- Key insight: New York’s Medallion Financial is counting on a newly hired home-improvement lending team to boost loan growth in 2026.

- Supporting data: At the one-time taxi lender, medallion loans now comprise less than 1% of total loans.

- Expert quote: “The last five years, we’ve made more than we have in the first 85 combined. Things are flowing really well for us today.” — Medallion CEO Andrew Murstein

Medallion Financial, a New York City-based lender that has diversified away from its roots in taxi-medallion lending, expects to grow home-improvement loans at a rapid clip in 2026.

Processing Content

CEO Andrew Murstein told analysts Thursday that the company is “excited” about the growth opportunities in home-improvement lending. “We think we’re going to grow mid-teens, which is substantially above where we’ve been for the last year or two,” he said during a conference call.

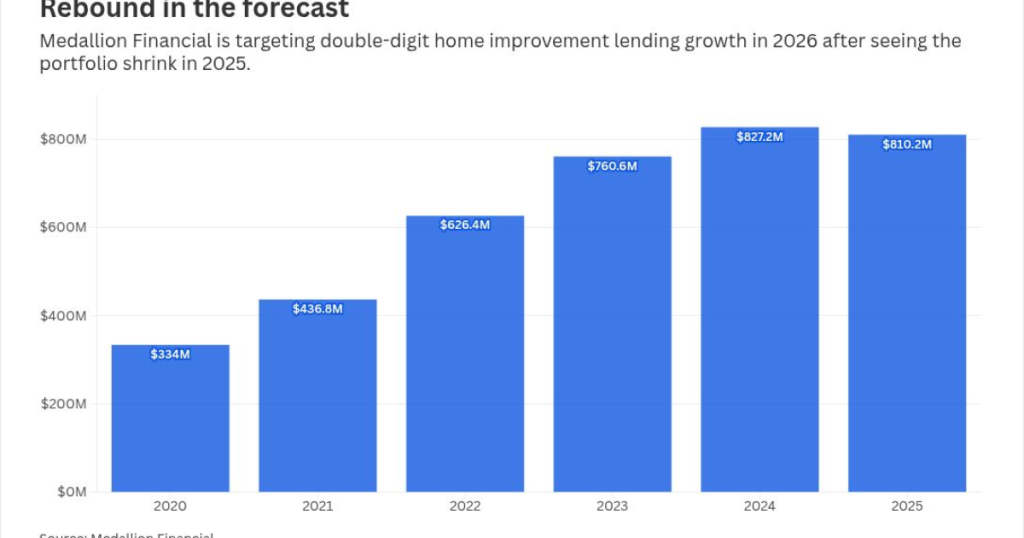

Medallion, the holding company for Medallion Bank, has been active in home-improvement lending since 2012. Though the portfolio has experienced rapid growth historically, 2025 was an off year. Total home-improvement loans actually shrank 2%, totaling $810.2 million on Dec. 31.

Earlier this month, the $3 billion-asset Medallion named veteran consumer lender Joel Cannon senior vice president of sales and marketing. Cannon heads a team of seasoned home-improvement lenders that Medallion lured away from the $159.6 billion-asset Regions Financial in Birmingham, Alabama.

Murstein is counting on Cannon and his team to help galvanize Medallion’s results in 2026.

Medallion Financial

“I’ve been tracking how well they’ve been doing through the years,” Murstein said on the call with analysts. “We approached them and brought them in.”

Cannon’s brief at Medallion covers both of the company’s biggest consumer-lending business lines: loans for recreational vehicles and home improvements.

Medallion is not the only bank to forecast big home-improvement loan numbers for 2026. The $32.3 billion-asset First National Bank of Omaha is projecting a 30% year-over-year increase in the loan volume generated by its Slice home-improvement loan platform.

Medallion takes its name from the taxicab lending business Leon Murstein, Andrew’s grandfather, started in the 1930s. While the company expanded into commercial lending in the mid-1990s and founded Medallion Bank as a Utah-chartered industrial bank in the early 2000s, taxi lending remained a mainstay.

But with the

Medallion’s strategic partnership loan originations totaled $771.6 million in 2025, up materially from the $203.6 million it reported in 2024. “Originations continue to expand meaningfully quarter-over-quarter,” Murstein said Thursday. “We see great potential for this business over the next several years.”

Medallion on Thursday reported fourth-quarter net income of $12.2 million, up 20% from the same three months in 2024. Full-year 2025 net income totaled $43 million, compared with $35.9 million in 2024.

Medallion reported that its legacy portfolio of taxi medallion loans declined to $4.3 million on Dec. 31, representing less than 1% of total loans.

Murstein said Medallion will “remain thoughtful and disciplined in evaluating new business lines and growth opportunities,” but he added that acquisitions aren’t “top of mind.”

“I don’t see us really buying any businesses in the near term,” Murstein said. “I think there’s just so much growth potential in the ones we have.”

Murstein, who became CEO on Jan. 31, succeeding his father Alvin, also did not rule out a sale of Medallion. The company might “pull the trigger” if it received an offer with “a significant premium,” he said.

All that said, steady-as-she-goes appears to be Medallion’s preferred course.

“The last five years, we’ve made more than we have in the first 85 combined,” said Murstein, who previously served as the company’s president and chief operating officer. “Things are flowing really well for us today.”