- Key insights: Visa released a software development kit designed to make it easier for merchants to adopt Apple’s Tap to Pay technology, which enables iPhones to accept payments without added hardware.

- What’s at stake: Merchants are looking to reduce their relationships with technology vendors and simplify deployment, while maintaining a digital payments strategy.

- Forward look: Visa will sell the SDK directly to merchants and to the card network’s reseller partners in the software and payments technology industries.

As merchants look to

Processing Content

Visa has introduced a software development kit that enables merchants to accept payments by letting people tap their payment card against an iPhone. The SDK is being offered through the card network’s Acceptance Platform, which includes payment tools from Visa and its partners. That is designed to make the software easier for merchants to discover and activate.

“The new SDK means offering merchants a complete payments platform, not just a point solution. It addresses their immediate acceptance needs while supporting their growth as they scale,” Andre Machicao, senior vice president of product and acceptance solutions for Visa, said in an email.

What is Tap to Pay?

The ability to accept near-field communication payments through a smartphone, which Apple and Google call Tap to Pay but that’s also referred to as SoftPOS (software point of sale), is not a new technology. It has potential appeal for businesses that are trying to reduce overhead while embracing automation in a challenging economy.

To make a payment via SoftPOS, the consumer holds their contactless payment option near the merchant’s iPhone, and the iPhone’s near-field communication technology accepts the payment. This means a merchant does not have to use extra hardware to accept payments, making it an option for small businesses or for large retailers that want to check out consumers in flexible locations or accept contactless payments at an event. Most mobile point of sale options require a separately sold dongle, or an attachment, that enables a smartphone to accept card or contactless payments.

SoftPOS is also a low-cost enabler for a merchant’s digital strategy, including access to mobile wallets, cards and shopping journeys that cross channels.

“It’s critical to be able to accept digital wallet payments,” Tony DeSanctis, a senior director at Cornerstone Advisors, told American Banker. “For small merchants, Tap to Pay is going to be critical not only in order to enable low cost terminal solutions like a phone.”

Who wants SoftPOS?

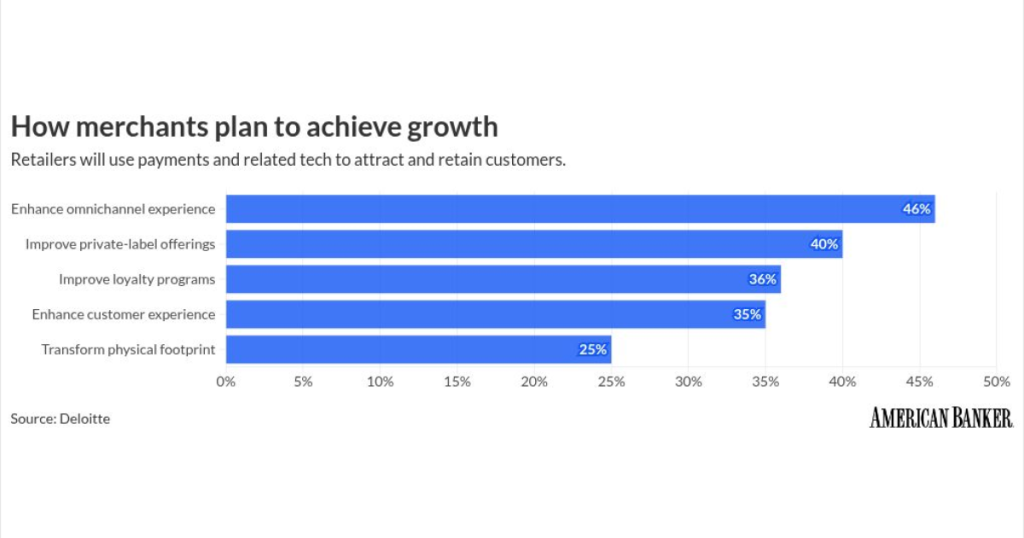

Retailers crave the benefits of digital commerce. Forty-six percent of merchants plan to emphasize omnichannel, or multichannel experience, in 2026, according to Deloitte, making it the top strategy for merchant growth. In-store experience also ranks high at 35%, according to Deloitte. And 51% of bank executives say enabling new payment technology is their top priority, according to

Payment service providers and independent software vendors that sell payment technology to merchants can use Visa’s SDK to integrate SoftPOS on iPhones directly as part of Visa’s merchant services bundle. Merchants can also use the SDK to offer Tap to Pay on iPhones. This avoids the need for Visa or its resellers to market the SDK to merchants individually — it’s embedded in an existing basket of payment tools.

While SoftPOS is designed to be easy to deploy, there is still a step to make merchants aware of its existence and convince them to adopt it. When payment service providers, independent software vendors or acquirers integrate through Visa’s Acceptance Platform, they access Visa’s full infrastructure: global connectivity, built-in token management, fraud and risk tools, and unified commerce across in-store, online and mobile channels, according to Machicao.

“The SDK simplifies integration of tap to pay on iPhone for our clients,” Machicao said. For Visa, supporting services that aren’t directly tied to card fees is part of its diversification strategy.

In a recent note, analysts from Jefferies said Visa’s value-added growth was up 28% in the first quarter, compared to 25% in the fourth quarter, making up more than 50% of Visa’s overall net revenue growth. “Visa’s first quarter strength was attributed to demand for advisory and marketing services,” Jefferies said.

The SDK also helps Visa compete with payment rivals. Mastercard’s SoftPOS technology, which was

Given SoftPOS’s potential to automate payments without adding payments hardware, payment companies have rushed to adopt the tool since

“As for merchant benefits, these solutions are rarely a replacement for the actual terminals at larger merchants but can be a useful additional option, for example, to enable customer support staff to accept payments anywhere in the store,” Zil Bareisis, a director at Celent, told American Banker. “More commonly, they are used by mobile salespeople often on the road, or smaller sellers that only need to process transactions occasionally.”