer as fair, we see it as quite generous given Comerica’s lagging historical performance across key metrics,” the note said. “With Fifth Third also having one of the strongest currency among peers, not many others could have offered a price above what was offered by Fifth Third.”

The TD Securities analysts added that moving forward with Fifth Third would maximize value for Comerica shareholders.

Since the deal was announced, Fifth Third’s stock has fallen 4%, to $42.42, but Comerica’s stock has risen more than 10%. The Nasdaq Regional Banking Index has fallen about 2.9% in the same time period.

HoldCo alleges that details in the merger agreement that keep the deal from falling apart — like a $500 million termination fee and a no-shop provision that prevents Comerica from terminating the deal for a superior offer — are “preclusive and coercive” and violate “the most basic fiduciary principles.”

The complaint also raises questions about the hand-off of a lucrative government contract from Comerica to Fifth Third. The U.S. Treasury Department terminated Comerica as the agent of the program, called Direct Express, last year. Comerica had been the longtime manager of Direct Express before regulatory concerns arose around its handling of the program.

Fifth Third announced it had won the contract in early September, days before negotiations for its acquisition of Comerica began on Sept. 18. Farmer told American Banker when the deal was announced that the contract handoff and the acquisition were unrelated.

Standards for speed

While HoldCo’s lawsuit alleges a breach of fiduciary duties, some industry experts say the Fifth Third–Comerica deal doesn’t necessarily raise eyebrows. They point to the fact that both companies are public and to the deal-friendly environment of 2025.

“I wouldn’t necessarily interpret speed with distress,” said Shawn Turner, a lawyer at Holland & Knight who focuses on the financial services sector. “Just because somebody moves quickly, it doesn’t necessarily mean there’s an issue there. Maybe it does, maybe it doesn’t.”

Turner, who was speaking broadly about the deal environment and not about specific transactions, said that public companies likely started modeling deals with potential targets over the last few years, when the M&A environment was more muted. But when the regulatory landscape shifted this year, negotiations and diligence could be moved along relatively quickly.

Bill Burgess, co-head of financial services investment banking at Piper Sandler, said the Comerica–Fifth Third deal seemed to come together at a “light-speed” pace. But he added that experienced buyers constantly run the numbers for a handful of possible targets based on publicly available information. And many sellers can compile most of the information needed for due diligence before initial contact is made, he said.

Fiduciary duty concerns are also different in all-stock strategic acquisitions than they are for cash deals, Turner said. The highest offer isn’t necessarily the most beneficial to the company.

“In a stock-for-stock transaction, the seller has latitude to work with a single buyer or even take a lower implied consideration at the announcement if it believes that it’s the right thing to do with that stock currency,” Burgess said.

Burgess, who worked with Fifth Third when it acquired MB Financial in a deal valued at $4.7 billion six years ago, said that “no one is more professional in their diligence review” than the Cincinnati bank.

“This is not their first rodeo,” he said. “If provided with the information, they can review information quickly. If you have an experienced seller, you can prepare a lot of information quickly to expedite the due diligence review.”

Turner and Burgess also both said that companies making deals may want to hurry the process before reports of negotiations are leaked, out of concerns about flighty depositors and punishment on Wall Street.

HoldCo wants the Delaware court: to find that Comerica’s directors breached their fiduciary duties; to declare that the provisions keeping the deal together are invalid; to agree that Fifth Third aided and abetted the breaches of fiduciary duty; and to award relief as the court “may deem just and proper.”

The judge assigned to the case, Vice Chancellor Morgan Zurn, will hold a hearing Tuesday to discuss a motion to expedite the case. HoldCo is represented by Greg Varallo, a lawyer who made his name representing corporations, but switched to representing shareholders a few years ago. Varallo represented Tesla shareholders in a 2024 case involving CEO Elon Musk’s pay package.

The two banks currently plan to hold special shareholder meetings on Jan. 6 to vote on the adoption of the merger agreement.