Editor’s Note: Welcome to Part 2 of Chief Income Strategist Marc Lichtenfeld’s three-part series on stocks to play the AI boom. He’s giving away the names and tickers of all three stocks for free right here in Wealthy Retirement.

If you missed Part 1, you can check it out here. Stay tuned for Part 3 on Saturday.

– James Ogletree, Senior Managing Editor

The AI boom is creating huge opportunities for plenty of companies besides the giant tech names.

In Part 1 of this series, I highlighted Prologis (NYSE: PLD). The company owns real estate and warehouses in areas with strong data center growth.

Today, I’m focusing on another asset – one that’s just as necessary for data centers as land is, but harder to come by.

Water.

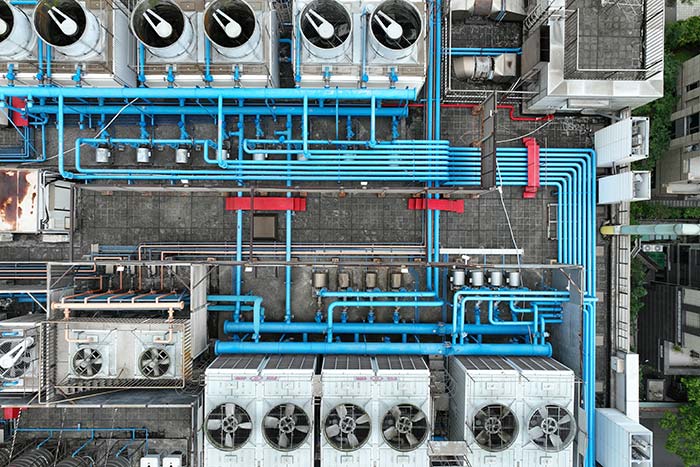

Data centers have massive cooling needs, and water is the primary resource for cooling them.

There are various ways to play this surge in demand, including companies that have water technology systems. But all of those advanced systems still need the raw material. Without the water, those systems are worthless.

Gladstone Land (Nasdaq: LAND) owns 110,000 acres of land, much of which is in California and Arizona. Importantly, it owns 55,000 acre-feet of water assets in California. (Note: Though the company is part of the same investment family as recent Safety Net stocks Gladstone Commercial and Gladstone Capital, it is a separate entity.)

Now, Gladstone is not like Prologis in that it will not host data centers. Gladstone primarily owns farms. But that land, especially the land with water rights, is becoming more valuable.

The average price per acre in Arizona has swelled to $8,500. In California, it’s between $11,000 and $16,000. But elsewhere, as they increasingly seek land with access to water, developers are paying as much as $150,000 to $400,000 per acre.

Data center operators are under increasing pressure – including from the President of the United States – to pay for their enormous power and water needs without burdening taxpayers or utility customers. That’s why private water rights will be so important. (Private water rights would also certainly be cheaper than paying a utility surcharge.)

Gladstone has shown a willingness to sell properties for a profit. Last year, it sold several properties, including one that netted a 112% return in less than seven years.

Additionally, shareholders get paid a monthly dividend that comes out to an annual yield of 5.8%, so investors can generate solid income while waiting for Gladstone’s land to increase in value.

The stock is not a direct way to invest in AI, but Gladstone owns two resources that are desperately coveted by the major tech firms that are building AI data centers: land and water. These firms have enormous bank accounts, and they’re already writing checks for absurd amounts in order to acquire these kinds of assets.

It’s likely only a matter of time before Gladstone starts accepting offers.

In Part 3 of this series on Saturday, I’m going to look at a way to take advantage of AI’s thirst for energy.