- Key insight: Santander is posting AI-generated deepfake ads to educate consumers about shopping fraud.

- What’s at stake: Eroding consumer trust on social platforms could depress social commerce volumes and increase chargebacks.

- Supporting data: 16.7 million pounds were stolen from Santander customers in 2024; 67% of incidents originated on social media.

Source: Bullets generated by AI with editorial review

With the holiday shopping season comes a new round of online shopping-based scams, with AI-generated fake advertisements becoming an increasingly common way to attract unsuspecting buyers.

In response, Santander’s U.K. division has created a new social campaign with the aim of educating consumers about the risks of fraudulent advertisements on social media platforms created with artificial intelligence.

The international bank, with divisions in regions such as its native Spain, the U.S., the U.K. and Mexico, announced last week that it created ten intentionally “fake” AI social media advertisements to both demonstrate to consumers how realistic deepfake ads can be and educate viewers on what signs to watch out for as they shop for holiday gifts.

“Generative AI has opened the floodgates to a new wave of highly convincing scams that can be almost impossible to spot at first glance,” said Chris Ainsley, head of fraud risk management for Santander U.K. “As fraudsters become more sophisticated, it’s vital that people stay alert and think twice before engaging with adverts or offers that appear too good to be true.”

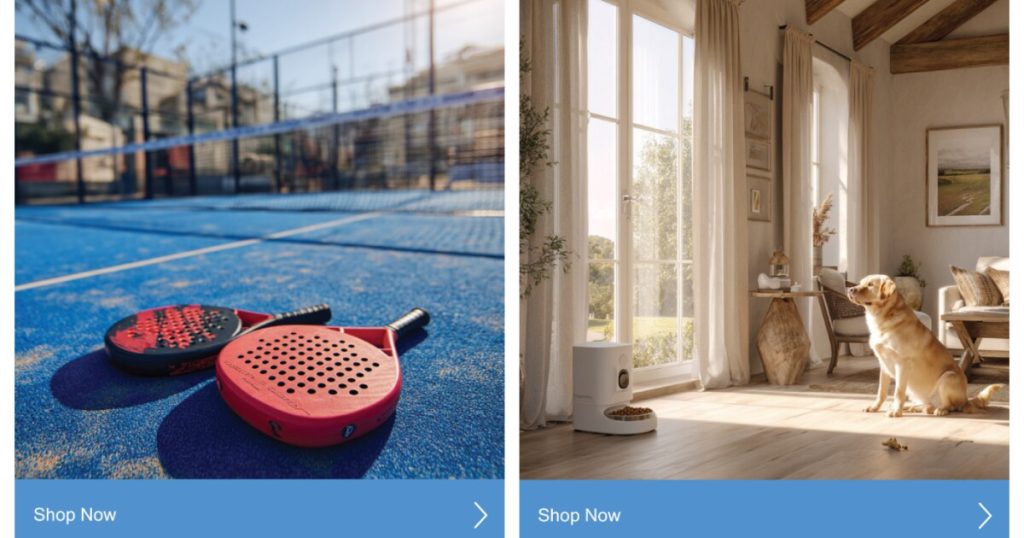

Santander conducted a study with two of its AI-generated deepfake advertisement examples and reported that nearly three in four consumer respondents (74%) couldn’t spot that an ad for padel bats was an AI-created deepfake (padel is a racket sport sometimes called paddle tennis in the U.S.). Similarly, 71% of respondents couldn’t identify that an advert for a dog feeder device was also a deepfake.

According to Santander, a survey of 2,000 U.K. adults conducted in November 2025 by Opinium Research and sponsored by the bank found that over half (56%) of respondents feared that they or a family member could fall victim to this type of scam. Two-thirds (63%) of respondents also reported that they wouldn’t purchase anything from social media platforms due to concerns around whether the advertisements on their feeds were legitimate or not.

“We want to make sure everyone knows what to look for so they can shop online with confidence, particularly as we head into one of the busiest shopping periods,” Ainsley said.

In 2024, the bank reported that

Patrick Smith, senior vice president of fraud operations for the American Bankers Association, told American Banker that the trade group also found that bank customers appreciate the efforts financial institutions make to educate people on possible scams.

“Innovative campaigns like Santander’s are a great example of the lengths to which banks will go to protect consumers from increasingly sophisticated fraud threats,” Smith said. “These kinds of campaigns can make a real difference in keeping consumers a step ahead of the bad guys.”

According to an educational statement from the bank, top tell-tale signs of fake AI ads include extremely low prices that are usually too good to be true, image discrepancies that often indicate that an AI image generator or editor was used, suspicious web addresses, insecure payment pages and spelling or grammar errors in ad copy.