- Key insights: Ant International is betting on iris-enabled biometric payments.

- What’s at stake: As biometrics become more popular, payment companies are starting to invest in new options.

- Forward look: Mastercard and Bank of America have also invested in iris-enabled payments.

Could iris authentication gain traction as a more mainstream form of

Singapore-based technology giant Ant International is betting on it. Earlier this month, Ant

Ant’s smart glasses offer a recent example of a provider testing the waters of iris authentication with consumers. Last year, Mastercard, Empik and PayEye

Whether iris authentication will gain meaningful traction in the U.S., however, remains to be seen. Biometric providers suggest that iris has a strong reputation as a biometric factor, but, thus far, there aren’t many opportunities to use it in the U.S., Christopher Miller, lead analyst within emerging payments at Javelin Strategy & Research, told American Banker.

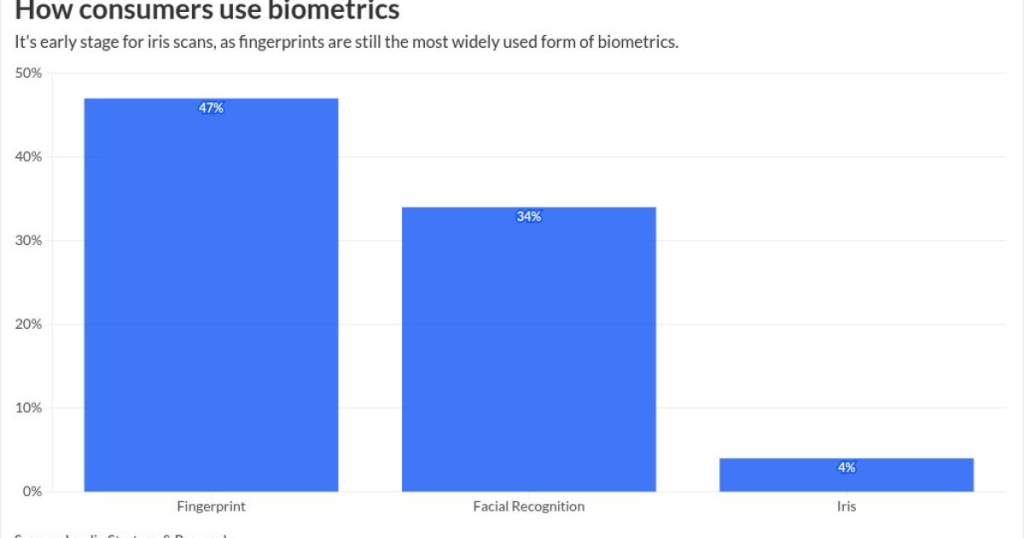

That means consumers aren’t that familiar with it, so there are more barriers to entry. A 2025 emerging payments survey from Javelin found that 70% of consumers polled had used biometric authentication for any reason, including unlocking a phone, logging into an account or making a payment. Nearly half of the consumers, 45%, said they used fingerprint technology, and 34% said they had used facial recognition authentication. By contrast, only 4% said they had used iris scanning.

“We’re in the early days for all of this,” Miller said.

Here’s what banks need to know about how iris scanning and its future for payments authentication:

Why iris scanning could be a good biometric option

Iris scanning identifies the unique patterns in a person’s iris. There are distinctive patterns specific to every person. No two iris are alike—even identical twins—making it a potentially appealing choice for authentication.

For example, Alipay+ GlassPay’s iris authentication feature compares over 260 biometric feature points to verify and protect the identity of the user.

“As biometrics, iris scans are currently less prevalent than fingerprints, face, or voice, but are more difficult to spoof, which is important in the age of AI increasingly capable of creating hard-to-detect deepfakes. In addition to authenticating augmented reality-based transactions, iris-based authentication could also become an extra layer of security for ‘regular’ transactions,” Zil Bareisis, director of retail banking and payments at Celent, wrote in an email.

Will smart glasses proliferate?

Certainly, there’s a cool factor to smart glasses, which are expected to gain in popularity. “By industry estimates, consumer adoption of smart glasses could grow almost sevenfold between 2024 and 2029 to 18.7 million units globally,” Ant said in a press release, citing data from market intelligence company IDC.

Wearables, generally, are

Even so, the jury is still out on how popular smart glasses would be with consumers. “The early iterations of smart glasses launched a few years ago were met with quite a bit of skepticism, but it looks like both the technology and the society have moved on, and they seem to be firmly back on the agenda,” Bareisis told American Banker. “For anybody that wears such glasses, iris biometrics could be a seamless and convenient way to authenticate a transaction,” Bareisis wrote.

Other methods of iris scanning could prove more popular

There are other ways iris scanning could be used by banks for payment-related transactions beyond smart glasses. It could also be used at the point of sale or on mobile devices to authenticate users. Those methods are likely to be more prevalent than smart glasses, Miller told American Banker.

“I don’t know that something that’s worn on the bridge of your nose has any specific advantage in this regard,” he said.

How banks can respond

Even though iris scanning technology is still in the nascent stages, banks should be doing their homework now, investigating it as a potential payment authentication method for the future, Miller told American Banker. Considerations include: How likely is iris authentication to grow in the future? What would banks have to do to be prepared for iris identification to be used for authentication purposes? What would it mean for a bank’s cards and compatibility?

Aside from just the payments aspect, iris scanning could be used for in-branch authentication and other fraud-reducing tactics, so there are many avenues to explore. “It would be a mistake not to be thinking about it at all,” Miller said.