- Key insight: A new report details employment cuts at U.S. commercial banks and savings banks, including a net loss of more than 7,400 jobs during the third quarter.

- Supporting data: As of Sept. 30, commercial banks and savings banks employed 2.06 million people, the lowest number since the fourth quarter of 2019.

- Forward look: The job reductions may be permanent as more banks adopt AI, one observer said.

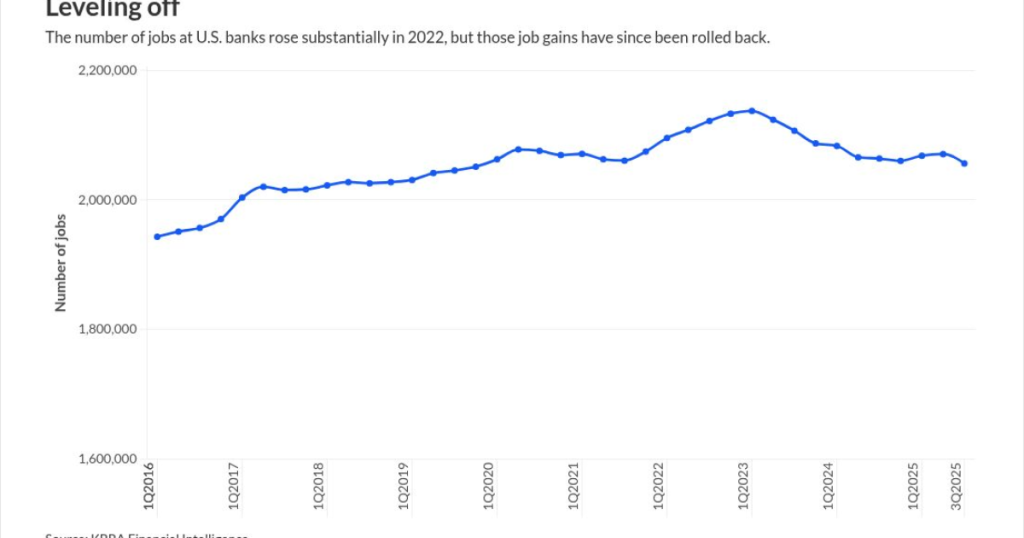

U.S. banks have shed nearly 81,000 jobs since the early months of 2023, and have now hit their lowest level since just before the pandemic, according to call report data analyzed by KBRA Financial Intelligence.

The latest figure includes reductions made during the third quarter, when full-time employment at the nation’s commercial banks and savings banks fell by a net 7,463 positions, or 0.4%, compared with the year-ago quarter.

As of Sept. 30, U.S. commercial banks and savings banks employed 2.06 million people, the lowest number since the fourth quarter of 2019, according to KBRA’s analysis.

The decrease in employment reflects a combination of factors, said Sean McGovern, an associate director at KBRA who leads the firm’s research unit. Higher-for-longer interest rates have put pressure on banks’ margins, forcing them to reduce their costs. And banks are increasingly adopting artificial intelligence tools that may make certain positions redundant, he said.

“The big takeaway here is that there’s a mix of factors, and you can’t really say that it’s one thing or another,” McGovern told American Banker. “We’ve seen that there are headwinds for the American workforce. We’ve seen higher interest rates that have been around for a while. And we also have this technological transformation that’s been several years in the making.”

Commercial banks and savings banks have been reducing their headcounts at a near-constant clip for more than two years. Following the peak of employment in the first quarter of 2023, at 2.137 million people, banks began a steady reduction that shrunk the workforce to 2.083 million in the first quarter of 2024, KBRA’s analysis shows. The declines have continued, with the exception of the second quarter of 2025, when employment rose 0.2% year over year.

The results line up with data from the Bureau of Labor Statistics. During the first nine months of the year, U.S. finance and insurance jobs declined by 13,000 year over year, KBRA’s analysis of BLS data showed. A BLS subcategory that includes banks and credit unions showed a decline of about 2,900 jobs.

The reduction in employment isn’t universal across the industry.

Banks with less than $250 billion of assets actually reported a slight uptick in employment — 0.2%, or 1,642 more jobs — between the second and third quarters of 2025, KBRA said. But banks with more than $250 billion of assets reduced full-time employment by 9,268 jobs, or 0.8%, according to the analysis.

Reductions at

The New York megabank is using AI-driven code reviews to improve developers’ productivity, and in September it released an agentic AI pilot to 5,000 employees that consolidates multistep tasks, Fraser said.

BNY, which also declined to comment, has expressed enthusiasm for AI. During the bank’s third-quarter earnings call, CEO Robin Vince said “at BNY, AI is for everyone, everywhere and for everything” He said BNY had deployed more than 100 “digital employees” that were “already working side-by-side with our people on tasks such as payment validations and code repairs.”

“I want to note that this was not driven by business sales or outsourcing, but in fact, real improvement in our efficiency,” Scharf said during broader comments about Wells’ cost-cutting.

The job reductions at bigger banks might be permanent, especially if the cuts are tied to the adoption of technology such as AI, McGovern said.

Even though interest rates are beginning to fall, “we might not see a snapback where all of these jobs come back,” McGovern said. “It might be something that’s embedded now in larger banks, which often are faster [than smaller] banks to adopt new technology.”