- Key insights: The GENIUS Act will push banks to create strategies for stablecoins and other digital assets.

- What’s at stake: Complicated technology work will be required to manage compliance, security and data.

- Forward look: As post-GENIUS Act policymaking continues, the requirements will become more complicated.

Once banks decide how they’re going to play in digital assets such as

“It’s yet another payment network that banks will have to integrate with and adopt,” said Kristiane Koontz, executive vice president of treasury management and payments at

Koontz and other financial experts spoke about stablecoins and other cryptocurrencies in the wake of the GENIUS Act, which is expected to lead to a wave of

“A lot of crypto was built before the regulations came into play, and the engineers who were thinking about solving problems, and then worrying about the regulations later,” said Benjamin Tsai, co-founder of Wave Digital Assets, which sells venture capital, fund and wealth management to the digital asset industry. “But in order for digital assets to be connected back to the traditional financial world, there needs to be guardrails.”

A growing market

According to an S&P Global Markets report issued this week, stablecoin market capitalization has grown quickly in recent years, jumping from $1 billion in 2020 to more than $260 billion at the end of 2025. S&P also reported USD stablecoin issuers held $155 billion in Treasury bills as of October 2025, about 2.5% of outstanding marketable T-bills, with $50–$55 billion in net purchases expected by year-end.

Run-risk remains a concern, according to S&P, noting that even with liquid reserves, large redemptions could trigger rapid T-bill sales; and broader bank acceptance of stablecoins as cash equivalents will be key.

“It’s no longer a question of whether stablecoins are a ‘thing,’ but how banks can unlock the benefits as well as manage the risks,” said Yolla Kairouz, executive director at JPMorgan Private Bank, at the UCLA panel.

UCLA

When considering partnerships to support stablecoins and digital assets, banks need to think about resilience, privacy, third-party risk management and cybersecurity, said Walter Mix, who heads the financial services practice at the Berkeley Research Group, at the UCLA event.

“You need the right people working on the tech stack. It can take a lot of good engineers to do this properly,” said Mix.

Writing for

“There are certain cornerstones that you need to keep in mind,” Mix said, noting that banks need to maintain a one-to-one backing between the stablecoin and the backing asset, and banks’ systems need to assure that

“Stalecoins can reduce cost and increase speed,” Mix said. “But I also think about security, documentation and regulatory compliance, which can be a big competitive advantage.”

Stuck in the past?

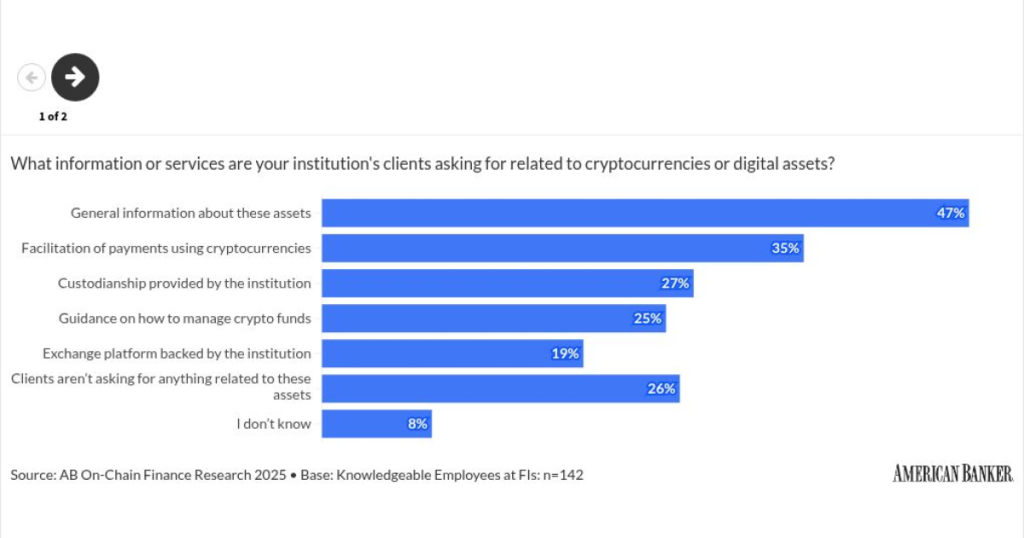

Clients are asking their banks about digital assets. Only 7% of national or regional bank clients do not have an interest in stablecoins, according to

“For banks, this is new infrastructure,” Koontz said. “We have relied a lot on payment infrastructure that was built in the 50s, 60s and 70s.”

Sixty-two percent of

“We spent ten years modernizing our back-end technology. It’s not overnight,” Koontz said. The major challenge was managing data from the disparate systems that the bank had accumulated through its acquired banks.

“We had a lot of different systems and used data differently,” Koontz said, adding that by digitizing historical loan files and other records, the bank has been able to make data more accessible. “We now have a single source that we can take advantage of these new payment options that we all have been talking about.”