- Key insights: Amazon has cut its palm payment technology amid larger cutbacks.

- What’s at stake: The technology is designed to streamline checkout by easing authentication, a key pain point.

- Forward Look: There are a number of pilots underway, including one involving JPMorganChase.

While Amazon has dumped its Palm vein biometrics as part of a

Processing Content

Amazon’s decision was based more on its desire to focus on agentic commerce and low-growth potential for its palm readers, given that most retailers wouldn’t want to use the e-commerce giant’s technology in their brick-and-mortar stores, according to industry observers.

Palm payments for Amazon were a “rounding error,” Richard Crone, chief executive of Crone Consulting LLC, told American Banker, adding the technology could divert the customer’s attention from agentic payments. “That’s game-changing in terms of facilitating a more hyper-personalized experience,” Crone said.

Where palm biometrics are being used

But that doesn’t mean there’s anything wrong with the underlying palm-vein biometrics technology, which is in use in several pilot programs in the U.S. and more broadly in several markets in Europe, Latin America and the Asia-Pacific region.

Late last year, several payment companies that had been sitting on the sidelines in terms of biometric authentication at the point-of-sale were musing that palm-vein detection was likely to win in the long run, given the potential for higher accuracy than facial ID, according to Christopher Miller, lead analyst of emerging payments at Javelin Strategy & Research.

But it’s not likely to be an all-or-nothing proposition, Javelin’s Miller told American Banker. Payment providers need to offer multiple forms of biometric payment, not just a single method. This way, they can say they are future-proofed and support all payment mechanisms. “You don’t have to predict a winner,” he said.

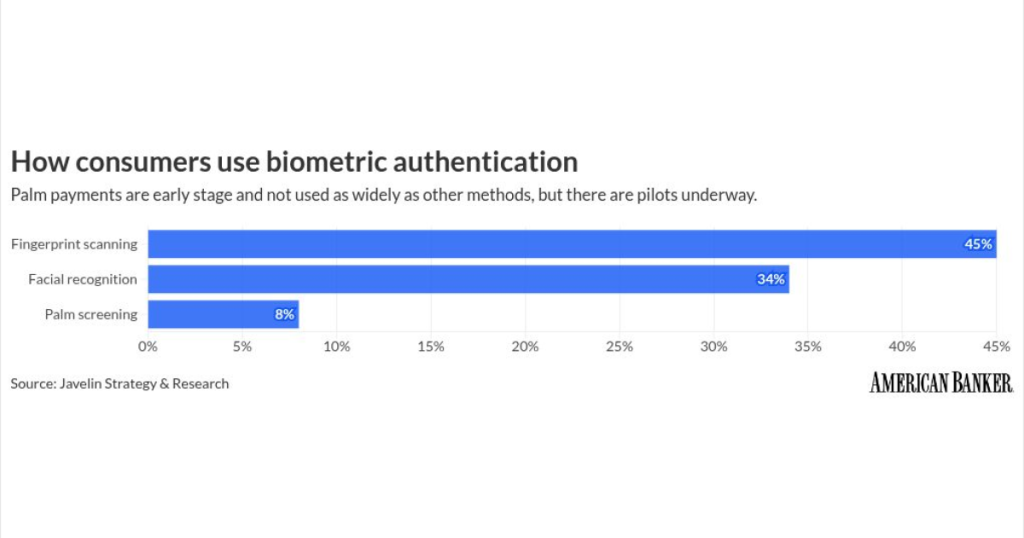

Thus far, consumers in the U.S. haven’t had much opportunity to experiment with palm-vein biometrics. Of the 70% of consumers who said they had used biometric authentication, only 8% claim to have used palm scanning, according to Javelin’s North American Payment Insights 2025 Emerging Payments Survey. By contrast, 45% said they had used fingerprint scanning and 34% said they had used facial recognition technology.

To be sure, adoption of the palm-vein biometrics technology is still in the early stages, especially in the U.S. But there are signs of life. JPMorganChase, for example, has been testing it in a company cafeteria. Additionally, the company’s payments business supports palm-vein enrollment with a touch-free, in-store infrared camera.

“The palm-based biometric solution is a crucial component of our overall biometrics strategy,” Jean-Marc Thienpont, global head of omnichannel and biometrics for

Testing

There are other examples of the technology starting to take hold in the U.S. Last February, Verifone and biometrics firm PopID announced a global partnership to launch biometric solutions that enable payments and loyalty transactions to be completed with a smile or palm wave.

Palm-vein biometrics now come as part of Verifone’s standard terminal, and merchants can decide whether to use it. The technology can be retrofitted to older terminals, John Miller, chief executive of PopID, told American Banker. It is a critical partnership for PopID because of the vast number of Verifone terminals in the market.

While 90% of payments using its technology are facial recognition, PopID CEO Miller predicted a future shift as palm-vein biometrics gains more attention. “We expect over time that it will probably be 50-50,” he told American Banker. It’s very customer-dependent; it’s important to offer both so “everybody can choose what they want,” he added.

Outside the U.S., there’s been more movement toward adoption of palm-vein biometrics.

In late January, The United Arab Emirates began piloting a regional biometric payment system, using facial and palm recognition technology provided by PopID. Notably, PopID in June secured new equity financing with backing from major financial and technology players, including Verifone, PayPal, Commerce Ventures, Visa Ventures and Chipotle’s Cultivate Next venture fund.

In 2024, Mastercard

Also in 2024, consumers had the opportunity to use palm-vein payments during the Summer Olympic Games in Paris. During the games, Carrefour Markets tested palm-vein recognition in a local store. Cielo, a global talent acquisition company, and Ingenico have also tested a palm-vein biometric payment system in a cafeteria inside Cielo’s headquarters in Brazil.

Arnaud Dubreuil, director of innovation at Ingenico, said the company had pilots in several markets in Europe, Latin America and the Asia-Pacific region that are being broadened to a wider market. The company is also hoping to expand to the U.S., where Dubreuil sees interest from retailers, despite the lag compared with other markets. “We think it’s the best biometrics for payments in stores,” he told American Banker.