Like most families, we eat turkey on Thanksgiving. Years ago, though, my wife and I started a small tradition of our own.

We roast a duck for the three of us – my wife, our daughter, and me. It started as a one-off experiment, but the flavor won people over fast. This year, my mother even asked for her own.

The big family gathering still runs on turkey. Tradition tends to stick. But anyone who’s tried my wife’s duck knows it’s the better bird.

Even then, the meal isn’t really the main point. The table is. Thanksgiving is about getting everyone in one place, telling the same old stories, and being reminded why these people matter. The turkey is just the excuse.

But that habit – and the predictability of it – is what makes turkey such a powerful business. Millions of families buy the same bird every year, and that annual surge flows straight through the country’s biggest producer.

Seaboard (NYSE: SEB) is a very strange bird. It ships cargo across oceans, trades grain, runs power assets, raises hogs… and owns half of Butterball – the largest U.S. producer of turkey.

Odd mix? Sure. But it works inside Seaboard’s broader protein and commodity business.

Through the first nine months of 2025, revenue rose to $7.3 billion from $6.6 billion a year earlier. Net earnings swung from a loss to $243 million. Operating income climbed to $174 million. Cash from operations reached $380 million.

Butterball’s share flows through Seaboard’s affiliate income, which has delivered $81 million so far this year – helped by stronger turkey pricing and steadier production.

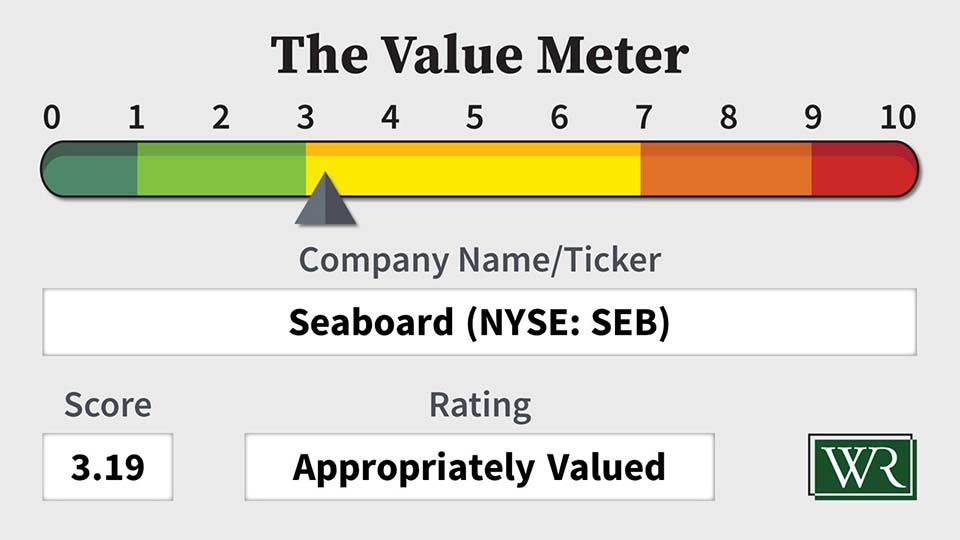

Even with those improvements, The Value Meter looks past the surface and asks a simpler question: Is the stock cheap, expensive, or fairly priced?

Its enterprise value is only 0.97 times its net asset value, far below the peer average of 3.70. That makes the company look cheap. But its free cash flow efficiency tells a quieter story. Seaboard produces quarterly free cash flow equal to 0.61% of its net assets, while peers average 1.18%.

Its 12-quarter record is almost identical to the market: positive free cash flow in about half of those periods. Nothing alarming. Nothing dazzling. Solid, steady, and average.

The stock illustrated that blend for a while. Early in the year, shares drifted sideways. Then the climb began.

On the chart, the summer rise forms a clean upward slope, followed by a quick dip and an even sharper surge into November. Today, the stock trades near $4,560 – its strongest level of the year.

Like Thanksgiving itself, Seaboard is a mix of many things – simple at first glance, complex once you look closer. It owns the turkey brand that will show up on millions of tables this week, yet the business underneath is industrial, global, and built for slow, asset-heavy returns.

The numbers say the stock is fairly priced. You’re not getting a bargain, but you’re not overpaying. For patient investors who prefer durable businesses over exciting ones, Seaboard is exactly what it looks like.

The Value Meter rates Seaboard as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.