I’ve learned the hard way that great stories don’t always make great investments.

When a stock dominates headlines and dinner conversations, the easy money is usually gone. That doesn’t make it a bad business. It just means the market has already done the rewarding.

I suspect that may be where Advanced Micro Devices (Nasdaq: AMD) sits today. The company is no longer the challenger it once was. It’s a fixture of the modern tech landscape.

Its chips power servers, PCs, gaming consoles, and now some of the most demanding AI workloads in the world. And investors know this. That’s why the stock price reflects it.

As you can see, after spending much of last year building a base, AMD didn’t grind higher. It surged. Shares leapt from below $80 in April to well above $250 in a short window before volatility set in.

Now, it’s easy to look at AMD and see a “chipmaker.” But that can be reductive.

The company designs high-performance semiconductors across data centers, consumer devices, gaming, and other computation-heavy ecosystems. Nowadays, that means the company sits at the intersection of cloud computing and artificial intelligence.

That’s a powerful place to be – as the market acknowledges. But it’s also a crowded one.

The latest quarter shows that the business is firing on all cylinders. Revenue rose 36% year over year to $9.2 billion, driven by strength in data centers, AI accelerators, and client CPUs. Operating income expanded. Free cash flow hit a record $1.5 billion.

The balance sheet is solid: over $7 billion in cash and about $3.2 billion in debt. AMD has room to invest without stretching itself.

This is a solid business producing great cash flow.

But the question isn’t whether AMD is a great company. (It is.) The real question is whether you’re being offered value at today’s price.

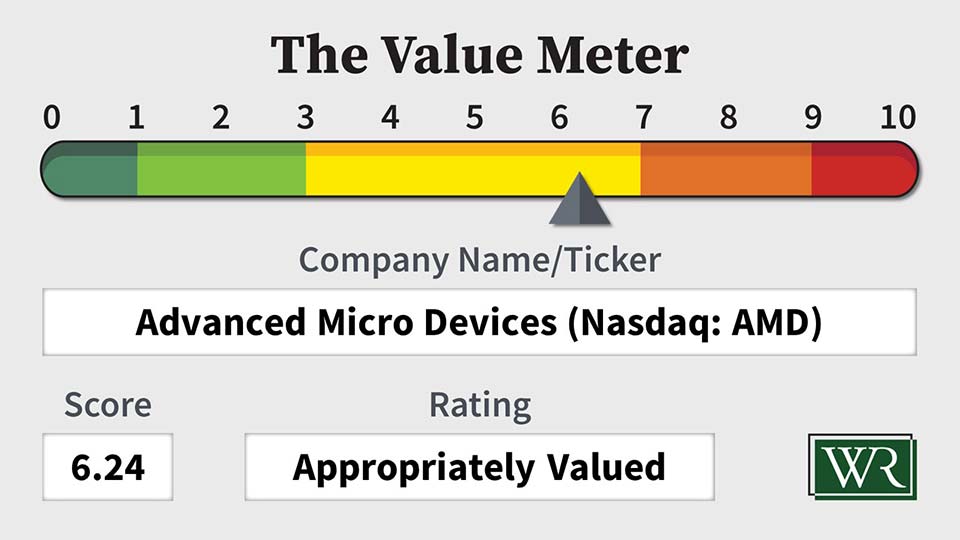

That, of course, is where our handy-dandy Value Meter comes in.

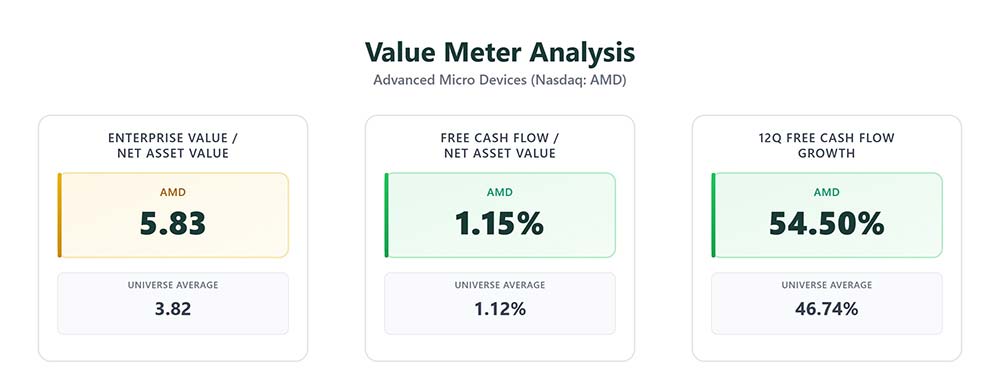

AMD’s enterprise value-to-net asset value ratio sits at 5.83. The broader universe averages 3.82. This tells us investors are paying a premium for AMD’s assets and its future. That premium may prove justified – but it leaves little room for error.

On efficiency, AMD’s free cash flow-to-net asset value ratio is 1.15%, only slightly above the 1.12% average. That’s fine. It’s not exceptional.

Where AMD does stand out is consistency. Over the past three years, it’s grown its quarterly free cash flow 54.5% of the time, well ahead of peers. Execution has been steady. The momentum is real.

In short, AMD has strong growth and solid cash generation… but a valuation that already assumes both will continue.

The stock’s recent run reinforces the point. Much of the upside came quickly, driven by shifting expectations, not neglected value. Early buyers were paid. New buyers are paying attention – and paying up.

For long-term holders, patience still makes sense. The business is strong, and the strategy is intact.

For new capital, discipline matters. The margin of safety is thin, and thin margins tend to show up after sharp rallies, not before them.

The Value Meter rates AMD as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.