- Key insight: One day after the Federal Reserve approved the merger, the companies said that they expect the deal to close on the first day of 2026, rather than later in the first quarter as had been expected.

- What’s at stake: Pinnacle and Synovus are looking to defy the checkered track record for mergers of equals in the banking industry.

- Forward look: The two banks expect the full systems and brand conversions to take place in the first half of 2027.

Pinnacle Financial Partners and

The two regional banks now expect to complete their merger on Jan. 1, subject to satisfying other closing conditions, they announced Wednesday. They had previously projected a closing date sometime in the first quarter of 2026.

The update came one day after the Fed’s Board of Governors gave

“Federal bank regulatory approval brings us another step closer to combining two strong organizations with a shared commitment to people,”

Analysts at Janney Montgomery Scott wrote in a research note that the anticipated Jan. 1 closing date is one month earlier than they had previously expected.

That accelerated timeline means the bank should have a larger earning asset base and a higher net interest margin for the entire first quarter of 2026, according to the Janney analysts.

On Wednesday, Pinnacle and

Also scheduled for the first six months of 2027 is the full systems conversion. The post-merger company’s technology stack will be built on

Investors had

Since then, the two banks have been keen to assure investors that their tie-up is different from other previous mergers of equals that didn’t work out well.

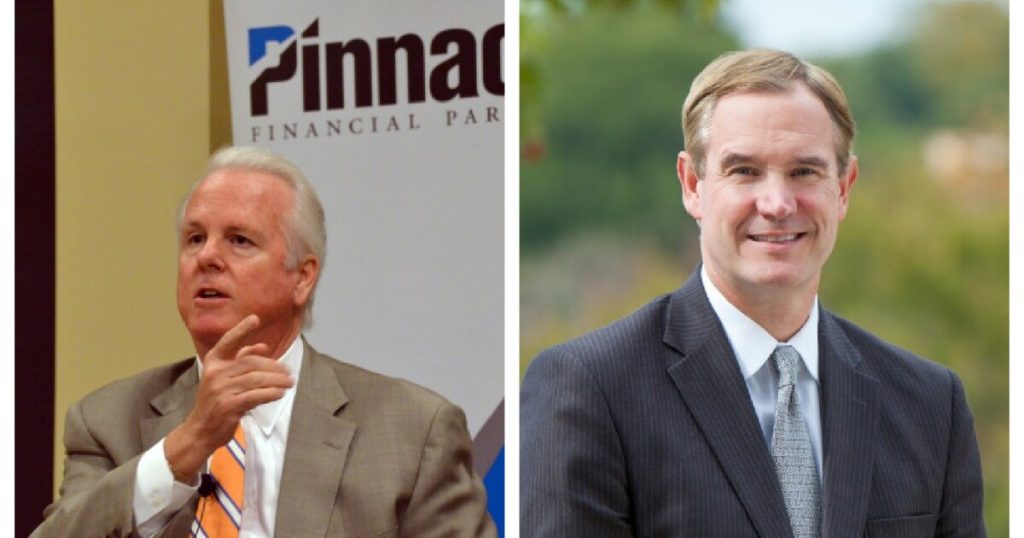

At a conference in September, Pinnacle President and CEO Terry Turner, who will become chairman of the merged company, said the transaction is not “Truist 2.0” — a reference to the 2019 merger of BB&T and SunTrust Banks, which initially failed to meet profitability expectations.

One key part of the message from the two banks’ management teams is that Pinnacle’s incentive compensation system, which is primarily based on growth in earnings per share and revenue, will be adopted throughout the entire company.

“If you have the best running back in the country, you’d better run the ball 100 times a game,” Blair

Since Nov. 5, an operating council made up of senior leaders at the two banks has been meeting to discuss and monitor the integration process.

“I’m incredibly proud of the teams on both sides of this deal who are working in lockstep to bring us together,” Turner said in Wednesday’s press release. “This is such a complex process, but both teams are pulling in the same direction toward the end goal, which is to create a bank that’s bigger, stronger and better able to serve the needs of our clients and communities than ever before.”