- Key insight: There were more bank M&A deals in 2025 than in the past three years, and the combinations were generally more valuable.

- Supporting data: Banks announced at least 170 deals in 2025, up more than one-third from last year and nearly 80% from 2023.

- Forward look: A more merger-friendly regulatory environment, and speedier deal approval timelines, may beget more acquisitions in 2026.

Merger and acquisition activity between banks sprang back to life in 2025 after several years of muted dealmaking due to economic pressure, the fallout of an industry crisis and political uncertainty.

Processing Content

Banks hatched more transactions this year than in each of the past three, as a more friendly regulatory environment opened the floodgates for consolidation. Not only were there more acquisitions in 2025, but the deals also generally had bigger valuations.

In 2024, banks announced 125 deals, for a total value of $16.34 billion, per S&P Global Market Intelligence. That was a rise from 2023, which saw 96 deals for a total value of $4.4 billion.

This year, more than 170 deals have been announced for a combined $47 billion of value.

Many merger agreements are also

On top of the deals announced this year, Capital One Financial also got its landmark acquisition of Discover Financial Services

Dealmaking still hasn’t returned to its frothiest levels. In 2021, banks announced 200 deals worth a combined $76.73 billion, per S&P.

And not all deals have pleased the markets. Several of the

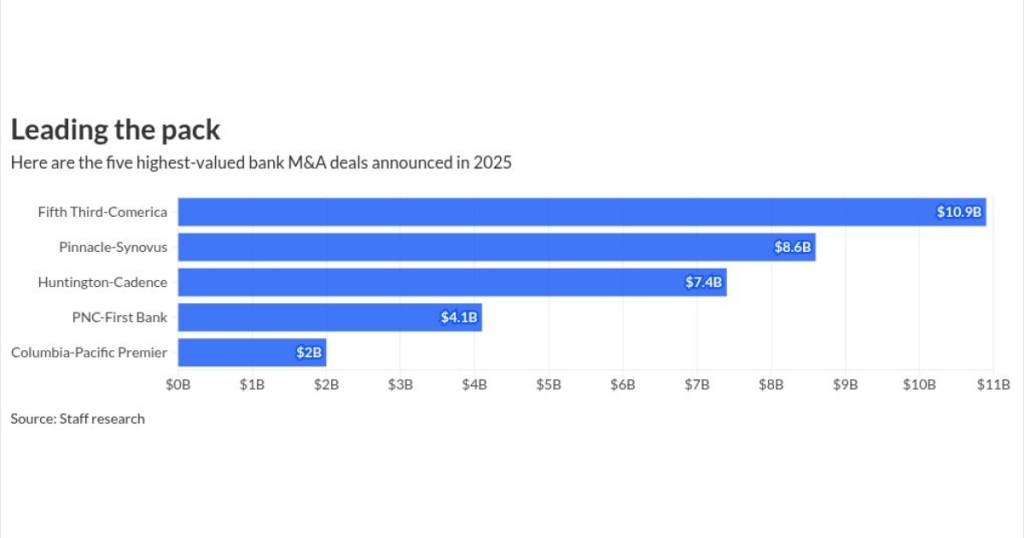

Still, 2025 saw major consolidation. Here are the five highest-valued bank deals announced this year:

1. Fifth Third-Comerica: $10.9 billion

But the

Still, most analysts have praised the deal’s financials. And in December, the Office of the Comptroller of the Currency gave its sign-off. The deal still needs approval from the Federal Reserve Board and the Texas Department of Banking, and the two banks’ shareholders are scheduled to vote on the transaction on Jan. 6.

2. Pinnacle-Synovus: $8.6 billion

Pinnacle Financial Partners and

The companies

Now, the combined company, which will operate under the Pinnacle flag, expects a full brand and systems conversion in the first half of 2027.

“The main thing I’m betting on, the main thing that I believe in, is that Kevin Blair is the single best person to run the next leg of the race at Pinnacle,” Turner said at the time.

3. Huntington-Cadence: $7.4 billion

Both sellers are part of Ohio-based

The Cadence transaction will vault

The two banks said in December they had received all the necessary regulatory approvals, and expected to close “on or about Feb. 1,” subject to earning “yes” votes from shareholders.

“We are exactly where the dynamic growth in Texas is occurring,” Steinour told American Banker in October. “We think we’ve got a really powerful economic engine in Texas and these other states that will propel [

4. PNC-FirstBank: $4.1 billion

“We just effectively bought Colorado,” PNC Chairman and CEO Bill Demchak said at the time.

The deal is slated to close Jan. 5 after winning regulators’ blessings in December. PNC expects FirstBank’s footprint to accelerate growth in Arizona and in Colorado, where its branch count will triple.

And although the

Negotiations between the banks came together quickly, as the CEOs agreed to “accelerated” timelines if the price was right.

But PNC has said that organic growth is its main focus going forward,

PNC Chief Financial Officer Robert Reilly said in November that the bank won’t do another acquisition if there’s concern that the stock price will tumble.

“We’re not masochists,” Reilly said. “We won’t lose our discipline. We won’t lose our focus on what’s best for our shareholders.”

At the time of those comments, PNC’s stock had dipped some 10% after the FirstBank deal was announced. But it has since recovered and is now trading up about 10% since January.

5. Columbia-Pacific Premier: $2 billion

Columbia Banking System closed its

The Tacoma, Washington-based Columbia had, and still has, a lot to prove to investors regarding its purchase of Pacific Premier in Southern California. Columbia’s earlier merger with Umpqua Holdings took 17 months to close and came with more challenges than expected.

But Columbia CEO Clint Stein said when the Pacific Premier deal was made public in April that

Pacific Premier accelerates Columbia’s growth in Southern California by a decade, the bank estimates, freeing up resources to expand in other regions, like Colorado and Utah.

In October, HoldCo put pressure on Columbia, demanding the bank swear off M&A, commit to more buybacks and consider selling itself after five years, or else the hedge fund would launch a proxy contest.

Following the heat from HoldCo,

Stein’s comments assuaged the activist investor, which said in a subsequent presentation that it would stand down on a potential proxy battle, adding that Columbia was “finally pursuing the right path.”