Target (NYSE: TGT) shares are near their lowest price in about six years. That’s resulted in an attractive 5% dividend yield.

But can investors rely on the hefty yield while they wait for the stock price to recover?

In fiscal 2024, which ended in February, free cash flow actually increased due to a sharp reduction in capital expenditures (or “capex”) despite declining revenue and profits.

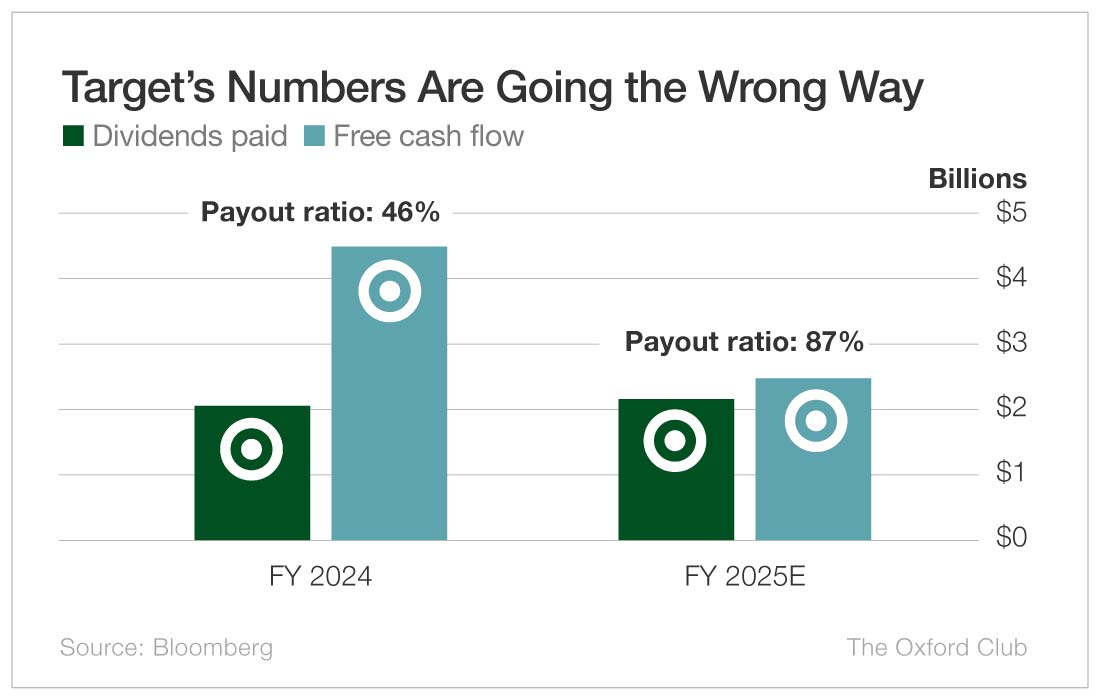

Cash flow from operations fell from $8.6 billion to $7.4 billion in fiscal 2024, but a 40% cut in capex boosted free cash flow by 17% from $3.8 billion to $4.5 billion.

In fiscal 2025, which ends this coming February, capex is forecast to rise by more than $1 billion, which will reduce free cash flow to $2.5 billion.

In fiscal 2024, Target paid $2 billion in dividends for a very comfortable payout ratio of 46%. This year, the retail giant is forecast to pay a little over $2.1 billion. With drastically falling free cash flow, the payout ratio jumps to an uncomfortable 87%.

However, Target has an incredible dividend-paying history. It has raised its dividend every year since 1972. I was still watching Sesame Street back then.

Since the company is a member of the S&P 500 and has raised its dividend for more than 25 years in a row, it is considered a Dividend Aristocrat, which is a prestigious label that attracts income investors.

Target’s numbers are all going in the wrong direction. Free cash flow is down over the past three years and is expected to fall sharply this fiscal year. As a result, the payout ratio in fiscal 2025 is now projected to be above my 75% threshold.

It’s becoming more difficult for Target to afford its dividend.

I suspect that the five-and-a-half-decade run of annual dividend increases is pretty important to management and they’re going to do what it takes to continue to boost the payout to shareholders.

But if free cash flow continues to deteriorate, Target may have a tough decision to make regarding that very long and impressive dividend-hiking track record.

I don’t suspect a dividend cut is imminent, but given the company’s cash flow situation, the payout can’t be considered safe – even for a Dividend Aristocrat.

Dividend Safety Rating: D

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.