- Key insight: Beyond courier scams, banks are battling “card cracking” schemes where fraudsters solicit credentials from young users on social media to deposit worthless checks.

- Expert quote: “Legitimate banks will NEVER send couriers to collect debit cards, nor will they request customers to surrender debit cards,” the Barnegat Police Department warned.

- Forward look: Consumer advocates advise using credit cards for online transactions to avoid the direct financial risks associated with compromised checking accounts.

Overview bullets generated by AI with editorial review

Processing Content

A New Jersey police department alerted residents this month to a brazen fraud scheme involving physical couriers, highlighting the persistent and evolving risks associated with debit card usage — and the distinct burdens these incidents place on consumers.

The scheme starts when a criminal calls a potential victim’s phone number using fake caller ID to mimic a legitimate bank fraud line, according to

After convincing the victim their account is at risk, the scammer tells them a courier will visit their home to collect the debit card for the bank’s fraud department.

“Once the card is surrendered, it is used to conduct fraudulent transactions,” the Barnegat Police Department said in the alert.

The scheme highlights both the diversity of methods criminals undertake to financially exploit victims and the relatively severe consequences of debit card fraud compared to credit card fraud.

For banks, handling disputes related to fraudulent transactions depends heavily on the specific regulations governing the payment instrument. The Electronic Fund Transfer Act, implemented through Regulation E, governs debit card transactions, while a different law (The Truth in Lending Act, implemented through Regulation Z) covers credit card transactions.

Under federal law, credit card issuers must limit a consumer’s liability for unauthorized charges to $50, and many card providers offer zero liability. Likewise, if a consumer notifies their financial institution within two business days of the loss or theft of their debit card, the consumer’s liability won’t exceed $50.

However, if the consumer fails to report the loss of their debit card within two days, their liability can jump to $500 — a liability that does not come with credit card fraud.

Crucially, if a consumer fails to report unauthorized transfers against their debit card within 60 days of their statement transmittal, they face unlimited liability for subsequent losses.

Scam vs. fraud liability

When it comes to debit card fraud, a critical distinction for risk officers involves whether a transaction counts as “unauthorized” under Regulation E.

An “unauthorized” transaction refers to a transfer a consumer did not authorize or initiate, whereas a “scam” often involves a transaction the consumer authorized because fraudsters deceived them, according to

The Consumer Financial Protection Bureau under previous presidential administrations interpreted “unauthorized electronic fund transfer” to include transfers where a consumer was misled into providing account details, but courts have not always agreed when the consumer initiates the payment themselves.

This distinction regarding who physically initiates the transfer proved decisive in Wilkins v. Navy Federal Credit Union in 2023. In that case, a plaintiff transferred funds via Zelle to a fraudster she believed was a utility company agent.

The U.S. District Court for the District of New Jersey dismissed the case because the plaintiff did not claim a hacker took over her account; rather, “the accountholder alleged ‘that she, in every sense of the word, authorized the … transaction.'”

The case has set a standard that, if a victim of a scam initiates a transaction, even if they were tricked into doing so, they cannot hold the bank liable for their loss.

Evolving debit threats

Beyond impersonation scams, banks must also contend with so-called card cracking.

In this scheme, criminals use social media to solicit account holders — often targeting consumers 25 or younger — promising “easy money” in exchange for their debit card credentials, according to a report from the American Bankers Association.

“The fraudster deposits worthless checks using mobile deposit and immediately withdraws the funds at an ATM,” the ABA said of the scheme. “The customer then calls to report a stolen card or compromised credentials.”

Once the bank replaces the card or credentials, the criminal driving the scheme gives the consumer a cut of the proceeds.

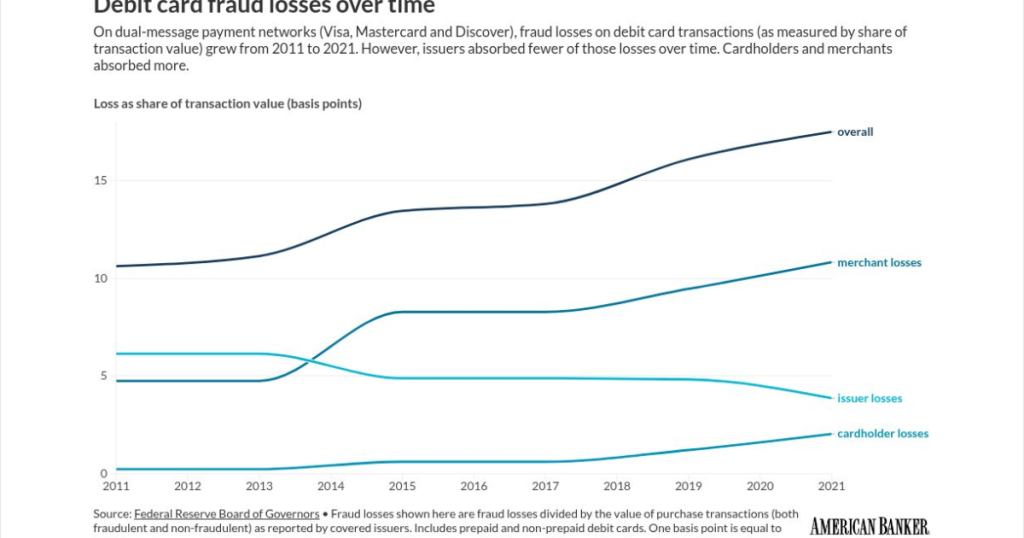

More broadly speaking, debit card fraud rates have gradually increased over the last decade, according to a

However, at least on the major payment networks (Visa, Mastercard and Discover), issuers have seen declining fraud loss rates over the past decade. It is merchants and cardholders that have borne the brunt of rising fraud losses, according to

Advising the consumer

To mitigate losses and headaches, banks often educate customers on recognizing spoofing and avoiding physical hand-offs.

“Legitimate banks will NEVER send couriers to collect debit cards, nor will they request customers to surrender debit cards or banking information in this manner,” the Barnegat Police Department said.

One key piece of advice is that customers should verify calls by hanging up and dialing the number on the back of their card, according to

Consumer advocates also suggest banks encourage the use of credit cards for online transactions.

“When you pay with a debit card, you are authorizing a withdrawal from your checking account,” wrote Herb Weisbaum in