In May of 2024, I looked at Gladstone Capital‘s (Nasdaq: GLAD) dividend safety, giving it a “B” rating. At the time, the only issue was a small dividend cut of just a cent per month in 2020.

Net investment income was growing, and the company was paying out less in dividends than it was making in net investment income.

Gladstone Capital is a business development company, or BDC. It invests in or lends money to businesses, and its cash flow is called net investment income. (It’s not to be confused with real estate investment trust Gladstone Commercial Corp., which I evaluated last month.)

As we examine Gladstone today, the numbers aren’t as problem-free as they were nearly two years ago.

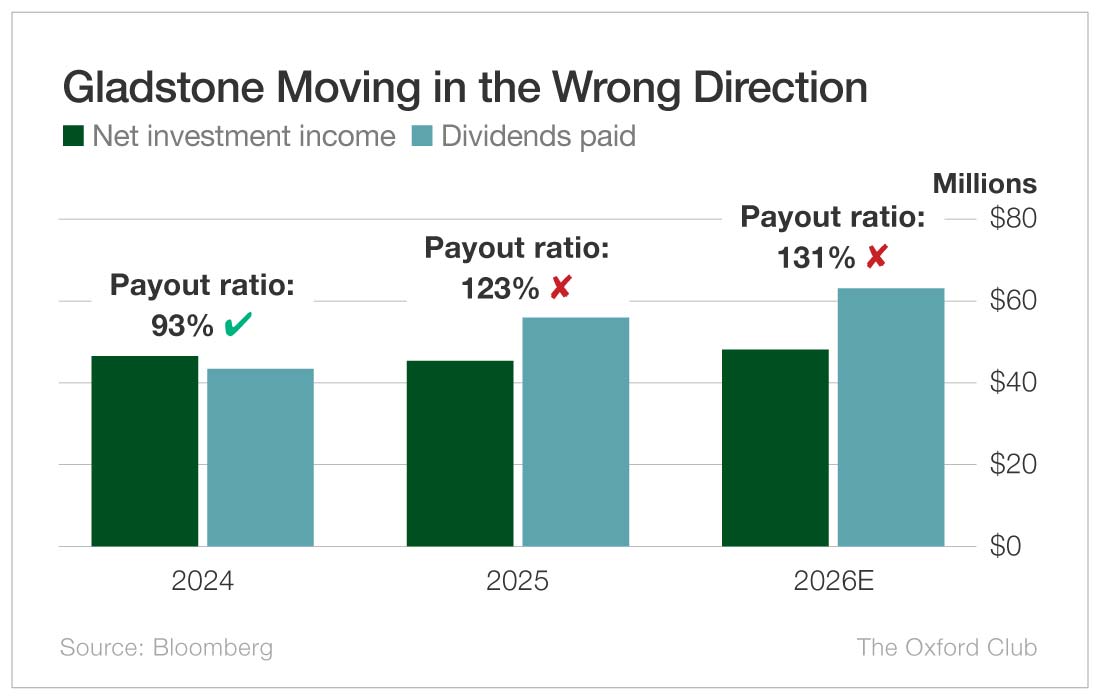

In fiscal 2025, which ended in September, Gladstone generated $45 million in net investment income. That was almost a million dollars less than the previous year. A bigger issue is that it paid out $55.5 million in dividends, or 123% of its net investment income.

I’m comfortable with BDCs paying out up to 100% of their cash flow in dividends. A payout ratio of 123% is a big concern.

This year, net investment income is projected to go back to growth mode, rising to $47.9 million. However, even if it does grow as expected, dividends paid is forecast to grow even more to $62.9 million, or 131% of net investment income.

Gladstone Capital cut its dividend again in 2025, this time from $0.165 per month to $0.15. Management said the reason for the cut was that interest rates and expected future rate decreases “no longer support the current dividend rate.”

The $0.15 monthly dividend comes out to $1.80 annually, or an 8.6% yield.

With only $32 million in cash on the balance sheet and projected $15 million and $20 million deficits between dividends paid and net investment income over the next two years, it’s hard to imagine how the company can afford to continue paying its current dividend.

Add in a couple of dividend cuts in the past several years, and you have to conclude that Gladstone Capital’s dividend is not safe.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.