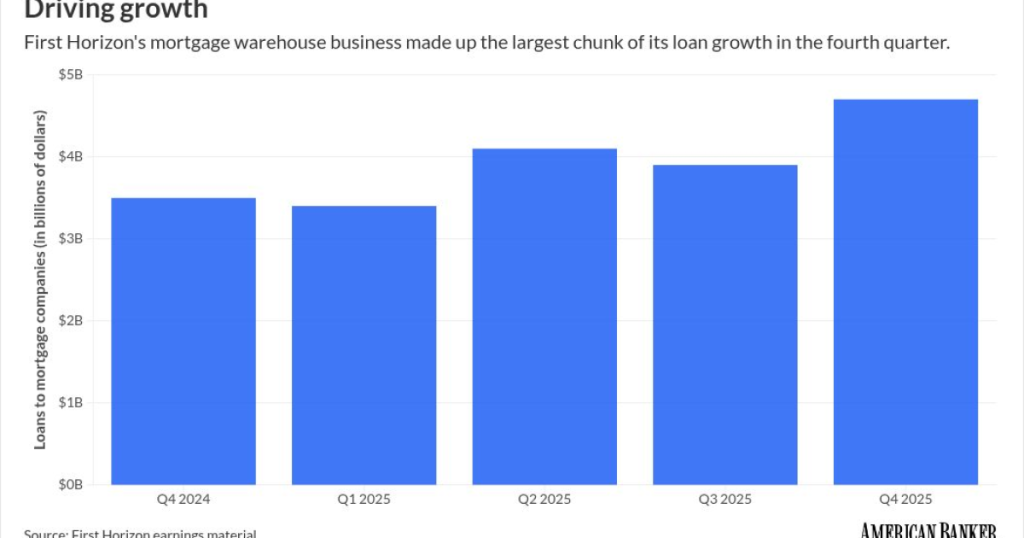

- Key insight: Lending to mortgage companies was the largest contributor to First Horizon’s loan growth in the fourth quarter.

- Supporting data: Seasonally adjusted home sales rose in December to their highest level in more than two years.

- Forward look: First Horizon expects the mortgage warehouse business to continue to pick up in 2026.

The three-year freeze in the housing market may be starting to slowly thaw.

First Horizon said Tuesday that its period-end loans to mortgage companies for the last three months of 2025 grew by 20% from the previous quarter.

Processing Content

Memphis, Tennessee-based First Horizon is one of the largest players in the mortgage warehouse sector, and its market share has steadily grown in recent years. Certain other banks that had major stakes in the business have pulled out over the last few years — largely in an effort to boost liquidity — which gave First Horizon space to move in further.

Most homeowners who locked in relatively low mortgage rates before 2022, when interest rates started rapidly rising, haven’t put their houses on the market. Total home sales have been in the historical trenches since rates started increasing.

But Hope Dmuchowski, chief financial officer at First Horizon, told analysts on Tuesday that she expects the mortgage warehouse business to continue picking up in 2026 as interest rates tick down.

The $84 billion-asset bank’s loans to mortgage companies increased by $776 million from the prior quarter. While about one-third of that business was related to refinances, the fourth quarter isn’t typically a strong time for the sector, Dmuchowski said.

“When you look at mortgage warehouse, especially, this tends to be a quarter where we always see our loans decline, and then we kind of dig out of it in January, February, and then March starts to stabilize in that business,” Dmuchowski said. “We’ve continued to see strong momentum there in January. I do think that will be an upside for us. We won’t have the normal quarter-over-quarter significant volatility we have.”

Nearly a year earlier, First Horizon’s loans to mortgage companies declined by $101 million from the fourth quarter to the first quarter.

In the fourth quarter of 2025, the mortgage warehouse business was the largest contributor to the bank’s 2% total loan growth versus the previous three-month period.

“2025 was another tough year for homebuyers, marked by record-high home prices and historically low home sales,” said National Association for Realtors Chief Economist Lawrence Yun in a prepared statement Wednesday. “However, in the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth.”

First Horizon reeled in $259 million of adjusted net income in the fourth quarter, up 14% from the same period a year earlier, when earnings were affected by a one-time securities restructuring. The bank’s earnings per share of 52 cents beat analyst consensus estimates of 46 cents.

Those earnings were buoyed by net interest income of $679 million — stronger than what analysts expected. Despite lower loan yields putting pressure on revenue, the overall rise was driven by

First Horizon expects its revenue, excluding deferred compensation, to grow by 3% to 7% in 2026, and it’s aiming to increase its total loans in the mid-single-digit percent range.

Dmuchowski said commercial-and-industrial lending seems to have hit an inflection point, with C&I loans other than those to mortgage companies growing by $727 million in the fourth quarter — the largest quarterly uptick in more than two years. The portfolio should continue to steadily contribute positively to loan growth, she said.

The higher end of the bank’s revenue guidance factors in double-digit percentage growth in mortgage warehouse lending, Dmuchowski added.

One of the companies that has stepped back in the last few years is Comerica, which

In 2024, Flagstar Financial — amid a massive overhaul of its business —

First Horizon isn’t the only company stepping deeper into the sector. Between the second quarter and the third quarter, Texas Capital Bancshares bulked up its mortgage finance business by 3%, with loan volumes in the latter period totaling $6 billion.

On Thursday, First Horizon Chief Credit Officer Thomas Hung said the Tennessee bank has continued to pick up new mortgage lending customers “at a pretty good clip” amid the disruption in competition. Despite First Horizon’s growth, he expressed confidence in the bank’s management of the unit.

On a year-over-year basis, the bank’s allowance for credit losses decreased during the fourth quarter.

But loans to mortgage companies are classified as a non-bank financial institution business, an area that stirred concerns among investors last fall after several lenders took major losses in their NBFI portfolios. Those banks said the hits were due to situations they alleged were one-offs and fraud-related.

Several banks, including First Horizon, have aimed to emphasize the differences in risk between certain categories of NBFI lending — like mortgage companies versus private credit. None of the incidents that led to losses at other banks were related to mortgage warehouse lending.

The mortgage warehouse business makes up about two-thirds of First Horizon’s total NBFI portfolio, Hung said Thursday. He added that the bank did a deep-dive analysis into the rest of its NBFI portfolio following the credit cracks elsewhere in the fall.

First Horizon CEO Bryan Jordan said that if there is an increase in First Horizon’s NBFI portfolio, it would likely be driven by growth in mortgage warehouse lending.