A little over a year ago, I covered Hercules Capital (NYSE: HTGC) in Safety Net.

At the time, investors were enjoying a 10% yield. I gave the stock an “A” for the safety of its regular dividend and a “B” when you included the special dividend.

Since then, the special dividend, which is paid every quarter, dipped by a penny per share from $0.08 to $0.07, but the regular dividend has stayed steady at $0.40.

Hercules Capital is a business development company based in San Mateo, California, that lends money to entrepreneurs and venture capital investors.

It has funded more than 700 companies. Of those, 270 either went public or were acquired.

Today, based on the regular dividend, the stock yields 9.4%. If you add in the special dividend, the yield is 11%.

Is the dividend as strong as the company’s name implies?

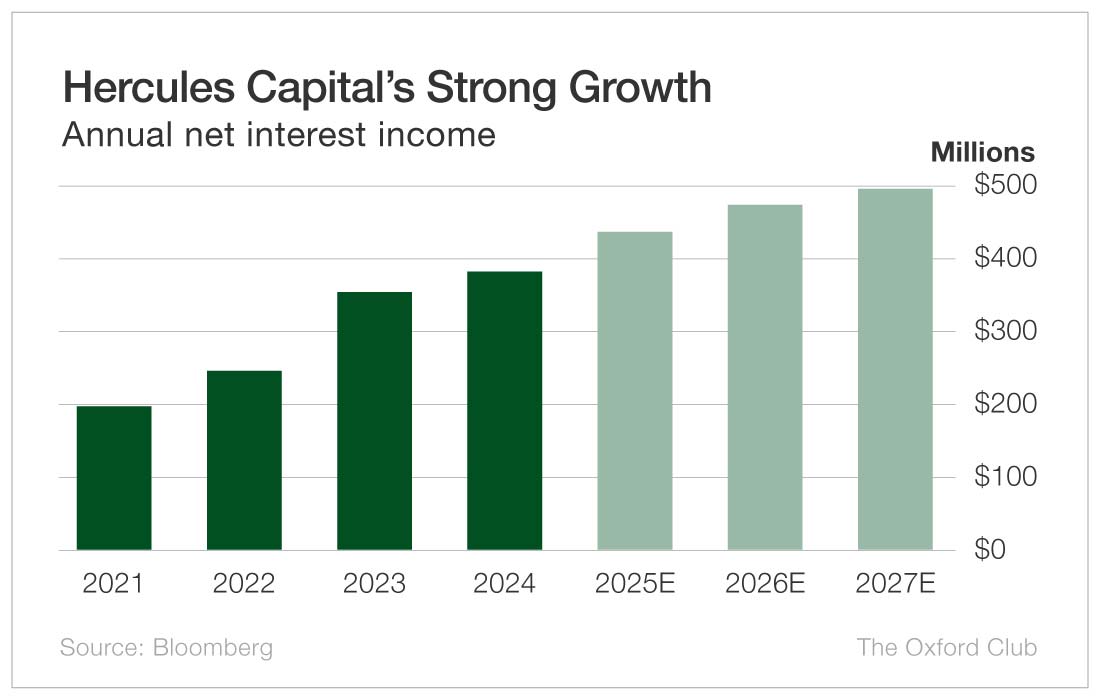

Because Hercules Capital is a BDC that acts as a lender, we focus on net interest income as our measure of cash flow to determine the affordability of its dividend.

The company has done a terrific job of growing its net interest income over the years. It nearly doubled from 2021 to 2024 and is projected to continue rising through at least 2027.

The payout ratio in 2024, the last full year of reported results, was 80%. The results for 2025 will be announced on February 12. It is expected that the payout ratio will come in at 78% for 2025 and will decrease again to 74% this year.

Hercules can easily afford its current dividend, especially when you consider that BDCs are required by law to pay 90% of their profits in dividends. Keep in mind, profits are not the same as net interest income, but because of the rule, BDCs’ payout ratios are typically higher than those of regular corporations. The fact that Hercules’ is so low is a very good sign for its dividend safety.

The company also hasn’t lowered its regular dividend in 16 years. Given that track record and its ability to pay for its dividend, the regular dividend has little risk of being cut.

I don’t see the special dividend being reduced anytime soon either, considering how much net interest income the company generates. However, because it’s a special dividend, it has a greater chance of being reduced than the regular.

Hercules Capital’s dividend safety ratings are the same as they were in late 2024.

Dividend Safety Rating for the Regular Dividend: A

Dividend Safety Rating for the Total Dividend (Regular + Special): B

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

The post HTGC: Did This 9% Yielder Maintain Its “A” Rating? appeared first on Wealthy Retirement.