A paper from Andrew Davidson & Co. reportedly supports the notion that dropping the tri-merge credit report standard would result in greater risk to mortgage industry participants.

Processing Content

The paper was brought to media attention by the Consumer Data Industry Association.

Others stand by their views that a single pull is sufficient to use in underwriting conforming mortgages. Part of that opposition is

The issue has divided the industry as seen in the debates on LinkedIn. Even trade groups have differing opinions with supporters of a single pull stating it is part of the overall housing affordability issue.

To come to its conclusions, Andrew Davidson used VantageScore 4.0 credit scores created from data provided by Equifax, Experian and Transunion. While VantageScore 4.0 use is permitted by the Federal Housing Finance Agency, conforming mortgages are typically underwritten using Classic FICO.

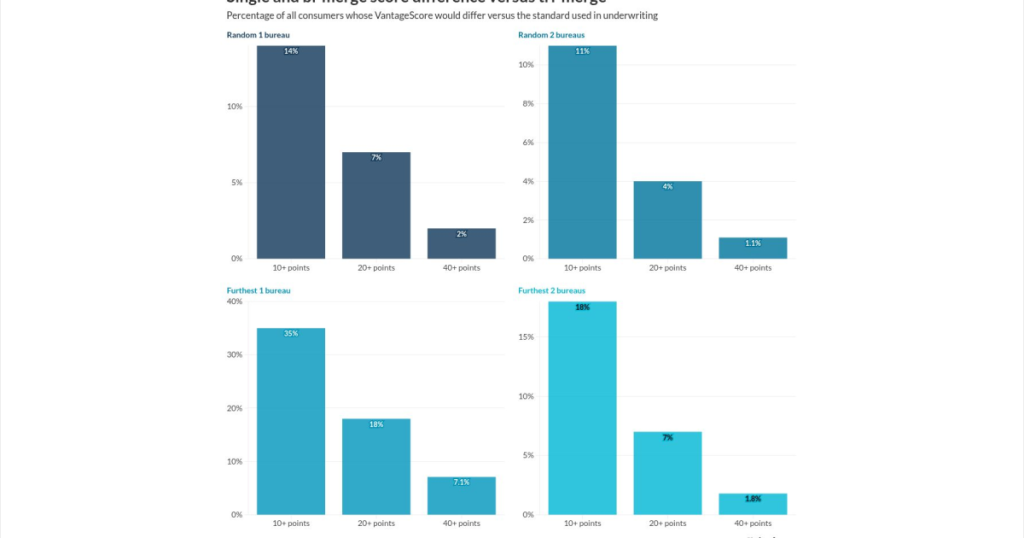

The researchers looked at files from 245 million scored consumers and found 35% had at least one score which differed from the tri-merge standard by at least 10 points; 18% had a score difference of at least 20 points; and 7% had a score which varied by 40 or more points. For the tri-merge comparison, Andrew Davidson used the median of the three scores.

In its comments about the research, the CDIA said the

“It’s a carefully balanced system that protects consumers, investors, and taxpayers,” Dan Smith, president and CEO of the CDIA said in a press release. “If we’re serious about affordability, let’s focus on the real cost drivers and embrace credit score competition.”

He called using a single pull in mortgage underwriting reckless and irresponsible.

“We shouldn’t sacrifice data quality and market stability to address business choices and lender margins,” Smith said. “Consumers deserve better.”

What the report concluded

Among lower credit score customers, those with a VantageScore between 600 and 639, reduced information used in underwriting has a higher potential for pricing variances; about a quarter of these consumers had at least one credit score which differed from the tri-merge standard by at least 20 points, Andrew Davidson said.

“We are going through a modernization phase in the mortgage industry,” said Sanjeeban Chatterjee, director of behavioral modeling at Andrew Davidson, in the company’s press release. “This study shows why knowing more is better from a risk management and affordability perspective.”

Earlier in February, Equifax put out its own infographic called The True Cost of Homeownership.

“Increased homeownership costs are driven by home price inflation, high interest rates, and increasing taxes and insurance — not credit reports,” the infographic stated. “Representing less than 1.5% of closing fees, the credit report is a small, essential cost that provides the transparency needed to unlock homeownership.”

Equifax did a comparison of lender-related closing costs in 2020 and 2025. While the cost of a tri-merge report nearly tripled over this period, to approximately $60 from $21, other combined costs rose by $1,059, to create a total of $4,526 from $3,467 five years prior, it claimed.

Looking at past FHFA action on credit score modernization

This report also comes out after the Housing Policy Council earlier this month

The paperwork showed the government-sponsored enterprises only wanted FICO 10T approved versus other iterations of that company’s modeling; it also did not support the addition of VantageScore 4.0. It also expressed skepticism over the use of a single report.

In her modernization pitch, Thompson called for use of a bi-merge from both FICO and VantageScore. A

The National Consumer Reporting Association, an organization of the agencies who provide lenders with the reports, also is in favor of keeping the tri-merge, saying the data shows using one pull does not fit all consumers.

“There are enough differences between the three bureaus to degrade the accuracy of a mortgage decision when only one credit report is used,” a statement from Eric Ellman, NCRA president, said. “This reduced reliability will lead to higher prices for consumers and increased risk to American taxpayers.”

What the mortgage industry says

The split in the mortgage industry is shown by the polar opposite positions taken by the Community Home Lenders of America, supporting the current system, and the Mortgage Bankers Association.

The MBA reiterated its backing in favor of the single pull, pointing to a Jan. 29 blog posting from Bob Broeksmit, president and CEO.

Its statement noted:

· The MBA believes the tri-merge credit reporting requirement has become a license for price gouging and ripping off consumers;

· The FHFA already determined over three years ago that the tri-merge is not the gold standard (versus bi-merge);

· Its Residential Board of Governors’ policy discussions following several years of credit scoring price hikes, supported an August vote to move the industry away from tri-merge, and it eventually proposed late last year to single-file as addressing the aforementioned problem;

· It has asked the GSEs and FHFA to review, release their most recent data, and engage with the MBA and the industry on this proposal and/or a better solution.

On the other hand, the CHLA sees this latest study

“The findings of the Davidson paper that a move to a single credit bureau pull would result in less accurate mortgage underwriting and higher rates as investors respond to uncertainty mirror conclusions in CHLA’s recent