Dorchester Minerals (Nasdaq: DMLP) is a limited partnership that owns oil- and mineral-rich land all over the United States, including in the Permian Basin, the Bakken/Three Forks system, and the Midland Basin.

The company does not explore for oil. Instead, it lets other companies do so on its land and collects royalties on the resources that are extracted. It’s a low-cost, high-margin business.

As a result, Dorchester pays a high distribution. (Limited partnerships pay distributions, not dividends, and they have units, not shares.)

The most recently announced distribution, which will be paid tomorrow to unitholders of record as of February 2, is just under $0.76 per unit. That comes out to a 12.3% yield.

Can Dorchester Minerals investors rely on such a generous payout?

The company’s free cash flow declined in 2023 and 2024, though it is expected to have risen in 2025. (Dorchester will likely report fourth quarter and full-year results in a few weeks.)

In 2024, Dorchester Minerals generated $132.6 million in free cash flow, down 5% from $139.8 million the previous year. Wall Street predicts free cash flow will come in at $148.2 million for 2025 and inch higher to $148.4 million in 2026.

There’s a problem, though: The company paid more in distributions in 2024 than it generated in free cash flow. That is projected to be the case again in the 2025 results. In fact, the gulf is expected to widen, as Dorchester is forecast to have paid out $182 million. This year, Wall Street forecasts $191.1 million, expanding the deficit between distributions and cash flow even further to a 129% payout ratio.

It’s a big issue when a company is paying out more cash than it takes in. That means that in order to pay unitholders, it has to dip into cash on hand or raise funds by either selling stock or taking on debt.

That alone would worry me about Dorchester’s ability to sustain its distribution.

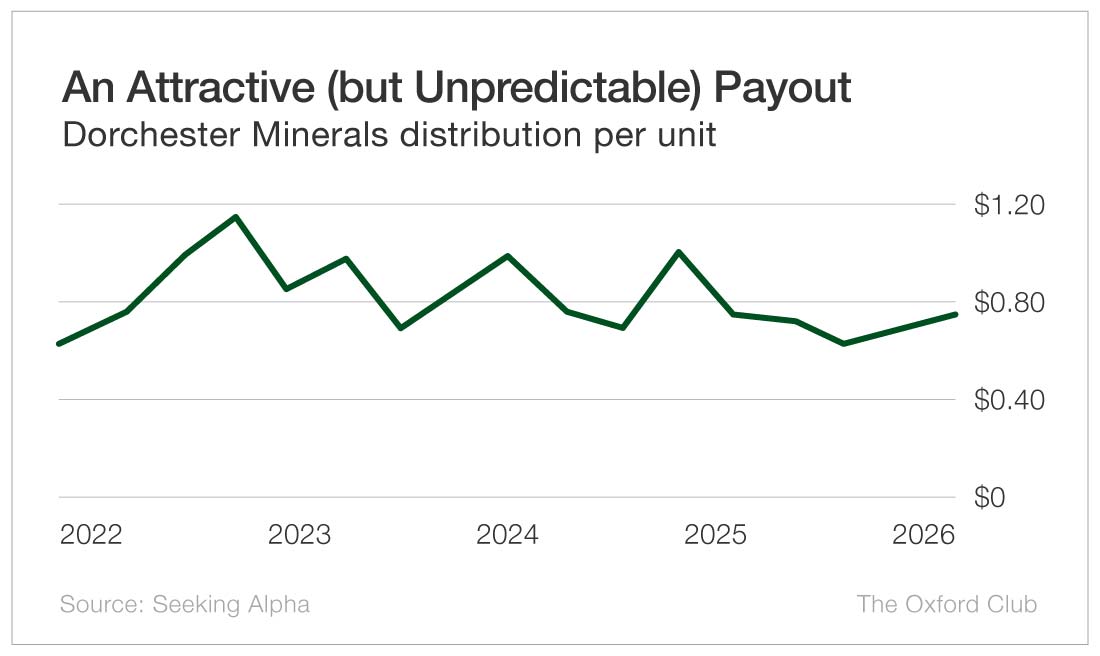

But here’s why I know for sure it won’t be able to: Its distribution policy is variable. That means it pays a different amount each quarter.

While the most recent distribution was a nice 10% increase over the previous one, the payout bounces up and down like an EKG reading.

A variable distribution policy coupled with the company’s inability to generate enough cash flow to pay for the current distribution means that the payout will most certainly be reduced at some point in the future.

The 12% yield is attractive, but by no means can it be considered safe.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.