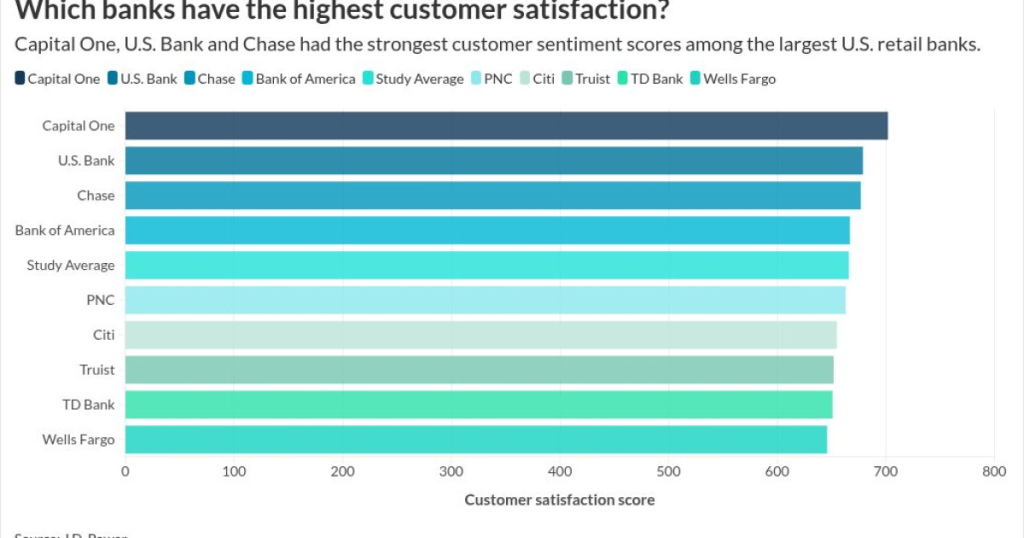

- Key insight: Capital One topped the customer satisfaction list for the sixth year in a row, with a score of 702.

- Expert quote: J.D. Power’s Paul McAdam: “What we saw was, customers this year — all of them — there was very nicely increasing satisfaction with their account offerings.”

- Supporting data: Across nine of the largest U.S. banks, average satisfaction scores rose eight points in 2025 from the prior year.

Customer satisfaction at the nation’s largest banks rose in 2025, though people over age 65 were less happy with their banks than younger users for the first time in at least five years, according to J.D. Power.

Processing Content

The research firm’s 2025 U.S. National Banking Satisfaction Study ranked nine of the largest banks in the country based on a survey of more than 11,000 retail banking customers.

While digitally oriented servicing models are strong options for most customers, seniors want more than just online capabilities, said Paul McAdam, senior director of banking and payments intelligence at J.D. Power.

“These banks have spent so much time and money and focus on digital interactions, improving them, which has been great, and customers love it,” McAdam told American Banker. “But it does make me wonder, ‘Do banks need to think about some sort of specialized senior financial care approach?'”

He added that older customers often “hold more deposits, more wealth and have more complex financial needs.”

Those older customers are increasingly going elsewhere for financial advice, like credit unions or 401(k) or pension providers, McAdam said.

Customers broadly grew more satisfied this year with their understanding of credit card rewards and how to navigate them, according to the survey. McAdam said those metrics “may be an indication of customers looking for more value, given budgets being tight and incomes maybe not holding up as well.”

Consumers who are financially healthier are more satisfied than those who are more financially vulnerable, McAdam added.

“Part of it is just because … being in a financially vulnerable position is stressful, and more can go wrong with fees and overdrafts,” he said.

The rankings

J.D. Power’s study defines a national bank as a U.S. bank holding company with more than $250 billion of domestic deposits and at least 200 branches.

The firm surveyed bank customers between July and October. Its scores are based on a 1,000-point scale. A strong score is around 700, McAdam said.

In this year’s results, Capital One Financial landed in the top spot for the sixth consecutive year with a score of 702. The strong results came even as the credit card giant completed its purchase of Discover Financial Services, one of the largest bank acquisitions in recent history.

U.S. Bancorp leapfrogged from fourth to second, beating out JPMorganChase, which had held the number-two spot since 2022. Bank of America saw the sharpest increase in customer satisfaction, with a 21-point rise, and ended fourth in the ranking, up from eighth in 2024.

TD Bank, which has spent more than a year focused on fixing its U.S. operations after historic anti-money-laundering violations landed it in the regulatory and legal doghouse, saw the steepest drops from 2024 to 2025. While the bank was third on the 2024 list with a score of 668, a 17-point fall put it eighth on this year’s list.

A TD spokesperson pointed Friday to comments the bank made at its September investor day. At the investor day, the bank laid out a plan to take advantage of what Leo Salom, its head of stateside operations, called “an unparalleled opportunity to become a more efficient, more profitable and more formidable competitor in the U.S.” The Toronto-based bank has been winding down nonscalable parts of its American business, while investing in enhanced technology and working to enhance branches.

Wells Fargo landed in the last-place spot for customer satisfaction for the first time since 2021, though its score only decreased two points from last year. Earlier this year, federal regulators freed the bank from its $1.9 trillion asset cap and the litany of enforcement actions it had been shackled by for nearly a decade.

Now, Wells Fargo has more flexibility to grow, but Chief Financial Officer Michael Santomassimo said at the time the asset cap was lifted that it wouldn’t be a “light-switch” moment.

J.D. Power’s McAdam said customers were generally more pleased with major banks in 2025 than they were the previous year, though he didn’t speak to any specific brands. The average customer satisfaction score across the nine banks rose eight points this year, to 666. There were “significant increases” in customer satisfaction with checking accounts, credit cards and certificates of deposit, he said.

It remains important that banks offer branch service and ATMs in conjunction with online and mobile banking, McAdam said.

“What we saw was, customers this year — all of them — there was very nicely increasing satisfaction with their account offerings,” McAdam said. “We see that these large banks drove really strong satisfaction, not only with online banking and mobile, but also with branch service and ATMs.”